USDA's Final 2021 Crop Production Numbers Are In, Here's What You Should Know

The wait is finally over. USDA’s provided traders and farmers with its final production tally for the 2021 crop year on Wednesday. Along with Crop Production, the agency also released the latest World Agricultural Supply and Demand Estimates (WASDE) and Grain Stocks. January is the only month where USDA releases WASDE and Grain Stocks on the same day. The slew of reports caused corn, soybean and wheat to all trade lower immediately following the release.

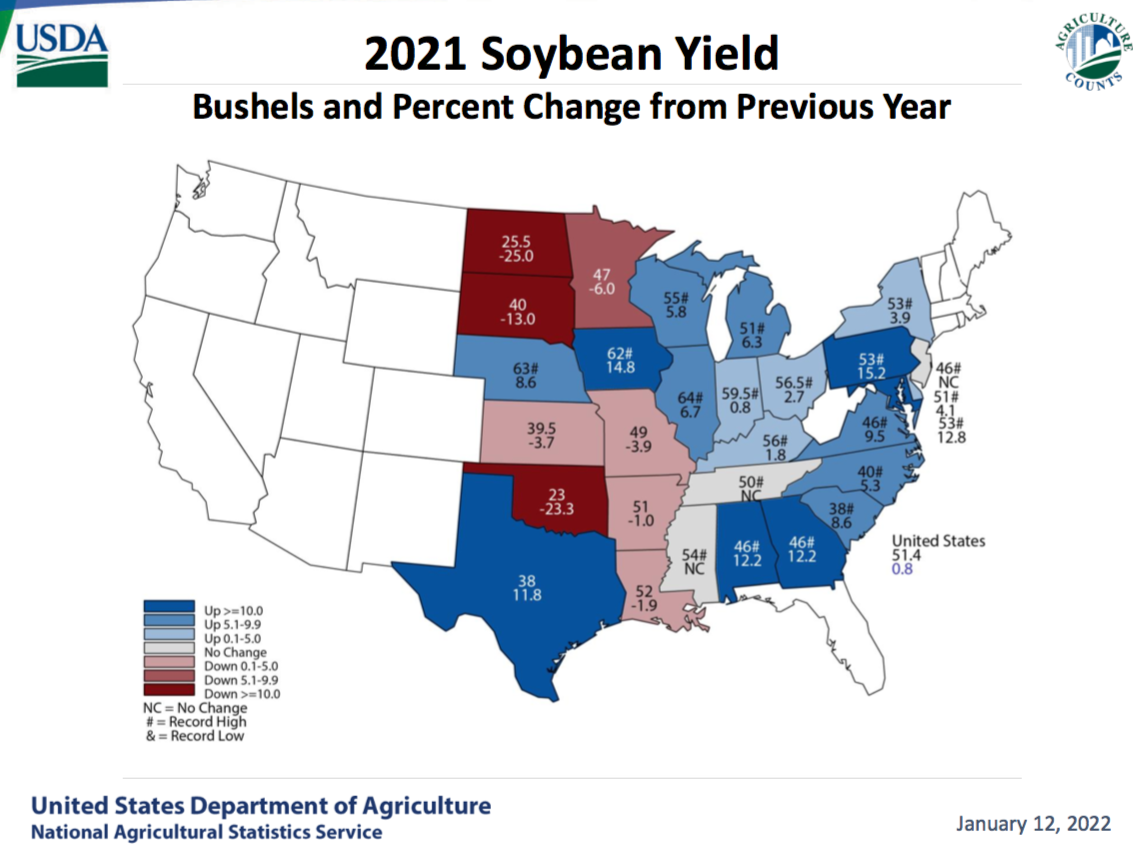

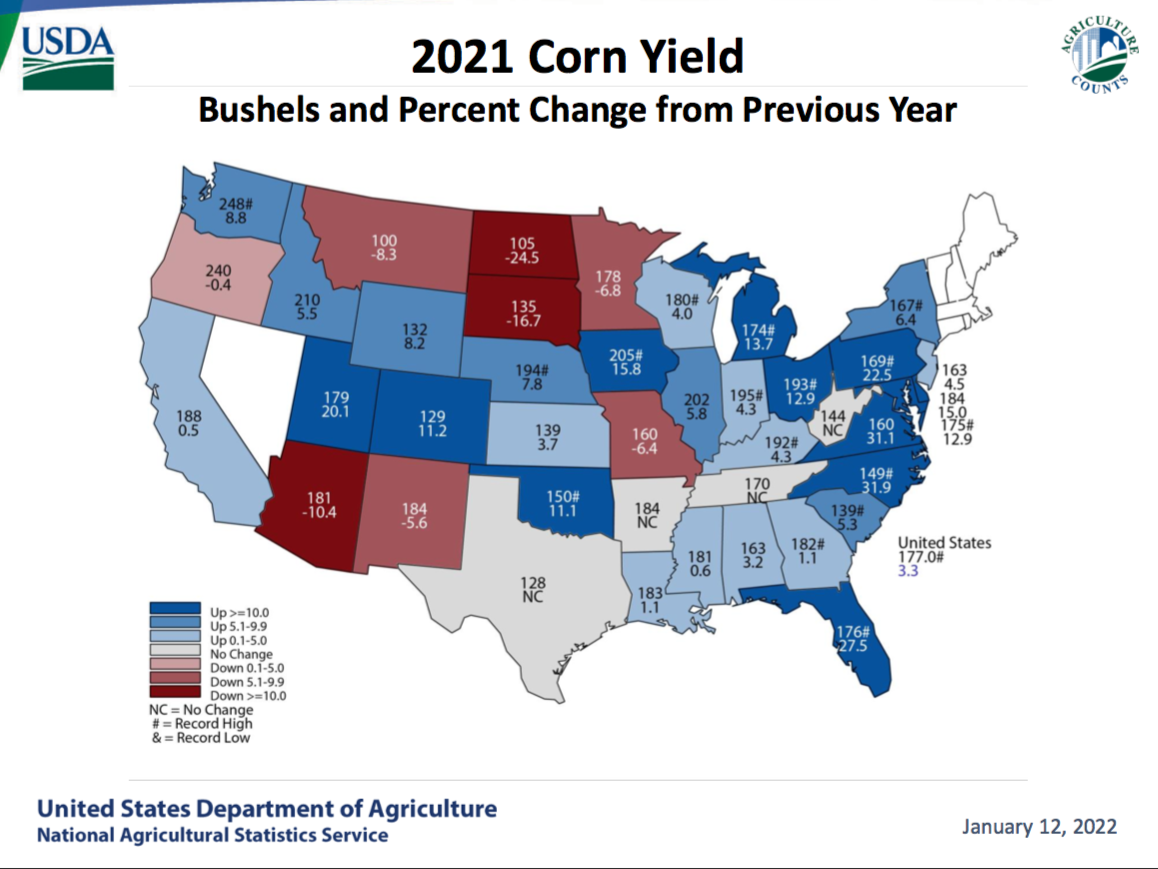

USDA slightly boosted corn-production estimates, but not due to a change in the national yield. Instead, corn saw a bump in total production due to USDA slightly increasing both area planted and area harvested. USDA did find the national average soybean yield in 2021 was slightly higher than in previous reports.

USDA’s changes to U.S. crop production in the January report include:

- Boosting soybean yield to 51.4 bu. per acre, up from the 51.2 bu. per acre forecast in December

- Soybean production up 10 million bushels, thanks to higher total production in both Iowa and Indiana

- Corn production increased by 53 million bushels

- Corn area planted at 93.4 million acres, up from 93.3 million in December

- Corn area harvested at 85.4 million, up from 85.1 million in December

While USDA's January Crop Production report did include final estimates on 2021 yield and production, Arlan Suderman of StoneX Group points out USDA tends to adjust those "final" numbers in the September Grain Stocks report.

"I guess these are final until September when USDA changes them again, right? But no change on the corn yield today, and he two-tenths of a bushel increase in soybeans. The soybean adjustments are well within what we normally get the way of an adjustment for the January report," says Suderman. "We saw about a 300,000 acre increase in harvested acres for corn, that's not really materially significant."

Final Yields Numbers are In

How do 2021 yields stack up to 2020? USDA says the corn yield of 177 bu. per acre, which has been penciled in since November, is a new, national yield-record average for the U.S. Last year, USDA reported the 2020 national corn yield came in at 171.4 bu. per acre average. And the average national soybean yield reached 51 bu. per acre, just 0.4 bu. behind the 2020 final yield.

Too much rain may have hurt yields for some producers this year. USDA says despite dry weather to start the growing year, Iowa actually outyielded Illinois this year in corn. USDA's says Iowa's average corn yield came in at 205 bu. per acre, compared to 202 in Illinois.

"It's really impressive what our genetics are doing," Suderman points out. "And it's not just genetics, it's also seed placement and the mechanical technology that we have in being able to get these crops to produce. Farmers are managing them very well. And so the dry Northwestern Midwest did a much better job than what we feared during the growing season. We saw how dry it was. We did have some drought yield drag from what we were hoping for in the eastern Midwest because of excess of wetness."

The drought did have a major impact on production in certain states this year. USDA's largest year-over-year revisions came in South Dakota and North Dakota where USDA took another 24.5 bu. per acre off North Dakota's state average yield for 2021. South Dakota saw its statewide yield cut by 16.7 bu. per acre year-over-year.

Cotton Crop Climbs

USDA revised its cotton-yield forecast 2 pounds higher in the January report. With a new average yield of 849 pounds per acre, 2021 total production ended up being 21% higher than in 2020. USDA says cotton farmers produced a crop that equaled 17.6 million 480-pound bales. Harvested acres was also a much better story, with USDA showing farmers harvested 9.97 million acres in 2021, up 20% from 2020.

Detailed Look at Demand

USDA says while food, seed and industrial use for corn is on the rise, exports were revised lower. USDA’s WASDE report shows:

- Total corn use is virtually unchanged at 14.835 billion bushels

- Exports lowered 75 million bushels to 2.425 billion, due to increased competition

- Ethanol use increased 75 million bushels

Largely expected changes on corn. Exports down 75 million bushels, Ethanol up 75 million bushels. If you've followed my past tweets- we were headed in this direction. pic.twitter.com/iHzuDVMLY7 — Ben Brown (@BenBrownMU) January 12, 2022

USDA didn’t revise crush and export estimates for soybeans, which left ending stocks at 350 million bushels. That was despite USDA lowering its production forecasts for Brazil, Argentina and Paraguay due to weather concerns. Key revisions to South America include:

- Paraguay’s crop was lowered 1.5 million tons to 8.5 million tons

- Global soybean stocks were reduced 6.8 million tons to 95.2 million, based on lower stocks for Brazil and Argentina

"What really I think was a bigger surprise to me is USDA has not started to reduce its soybean export target yet," says Suderman. "When we look at the how cheap soybeans are in Brazil, we can talk all we want about the weather problems there. But when soybeans are 65 to 70 cents per bushel cheaper in Brazil than they are in the United States, that speaks volumes to China and speaks volumes about expectations. And we're seeing that export season come to a quick end here."

Last weekend on U.S. Farm Report, analysts pointed out South American weather still trumped demand to provide year-end fuel in the markets. Garrett Toay of AgTraderTalk says if South American production forecasts continue to see revisions lower, it could spur more demand.

“The demand is going to come if these production cuts keep coming," said Toay.

Double Whammy with Grain Stocks and WASDE

January 2021 reports caused a big shock in Grain Stocks, mainly due to USDA saying it was fully accounting for production issues in Iowa and other key producing states. Much of that was due to the derecho that hit in 2020.

USDA didn’t have a repeat performance this year, as the agency made no major changes in Grain Stocks.

In the previous look at stocks, which happened in the September Quarterly Grain Stocks report, USDA’s revisions caused major market reaction. USDA raised the soybean stocks number, with one analyst calling the move "unprecedented." As a result, soybean futures dropped double digits.

Where Do the Markets Go From Here?

Despite no major surprises or market shocks in the reports USDA released Wednesday, corn, soybeans and wheat prices on the CME were all trading lower after the report. Soybean prices then made a comeback, with prices more than 10 cents higher on the day. Suderman says data on inflation released Wednesday morning was also a market mover mid-week.

"All of this takes place in a backdrop of inflation," says Suderman. "Ahead of the USDA report, we got a CPI number out showing the highest inflation in the last 40 years. We have a Fed that's moving decidedly hawkish. The market is assuming that the Fed is going to get aggressive and treating that inflation as long as inflation is as high as it is. That should channel money into the commodity sector, not necessarily preventing us from having sell off or lower prices, but managing supply and demand at a higher plateau than it otherwise would. And we're seeing that play out. If the Fed does get aggressive that does present some risk to that scenario going forward."