John Phipps: The Impacts and Implications of the Great Microchip Shortage (Part 2)

USFR-Johns World 4.19.2021

Last week we looked at how microchip manufacturing is network of separate operations from design to packaging, with disturbing bottlenecks and near-monopolies that make the whole business more fragile than we ever imagined. Until the pandemic showed us the problems. All of this matters more than ever because demand is growing and will continue to skyrocket with connectivity and automation driving the market.

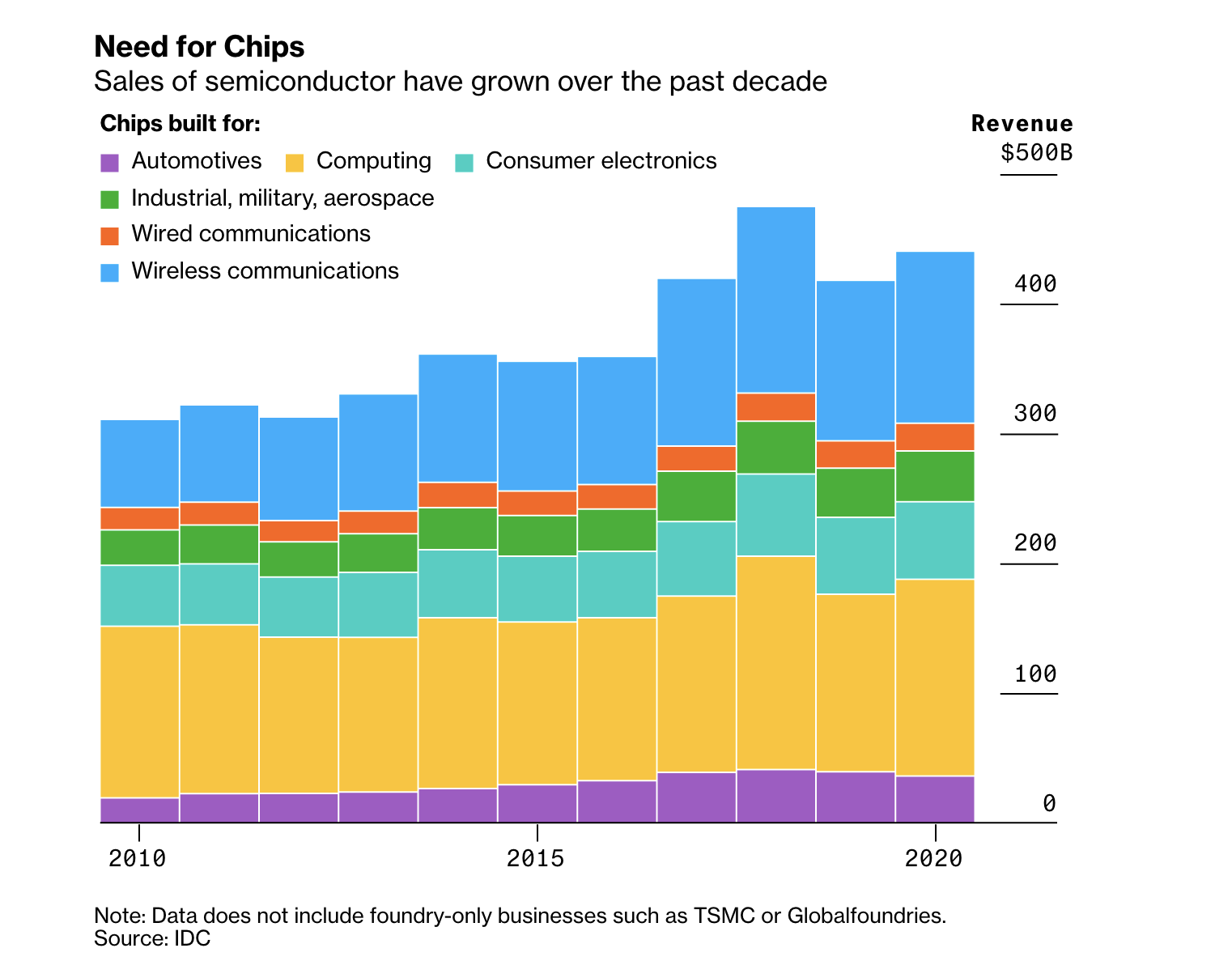

Again, this graph is by sales not chip volume, but it gives a rough idea of who is buying them. The Big Two are computing and communications. The communications demand will be driven by both 5G buildout and preparation for autonomous cars. Notice the demand by the auto industry is dwarfed by the Big Two. This is a big factor in which industry gets allocated how much of scarce supply. Obviously, supplying the millions of new iPhones would be more attractive than cranking out cheaper chips for cars. Now factor in competition from millions of new PlayStations and other consumer devices.

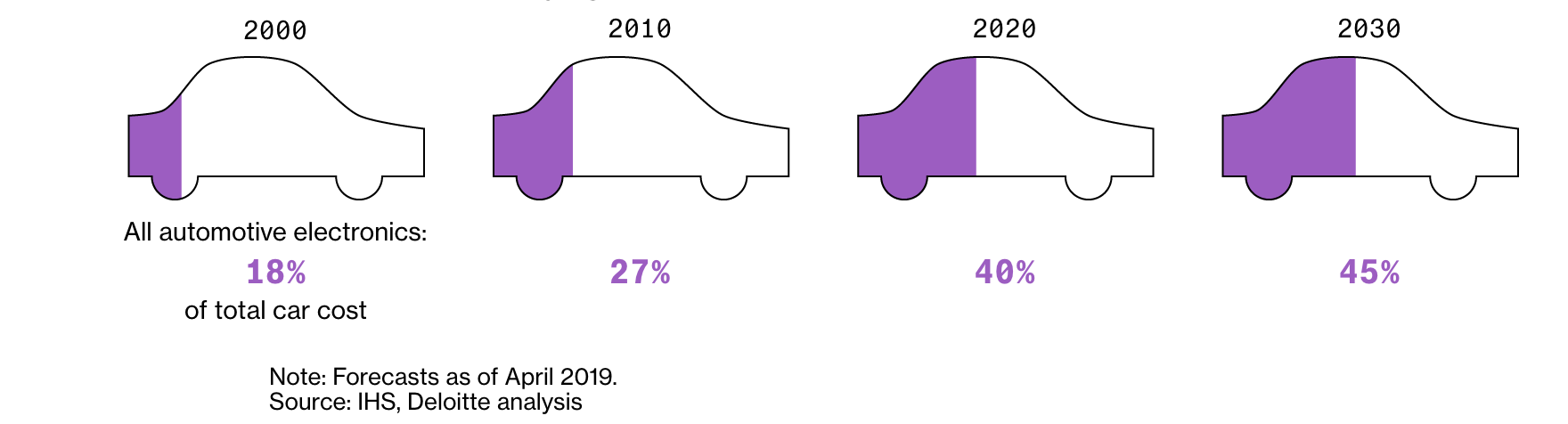

Meanwhile the use of chips in the auto industry is likewise growing rapidly. By the end of this decade, almost half the cost - not the price, but the cost - of cars will be for electronics. The oncoming wave of electric vehicles will push this number up as well.

Manufacturers were struggling to meet demand before the pandemic. The investment needed to increase capacity in some of the process steps is both enormous and long-term. We’re talking billions and years, not millions and months.

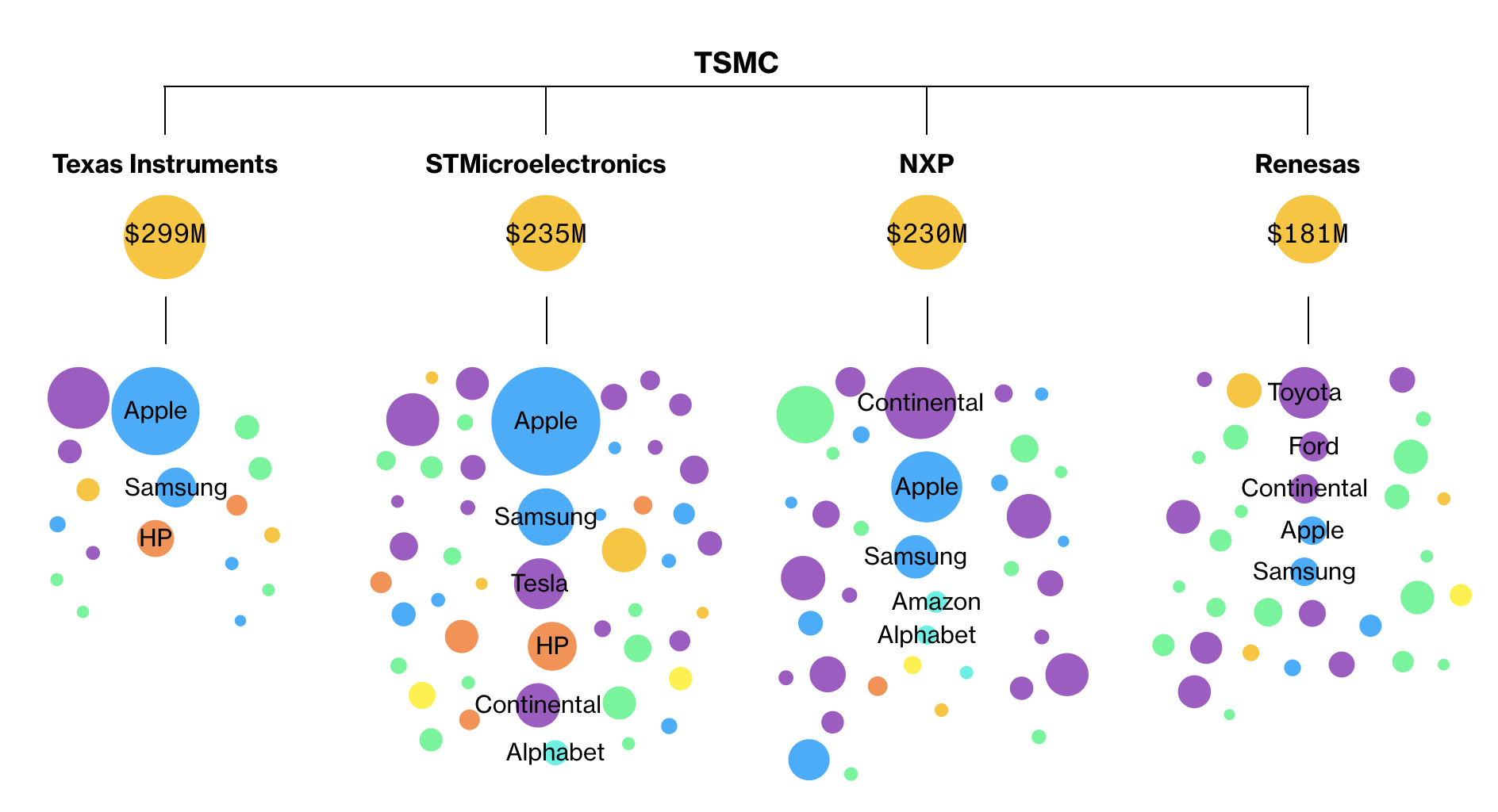

To illustrate how stretched and fragile this industry is right now, consider the recent fire in a chip manufacturer in Japan – Renesas Electronics. This company is just one of the fabricators using chips from TSMC, but its customers include many automotive manufacturers. The smaller purple dots also represent some ag machinery makers, a story Tyne will detail soon.

Microchips are not commodities, but individually designed and built components for specific end uses. Excess supply in one type is useless for others device makers. With all these factors and pressures, predicting how things will be changing is nearly impossible. Nonetheless, I’ll try to imagine the possibilities and implications for agriculture next week in the thrilling conclusion to The Great Chip Shortage.

Part 1: The Impacts and Implications of the Worldwide Microchip Shortage