A Guide to Your 2023 Crop Insurance Decisions

You have a big deadline approaching. By March 15, you need to make your crop insurance decisions for this crop season.

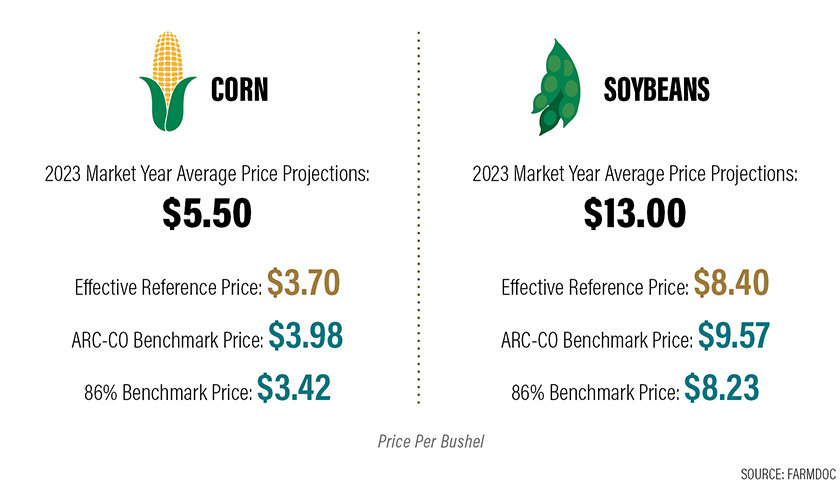

Jamie Wasemiller, market analyst for Gulke Group and owner of Wasemiller Insurance Agency, provides insights into this big decision. First, let’s talk Agricultural Risk Coverage (ARC) and Price Loss Coverage (PLC). Here’s an overview of the reference prices:

“With the Marketing Year Average prices being much higher than the base price, PLC has almost no change and with ARC it would take an almost catastrophic yield loss,” Wasemiller says. “I think the majority of farmers should elect PLC this year purely because it gives you the ability to purchase SCO as part of your crop insurance plan. If you do decide to elect ARC, you still can buy ECO, which is a step above SCO in insurance coverage, but it is about three times more expensive.”

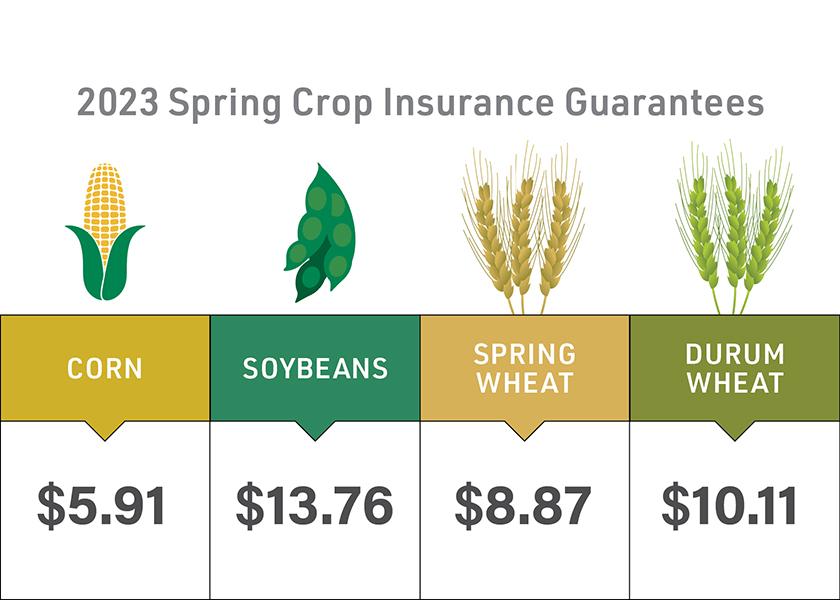

As for general crop insurance, here are the spring crop guarantees:

- Corn: $5.91

- Soybeans: $13.76

- Spring Wheat: $8.87

- Durum Wheat: $10.11

“In addition to price volatility is another component of how our insurance premiums are determined,” Wasemiller says. “This year, that volatility level came in lower, closer to levels back in 2014, as opposed the last couple of years. So, in theory, we're getting a little bit more coverage per dollar than we spend.”

Planting Risk Management Tools

With many farmers planting early, Wasemiller says they should think about how that translates into their crop insurance coverage.

“I think most producers should consider buying private replant coverage as it allows for a higher payment per acre than what you can get from your MPCI [multi-peril crop insurance] policy,” he says. “It also covers crops that are planted up to 15 days ahead of the counties initial plant date, which your MPCI policy will not cover.”

This year, Wasemiller says, will be different than recent years because farmers are facing higher input costs.

“Additionally, a concern we at the Gulke Group have been considering for quite some time now is prices have a real chance of being significantly lower come harvest,” he says. “I don’t think mid-range insurance coverage will provide much protection this year especially with better crop yields.”

As such, Wasemiller suggests buying up higher coverage mostly for price protection either through the government policies such as SCO or ECO or through private products such as RAMP, ICE or others like them.

For example, average yields in corn with an 80% policy price needs to drop down to $4.75, but at 95% price only needs to drop down to $5.64.

“That is almost $1 more coverage,” he says.

In soybeans, at 80% price needs to drop down to $11.02, but at a 95% level, price only needs to drop to $13.09, which is over $2 more coverage.

“What I look for as an agent and as a famer is if I can get close to 2.5 times or more return on coverage versus extra premium,” Wasemiller says. “If I can achieve that, I think it makes good risk management sense.”

If you have questions for Wasemiller, reach out to him at 707-365-0601 or jamie@GulkeGroup.com

Learn more at GulkeGroup.com

Disclaimer: There is substantial risk of loss in trading futures or options, and each investor and trader must consider whether this is a suitable investment. There is no guarantee the advice we give will result in profitable trades. Past performance is not indicative of future results.