As Anxiety Levels Increase, Farmers Eye Acreage Shifts

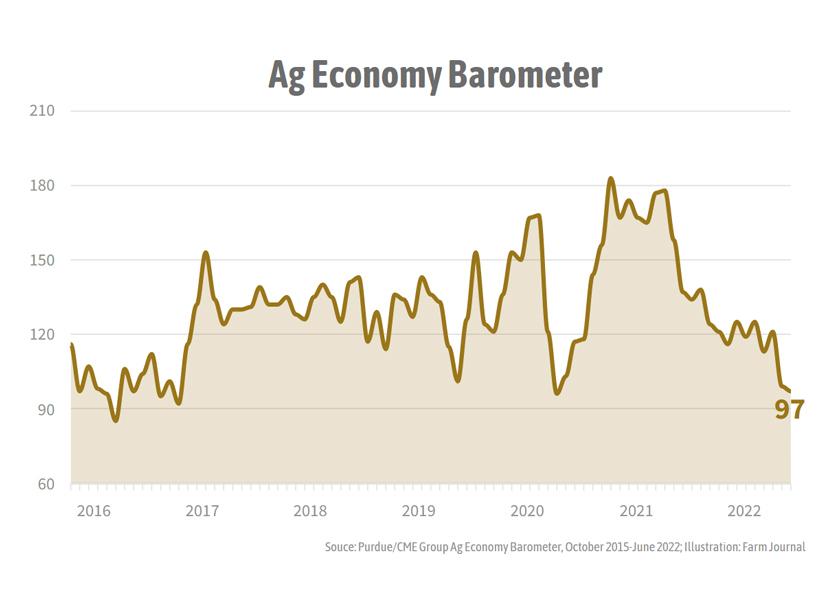

Another red flag is being raised for the farm economy. In June, the Ag Economy Barometer, by Purdue University and the CME Group, fell to a reading of 97. That is two points below its May reading.

Watch this AgDay clip:

This month 51% of survey respondents said they expect their farms to be worse off financially a year from now, the most negative response received to this question since data collection began in 2015.

“People are concerned about where the future is headed,” says Jim Mintert, director, Center for Commercial Agriculture, Purdue University. “We've got inflation concerns, rapid rises in input costs and uncertainty about output prices. People are worried about a cost price squeeze. That's the anxiety level we're picking up in the sentiment survey.”

Listen to Mintert discuss the latest survey results on AgriTalk:

One out of five crop producers in the June survey said they intend to change their crop mix in 2023 with the largest percentage of respondents planning a move towards more soybean production.

Among the farmers who planted winter wheat in fall 2021, one out of four said they plan to increase their winter wheat acreage this fall. Among crop producers who did not plant winter wheat last fall, 14% said they intend to plant some winter wheat this fall.

“People are worried about these production costs, and they're looking for ways to cut back on the dollars that are flowing out,” Mintert says. “When you think about the dollars invested to raise a crop, it takes fewer dollars to put a soybean crop in generally than a corn crop.”

The wheat increases, he says, are due to the global wheat supply uncertainty, because of the loss in production for Ukraine and Russia.

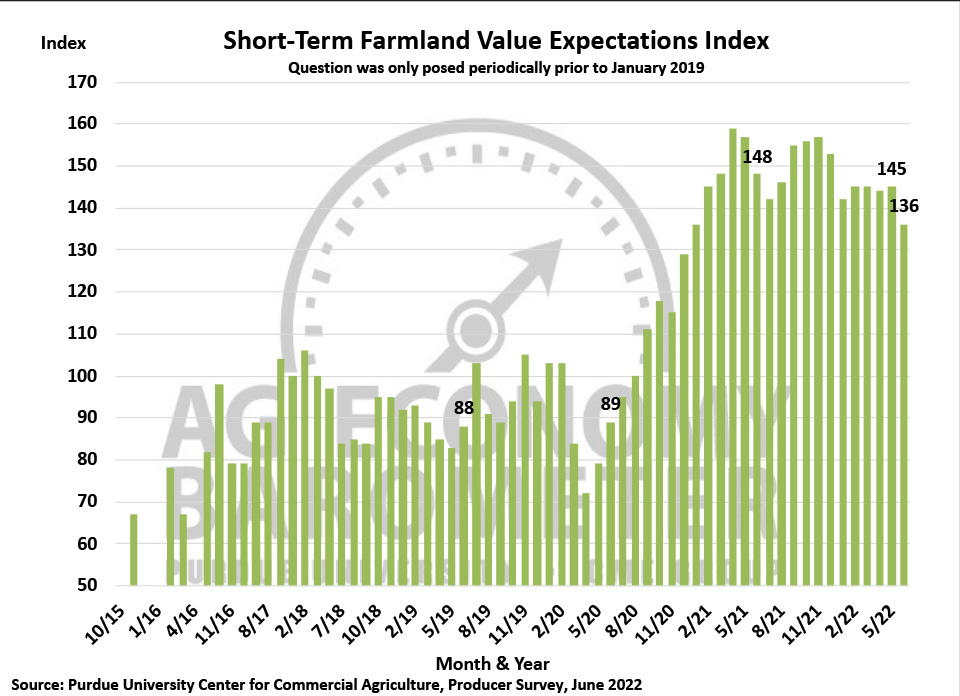

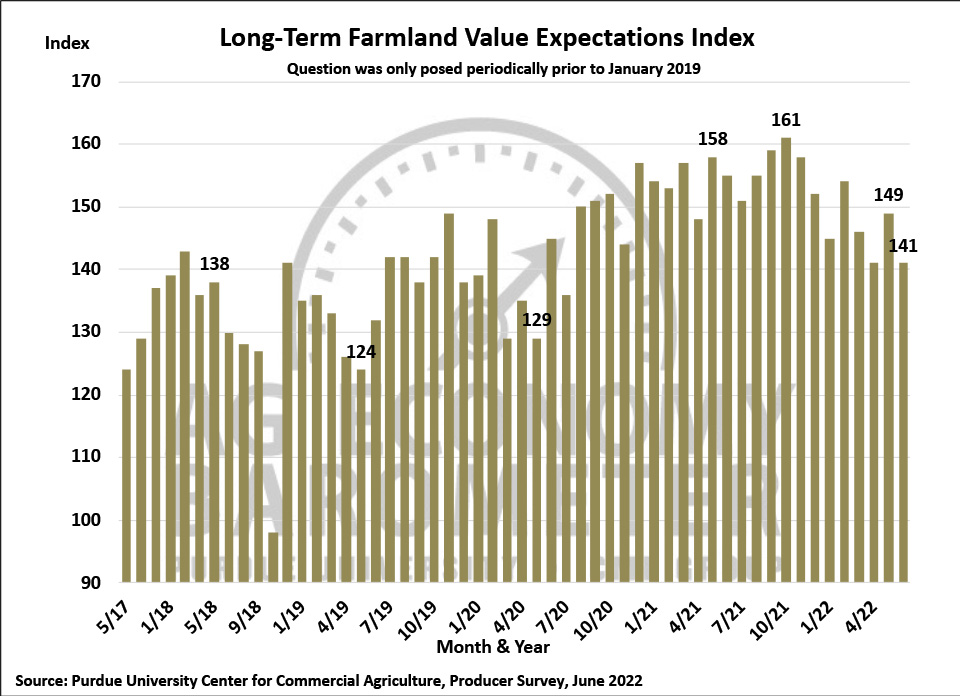

Although both farmland value indices remain at strong levels, producers were noticeably less confident farmland values will continue to rise than they were last fall. However, in our first attempt to learn about corn/soybean farmers’ expectations for 2023 cash rental rates, over half of producers said they expect to see rental rates rise.

Farmers expect cash rental rates to go up, Mintert says. The question is: How much?

Of the corn and soybean producers surveyed, eight out of 10 said they expect cash rental rates to rise 5% or more. Four out of 10 are predicting rates to rise by 10% or more in 2023.

“So, that's going to put some more pressure on that cost by squeeze,” Mintert says.

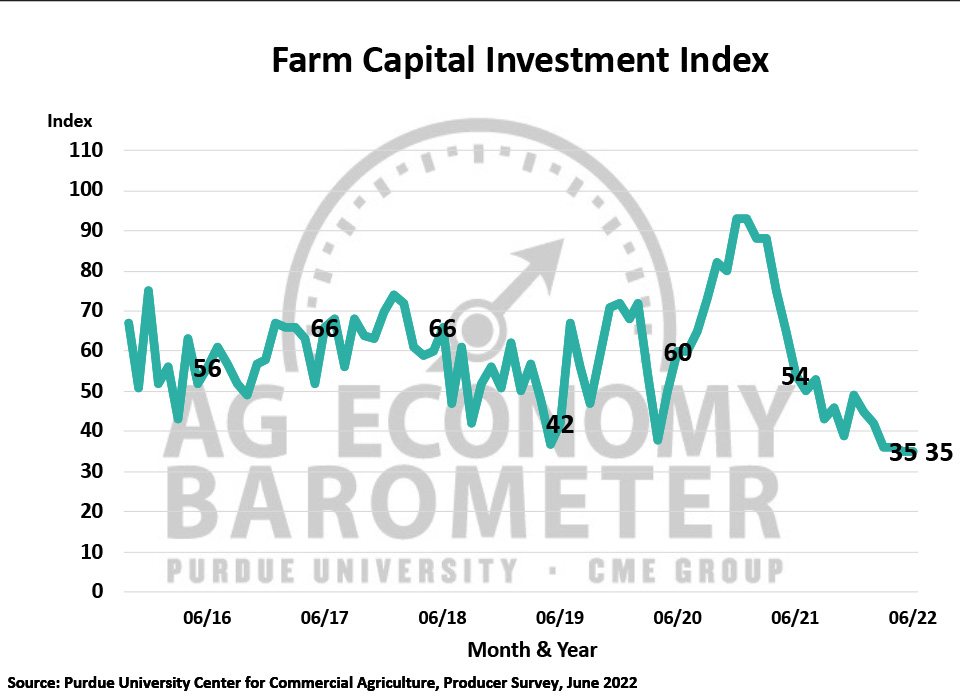

The Farm Capital Investment Index remained at its record low of 35 for the second month in a row. Producers continue to view this as not being a good time to make large investments in their farm operation. One reason producers say it’s not a good time to make large investments is the problems they’ve experienced in the supply chain.

The Purdue University-CME Group Ag Economy Barometer sentiment index is calculated each month from 400 U.S. agricultural producers’ responses to a telephone survey. This month’s survey was conducted from June 13-17, 2022.

Read More