Potential Game Changer? Exports Explode as Crop Conditions Crumble

U.S. Farm Report 09/09/23 - Roundtable 1

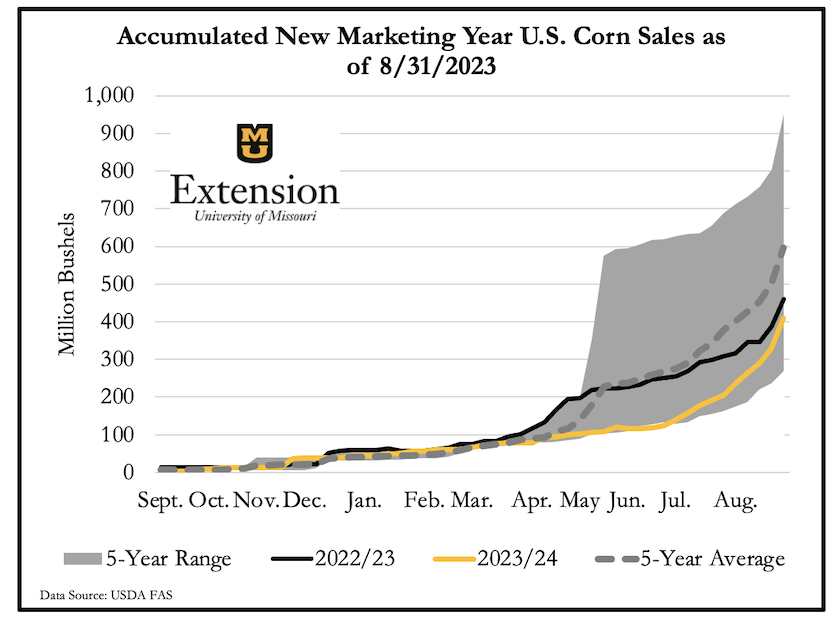

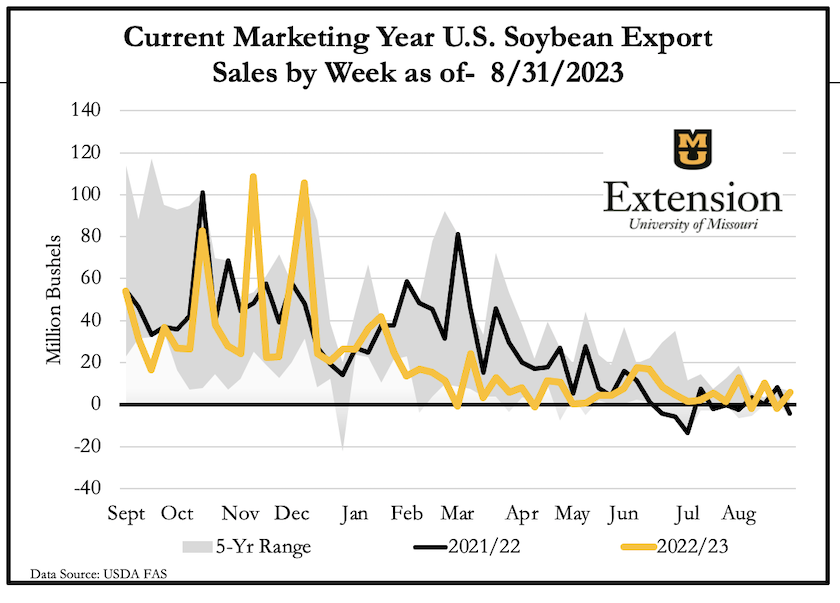

It's a story that has been told for months. Corn and soybean export sales lag the previous three years, a factor that seems to be a wet blanket for prices. But with an explosive end to the marketing year for export sales, and a sudden shift in crop conditions, is the story changing for crop prices?

Crop Conditions Crumble

Although the U.S. corn crop could take a hit from the dryness earlier this summer, the Pro Farmer Crop Tour found a crop that wasn't a disaster. Soybeans, however, were a different story. Scouts discovered a crop that took a sharp decline as they scouted fields with extreme heat in August.

USDA's Crop Progress Report this week showed:

- 53% of the U.S. corn crop is rated good to excellent, down 3 points in a week

- 18% of the crop is considered mature, 2 points ahead of normal

- 53% of the U.S. soybean crop is rated good to excellent, down 5 points from the prior week

Kansas took a major hit, with 40% of the state's crop rated poor to very poor.

With the sharp decline in ratings, could the soybean crop be worse than 2012?

"I think in some cases, it is," says Scott Brown, University of Missouri economist. "It's been a situation where just in the last few weeks, I think we've turned down in terms of what that soybean crop looks like. We got a little bit of rain in the middle part here, but we've really trailed off again with this additional heat. I think it's been tough on the soybean crop."

What makes it so difficult to project this year's soybean crop, according to Scott Brown, is the fact it's so variable.

"As we move around the state here in Missouri, I think there's going to be some really good soybeans in some parts of the of the state. And in other parts, it's going to be pretty tough," he adds.

Explosive End to Export Sales for the Marketing Year

While sales closed out the marketing year still trailing last year, thanks to some solid demand that surfaced the final week, it helped make up a portion of the lost ground.

Export data from the week that ended Aug. 31, showed net sales of 949,700 metric tons of corn and 1,783,100 metric tons of soybeans.

China was a big buyer, as the export data shows China bought:

- 2022-2023 net sales of 70,795 metric tons of sorghum and 141,808 metric tons of soybeans

2023-2024 net sales of 76,000 metric tons of corn, 59,395 metric tons of sorghum, 735,167 metric tons of soybeans, and 16,150 running bales of upland cotton

According to University of Missouri economist Ben Brown, the export sales for the final week of August were explosive.

“It was a big week for new crop corn sales,” says Ben Brown. “81.2 million bushels marks the largest week of sales for the 2023/24 marketing year to date and double the previous record weekly volume for the year set last week.”

Ben Brown says even with the uptick in sales to end the year, 2023/2024 new crop corn exports finished the marketing year 11% behind last year, and 43% behind the three-year average. But he notes 2020/21 and 2021/22 were big export years.

“On the soybean side, the reported new crop sales for 2023/24 of 110 million bushels were also a high mark to date. New crop soybean sales are 35% behind where we were at this point last year and 36% behind the three-year average,” says Ben Brown.

Price Picture

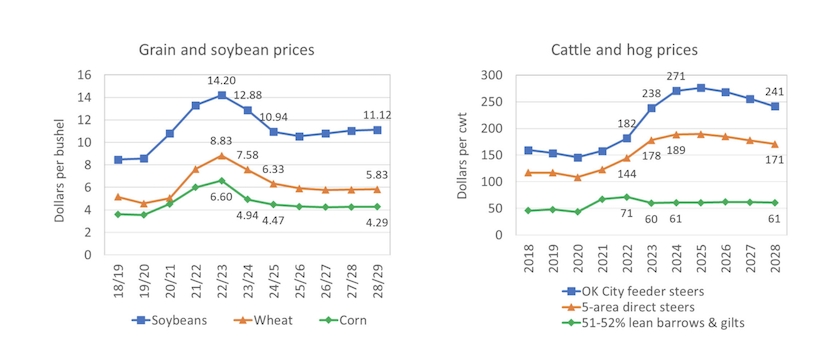

Soybeans have demand struggles, but domestic demand is helping offset some of the concerns for soybean exports, he says.

“The lower corn yield will probably offset some of that lower demand. We just don't have a lot of wiggle room on the soybean side, if we have lower production like some are projecting,” says Ben Brown.

FAPRI's Pat Westhoff says even with the declining crop production picture, FAPRI's crop price projections have stayed fairly static.

"They haven't changed as much as you might guess," says Westhoff. "While we may have a below-average crop this year, you might expect that to result in higher prices. But demand has not been as strong as we'd like it to be. Prices are actually where they were earlier this year."