50% Surge in Fertilizer Prices Adds $128,000 in On-Farm Costs for 2022, Finds Texas A&M Study

AgDay 01/12/22 Fertilizer Cost

As farmers furiously try to price and source fertilizer ahead of the spring rush, a new report from the Texas A&M Agricultural and Food Policy Center (AFPC) shows supply chain disruptions are wreaking havoc on nitrogen, potassium and phosphorous prices, costing feedgrain farms the most.

The AFPC conducted an economic impact study on fertilizer prices at the request of U.S. Rep. Julia Letlow (R-La.).

"I think the impetus for it was, you know, her office hearing from concerned constituents back home, and nationally, it's a concern that I think a lot of producers are having across the country," says Bart Fischer, Co-Director Of The Agricultural & Food Policy Center, Texas A&M University. "That concern really is across the board on all inputs with inflation and the general supply chain concerns resulting from COVID. We were asked to look specifically at fertilizer impacts. And so her office reached out asking if we would do an analysis on the impact of increased fertilizer costs on the representative farms that we maintain here at the Ag and Food Policy Center."

The study found several key points, including:

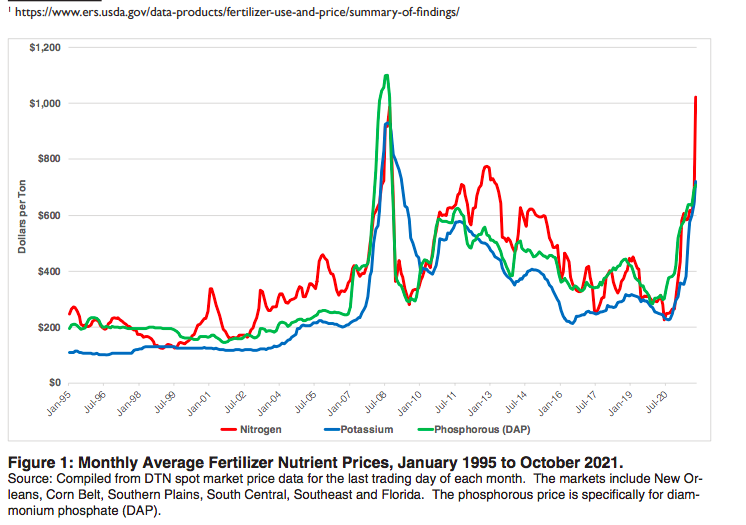

- As the nation struggles to recover from the COVID-19 pandemic, a number of supply chain disruptions continue to wreak havoc on agricultural input markets, both in terms of availability and cost of inputs. In the case of fertilizer, prices have exploded over the past year.

- Under FAPRI’s August 2021 baseline outlook, nitrogen prices were expected to increase about 10% in 2022. Based on current spot market prices, it appears as though fertilizer prices will increase in excess of 80% for the 2022 planting season (relative to 2021).

- The report found that the largest whole-farm impact would fall on AFPC’s feedgrain farms at an average of $128,000 per farm.

- The largest per-acre impact would fall on AFPC’s rice farms at $62.04 per acre.

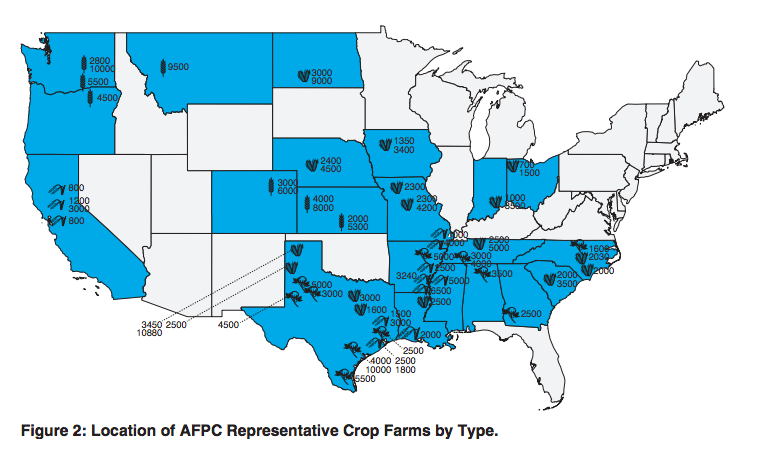

AFBC’s analysis was presented relative to the August 2021 FAPRI Baseline analysis, which is the same baseline many in Washington D.C. use as a guide for policy. AFBC then used a modeling system utilizing AFPC’s 64 representative crop farms across the U.S.

Texas A&M economists found heading into spring planting, fertilizer prices are up 80% compared to 2021, and in some cases, farmers are seeing certain fertilizer prices more than double what they saw last year. But for the report, AFPC was conservative in its estimate, using a 50% increase in fertilizer costs.

"On our on our feed grain farms, the impact was an increase in costs of about $128,000, just due to fertilizer costs alone. And so if you're a producer sitting here with no idea where prices are going to go in 2022, but knowing that you're trying to finance your operations and contemplating getting a crop in the ground here very soon, these are huge, huge considerations," says Fischer. "It's no surprise why there's so much angst among amongst ag producers, because they're the ones trying to figure out how to pay for this increase costs."

“Here's the key line in the report,” says Jim Wiesemeyer, ProFarmer Washington Correspondent. “Given the farm safety net is not designed to address rapidly rising cost of production, there are growing concerns in the countryside about the need for additional assistance, end of quote. Now, this report could be used by both lawmakers and farm groups to at least urge that Congress act on this issue.”

While the economic study from Texas A&M shows higher fertilizer prices are dampening the net farm income outlook for 2022, Wiesemeyer says it’s still unknown if and when Congress will take action on the rise in fertilizer prices.

The impact this could have on policy is also something AFPC economists explored in the economic impact study just released this week. While the economists didn't outline set solutions, the economists did provide perspective, saying current Farm Bill Safety nets aren't designed to handle a sudden increase in costs. And if Congress or USDA opted to go the route of direct payments, AFPC found the spike in fertilizer costs across all farms equates to an added production cost of $42 per acre.

The two key observations concluded in the survey include:

- The farm safety net is designed primarily to address price and yield risk or a combination of the two (i.e. revenue volatility). It is not designed to account for reductions in net farm income due to increased costs of production.

- Second, whether through the Coronavirus Food Assistance Program (CFAP) or the Pandemic Assistance for Producers initiative, Congress and the Biden administration have a solid roadmap for addressing COVID-related strains in the farm economy. The situation currently facing producers would certainly seem to fit that mold.

"In terms of design [by Congress] It could take a number of forms, but the point we observed is that there's really already a framework there," says Fischer. "The rounds of CFAP that have come before, that would be a perfectly fine vehicle if Congress chose to weigh in and do something, because it often comes down to a matter of just deciding on the amount of support ,and just in this report alone, we can concluded it $42 an acre, on average, just from fertilizer increases alone."

Not Just Price, Also Supply Questions

It’s not just climbing fertilizer prices that pose a problem for producers, it’s also availability that’s an issue for farmers still trying to source inputs for 2022. The most recent Ag Economy Barometer from Purdue University found nearly 40% of farmers had some difficulty purchasing inputs for the 2022 season.

“From a regulatory side, the U.S. government could work with the railroads to prioritize the movement of fertilizer and de-emphasize the movement of coal. I've heard that being talked about, but whether or not there's a specific payment to temper the run-up in prices, I think will be hard to get through the legislative route," Wiesemeyer says.

Wiesemeyer adds another option would be the Biden administration issuing an Executive Order to help with any relief on the supply side and policy solutions. That’s as farmers are running out of time to find fertilizer relief before spring planting this year.

More Background on the Data

AFPC says the data to simulate farming operations in their studies comes primarily from AFPC’s database of representative farms.

"Information to describe and simulate these farms comes from panels of farmers (typically four to six producers per location) located in major production regions in 21 states across the United States. The farm panels are reconvened frequently to update the representative farm data."

As the chart shows, the economists say the representative farms are categorized by their primary source of receipts, whether that be feedgrain, wheat, cotton or rice.

AFPC says the representative farm database has been used for policy analysis for over 30 years, analyzing the impacts of proposed policies on the past seven farm bills. The group used the same methodology in 2021 to calculate the possible cost of the Biden administration's proposed tax changes. At the time of the study, the economists found Biden's proposed tax changes would cause family farms to accrue additional debt just to be able to pay for the added costs.

Read more AFPC publications here.