Rabobank: Tighter Margins Globally For Row Crop Farmers in 2024

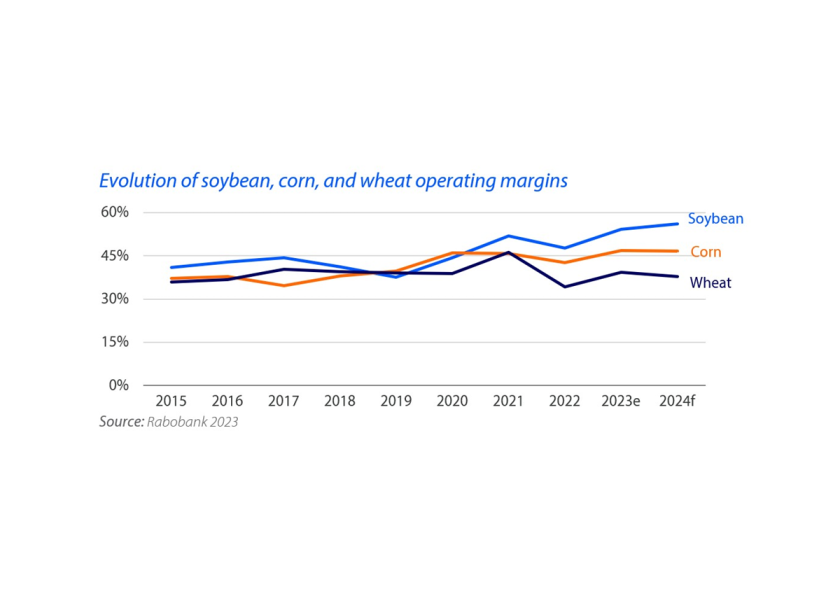

Ag analysts at Rabobank expect operating margins for row crop producers to continue to contract in 2024. The difference in next year’s outlook compared to the past two years is favorable commodity prices buffered the effect. Rabobank says things may change next year.

The bank expects a more positive outlook for soybeans than corn and wheat in 2024.

In a recent report, Bruno Fonseca, senior analyst on the global farm inputs team, details: “Soybean farmers are likely to achieve good margins in the coming season. However, corn farmers will feel their margins pressured by ample supply, while wheat farmers are unlikely to see improved margins despite declining costs.”

His global margin outlook for the row crops includes:

“The Only Certainty is Price Volatility”

Fonseca writes, “In terms of price risk, the corn market exhibits the least upside potential, with wheat presenting the highest. Soybeans fall in between, indicating an equal likelihood of upside and downside risk. The prevailing market uncertainty ensures that price volatility is an inevitable certainty.”

The report shares markets are at a crossroads — prices could move in either direction.

Fonseca is watching crop production from North America and South America, which have been strong and prevented global stocks declining. He notes global domestic demand for key crops declined for the third time since 1980/81.

He details, “Corn and soybean stocks increased, while wheat and rice stocks continue declining. Weather challenges and geopolitical instability coupled with economic uncertainty prompt consideration of a risk premium in the market.”

One risk area to continue to watch is the Black Sea region.

“Despite Ukraine’s comparable or improved corn and wheat crops, the discontinuation of the Black Sea Grain Initiative has cut off a crucial export gateway,” Fonseca writes. “Ukraine, once heavily reliant on Black Sea ports, has diligently diversified, now dispatching around 60% of its commodities via seaports. Despite ongoing challenges from war, Ukraine's agricultural exports face impediments, with bans from Poland, Slovakia, and Hungary persisting despite the EU lifting restrictions on September 15."