One Black Swan Avoided For Glyphosate Supplies

Over the weekend, Bayer announced a force majeure situation with its glyphosate supplies. And a second story also developed as an error at the US Trade Representatives office could have amplified imported materials for glyphosate production from 3.7% tariffs to 25%.

“Last week—out of the blue—we found out the tariff codes for imported glyphosate acid were changed by Presidential proclamation as part of updating the HRS codes for 2022,” says Mike Massey with Ragan & Massey, a pesticide manufacturer located in Louisiana. “During this change the HTS code was mistakenly entered as a 301 tariff schedule 3 item instead of what it is which is a 4b schedule. This imposed a 25% tariff on all the acid coming to the USA immediately.”

The concern was of grand scale as he says there’s probably hundreds of millions of dollars of inventory on the ocean now that would have been subject to the elevated tariffs.

Massey credits politicians and staff in the trade representative office at quickly remedying the error.

“Here’s the good news, these folks acted much quicker than normal because everyone recognized it was a mistake and there was going to be a major issue. And it appears that anyone who did pay the elevated tariff will get reimbursed,” he says.

This latest issue is just one of many that has popped up and caused angst and anxiety about the 2022 crop input supply chain, and specifically at times glyphosate.

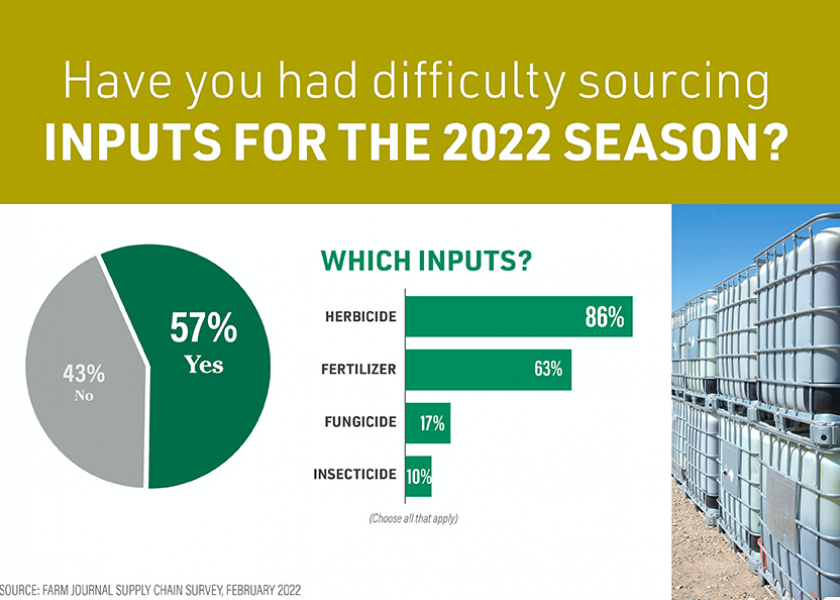

According to Farm Journal research, 57% of farmers have had difficulty sourcing inputs for their 2022 crop. And herbicides were at the top of the list.

Massey highlights how Hurricane Ida’s disabling the Bayer glyphosate plant in September really put into focus how challenging the supply chain was going to be.

“We had a lot of catching up to do as an industry,” he says, noting the decreased supplies from China due to reduced electricity for manufacturing as well as challenging with cargo shipments exacerbated the issue.

“In September, there wasn’t 5% of the acid produced in the world that was going to be needed,” he shares. “But really in the past 60 to 90 days, plants have been online and shipping hard. So as I see it, we may have a week here or there where inventory is interrupted, but it’ll get resolved, and unless another one of these crazy things happens, we won’t have any supply issues.”