John Phipps: The $3T Burning Question Economists Are Now Asking

U.S. Farm Report 11/20/21 - Johns World

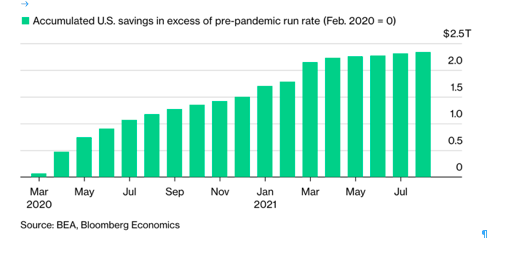

Last week I talked about the excess savings, or savings above pre-pandemic normal. It has reached nearly $3T by now. We have also had several stories about the supply chain failures. These two factors are beginning to collide. First let’s get some idea of what consumer spending amounts to. A good round number is $14T, or roughly 70% of our $21T Gross Domestic Product (GDP). The excess saving then represents about 20% more spending. Consumer spending is divided into goods , durable and non-durable, and services. Services include a range from restaurant servers to attorneys. Services comprise about 45% of consumer spending and goods the remaining 55% or about $7.5T.

Up until the pandemic these numbers and trends were predictable to the point of boring. They grew slowly and stayed roughly proportionate. Covid stirred things up. While we don’t know and won’t for a few years whether the goods versus services split will return to former numbers, buying stuff seems to be the early trend.

Let’s assume this trend holds and most of the savings are spent on goods. Adding most of that additional 20% would be a whopping increase under normal supply chain circumstances, like the good old days back in 2018. For an impaired system with significant headaches, such a demand increase virtually insures longer-term overload and delivery problems, not to mention demand-driven inflation.

Americans seem ready to shop and spend with trillions burning a hole in our collective pocket. Meanwhile many service providers, especially in the hospitality sector are already on the brink, and the labor shortage will hamper their ability to take advantage of a demand boost. Demographics show most excess savings are held by older people, not free-spending kids in their 40s. Add the fact that all those savings aren’t earning much interest, while the prices of many items jump. These contradicting factors make predicting consumer spending tricky. If a buying spree comes about, which is not a sure thing, it will certainly pressure consumer inflation, and prolong supply chain problems. After all, why would supply chain links invest in what could soon be excess capacity after that money is gone? It boils down to the question of how fast can we spend $3T? We may be about to find out.