Top Coverage Gaps for Large Farmers

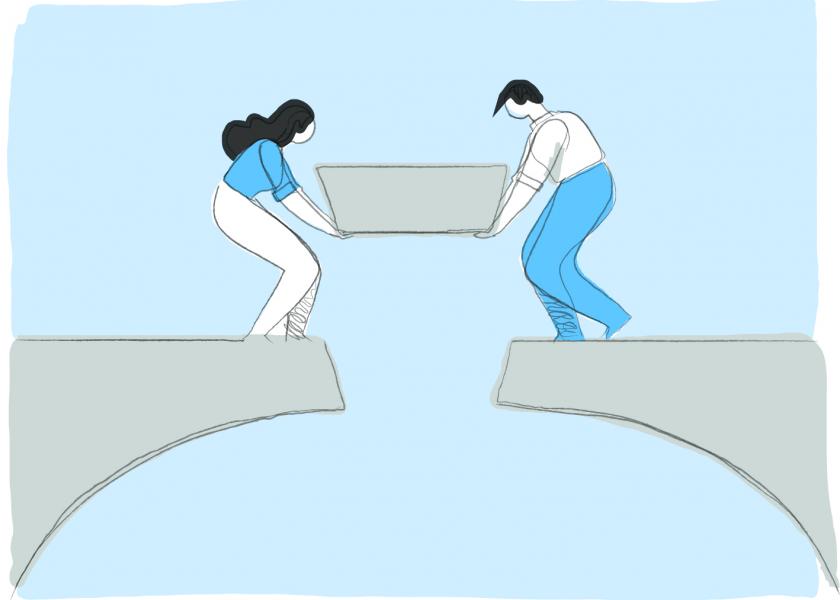

Don’t let your assets fall through insurance coverage holes.

Top Nationwide agents point out the gaps so you can fill them.

Large farmers face unique exposures, take on additional liabilities and are becoming more and more dependent on ancillary income sources. For these reasons they’re in need of insurance coverage that fully protects them and the farm operation they’ve worked tirelessly to build. That’s why two top Nationwide agents have come together to point out some of those gaps and offer solutions large farmers can take advantage of today.

Meet the Nationwide agents:

Amy Fairchild, Commercial Account Manager, ProValue Insurance

Jay LeFevre, Agent, First Gabrielson Insurance Agency

Q & A:

1. What areas do large farmers most commonly overlook in an insurance policy?

Amy: Large farms overlook their liability exposure and do not have high enough limits to protect their assets in a large loss, or employees in the case of injury.

Jay: Large farmers tend to neglect the need for proper umbrella coverage limits, especially when it comes to the increasing net worth of the farm. Many farms are involved in secondary operations, such as trucking, that require additional liability to cover commercial exposures.

2. What issues to large farmers need coverage for that others don’t?

Amy: As large farms grow, they often diversify. The addition of seed dealerships, acquiring smaller operations, and the addition of technology and telematics brings about the need of proper coverage.

Jay: When farms expand more employees are hired. This creates the need for additional coverages such as a crime policy and an employment practices liability policy in case of wrongful termination.

3. What was learned from the unforeseen events of 2020 (COVID & derecho) that will influence the coverage large farmers will want to have in 2021.

Amy: COVID was the beginning of the steep rise in construction costs which led to undervalued property. Many farms also discovered after the derecho that their coverage was inadequate to totally rebuild. It is critically important to review coverage at least on an annual basis.

Jay: COVID created conversations regarding employee benefits ranging from employee benefits liability to life insurance. The derecho shined a light on the topic of replacement cost versus actual cash value – there’s a difference and large farm operations need to understand it.

4. At the end of the day, what’s the single bit of advice you give your large farmer clients?

Amy: To find an insurance agent who truly understands your farming operation and the risks you face each day – an agent who is able to give you a broad range of options to protect your assets.

Jay: Meet with your agent frequently. We’re always willing to make an on-site visit, zoom conference or phone conversation to review coverage and catch up on any changes the operation is contemplating. Open communication is vital!

For more information, visit Nationwide.