Surprising Cut to Corn Yields and North Dakota's Planting Nightmare Show Crop Supplies are Shrinking

U.S. Farm Report RT1 5/14/22

Despite USDA releasing a forecast for a record soybean crop for a second year in a row on Thursday, soybean prices skyrocketed Friday, with the May contract closing 63 cents higher on the day. July soybeans shot up 32 cents.

USDA's May WASDE report indicated while farmers may harvest a record large soybean crop for the second year in a row this year, supplies will remain tight due to roaring demand. USDA put its soybean production forecast for 2022/23 at 4.640 billion bushels.

The same report indicated the U.S. corn crop is already in trouble, yet corn prices trended lower Friday. The front-month May contract down 19 cents, despite USDA making a surprising move Thursday to trim the U.S. corn yield in the May report. USDA is projecting a national average corn yield of 177 bu. per acre. That is 4 bu. below the weather-adjusted trend presented at USDA’s Agricultural Outlook Forum in February. According to AgWeb, prior to Thursday’s report, USDA had only lowered the national average corn yield from trendline in its May report five times, with 2013 being the most recent.

“It really surprised me,” says DuWayne Bosse of Bolt Marketing. “They dropped the yield down to 177 [bu. per acre] versus the 181 from the February outlook and the trendline. Yield. They did so because of the late planting, and it did surprise me. They hadn't made an adjustment like that since way back in 2013, when we did have similar type delayed planting start to the planting season. So, justified or not, that's the numbers we'll work with for now.”

Slow Start to Planting and Impact on Yields

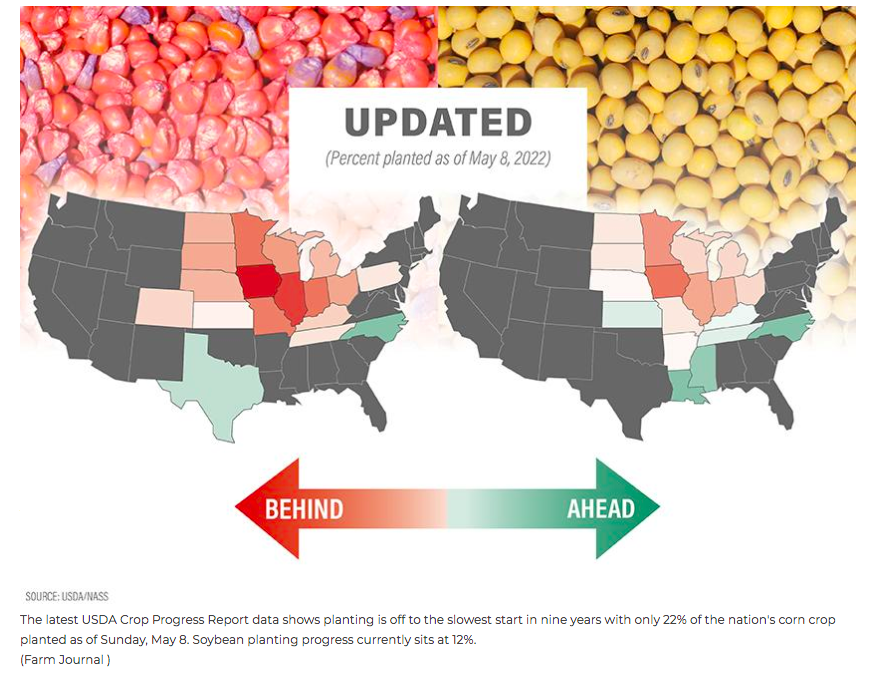

While USDA’s decision to go ahead and trim yields, Monday’s Crop Progress data showed planting is off to its slowest start since 2013, which is the last time USDA made an adjustment to corn yield in May. Matt Bennett of AgMarket.net thinks the revision is not only justified, but needed.

“I was surprised, as well, because typically, you're going to use that 181 [bu. per acre] from the Outlook Forum,” says Bennett. “But you come in here this year, and you get kind of a late start. I think everyone's just a bit more on edge than what you would typically be given the fact that we need good production this year, there's no question.”

Bennett points out the commodity markets have done everything it can to buy acres this year, but no matter what happens with price, the weather is always the final deciding factor.

“But if Mother Nature doesn't cooperate, then all of a sudden you start pulling some acres away from certain areas, for instance, North and South Dakota and Minnesota,” he says. “Now, how many acres have we possibly picked up in other places due to the fact that the markets have been so good late spring? I think is definitely going to be something that's going to be a bit of a roadblock there. But I think when it's all said and done, you probably lose a few acres and and second of all, it's going to be really hard to outdo your all-time record yield last year with you getting off to such a poor start. So, I can go along with the 177 [bu. per acre]. I was just surprised that they did it.”

Derecho Strikes South Dakota, Minnesota

Not much planting took place in North Dakota or northern South Dakota this week as more rain swept across the state. Then Thursday, severe weather struck much of South Dakota and into Minnesota as a derecho blasted the area. Hurricane-force winds clocked in between 70 mph and 107 mph in some areas. Producers across the area suffered a heavy amount of damage including roofs ripped off barns and grain bins crushed.

pic.twitter.com/weVp6j7wCJ — Nate (@NateHan_sen2) May 12, 2022

Bosse says the storm caused damage across nearly the entire state of South Dakota, starting at the southern border that touches Nebraska and spanning up to North Dakota.

Running Out of Time to Plant

Planting in that area was already behind. As of the last Crop Progress report, USDA said only 1% of North Dakota’s corn crop had been planted. Bosse says South Dakota is in a similar situation, and now producers in the area are faced with major damage that will need to be cleaned up.

“We haven't even done the tillage work to prep the ground yet for planting,” says Bosse. “From about highway 212 north in South Dakota and all the way through North Dakota, it's very similar and very little planting progress has been done.”

Bosse says he doesn’t think all the forecast corn acres in South Dakota and North Dakota will get planted, just due to extremely wet field conditions with even more rain on the way.

“When you look at the S&D tables right now, you start to take 1 to 3 million acres off of corn or soybeans, it gets very tight,” he says. “We're supposed to plant 3.5 million acres of corn in North Dakota, I think there could be 1 million acres taken off there due to 1 million acres of prevent plant corn.

Prevent Plant Acres Could Grow

Bosse says while producers have every incentive to plant, the weather is making it impossible to get in the field. He thinks the loss of acres won’t be a story that fully hits the market until more than a month from now.

“Probably mid to late June,” says Bosse. “Right now, USDA is forecasting about 2 million acres of prevent plant, which would be close to last year's number. The average is around 4.5 million. And right now, as wet as we are, we're looking wetter than normal. So mid-June that should really start to hit the market when we talk about it.”