How Low Will it Go? Harvest Barge Traffic Slows Due to Low River Levels

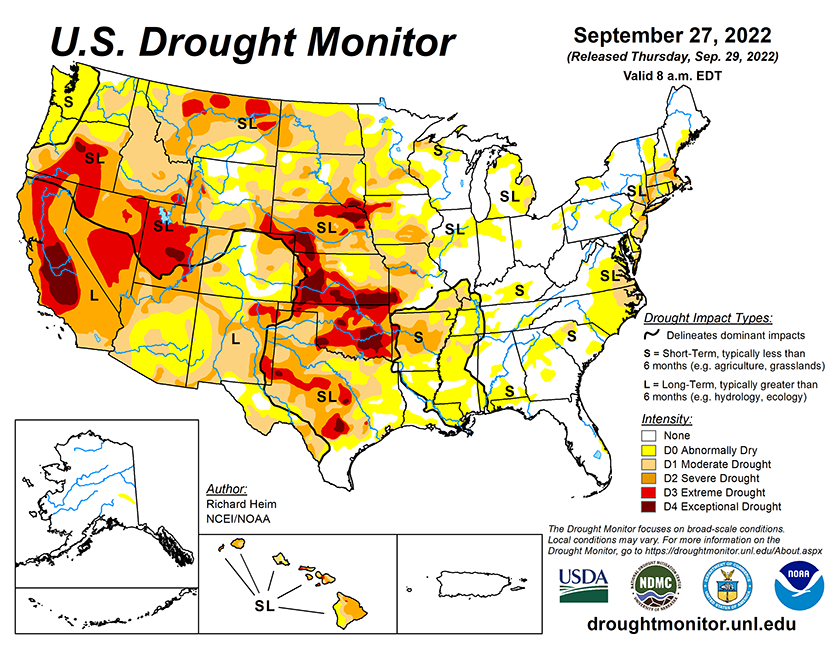

Harvest progress is up, but river levels are down. South of St. Louis, parts of the Mississippi River are so low from weeks of drought that barge traffic is being limited.

“As if agricultural shippers did not have enough supply chain challenges to occupy multiple lifetimes, there is current and growing concern related to the diminished water levels along the inland waterway system that will impact barge transportation,” says Mike Steenhoek, executive director of the Soy Transportation Coalition. “This will become more acute as we increasingly enter harvest season.”

Since the Sept. 1, 890 grain barges have unloaded in New Orleans, according to USDA’s grain transportation report. That’s nearly 40% fewer than the five-year average.

Similarly, barge freight rates have increased steadily since early August. As of Sept. 27, the St. Louis barge rate for export grain was a record 1,250% of tariff ($49.88 per ton), 95% higher than the five-year average, and 58% higher than same period last year.

Unless barge supply improves, the increased demand for barges from grain shippers during harvest will likely put even more upward pressure on barge rates, according to USDA.

More Barge Tows = More Cost

Low water levels hurt navigable waterways in two ways, Steenhoek says: channel depth and channel width.

To prevent barges from running aground during their voyages, companies must lighten the load. Steenhoek says a typical barge can be loaded with 1,500 short tons of freight (50,000 bu. of soybeans, for example).

A 15-barge tow can easily accommodate 750,000 bushels of soybeans. Each reduced foot of water depth will result in 150 to 200 fewer short tons (5,000 to 6,700 fewer bushels of soybeans) being loaded per barge.

Steenhoek provides this example:

If a company needs to transport 100 million bushels of soybeans via barge, they would need 133 barge tows under normal conditions (100 million bushels ÷by 750,000 bu. per 15 barge tow = 133 barge tows).

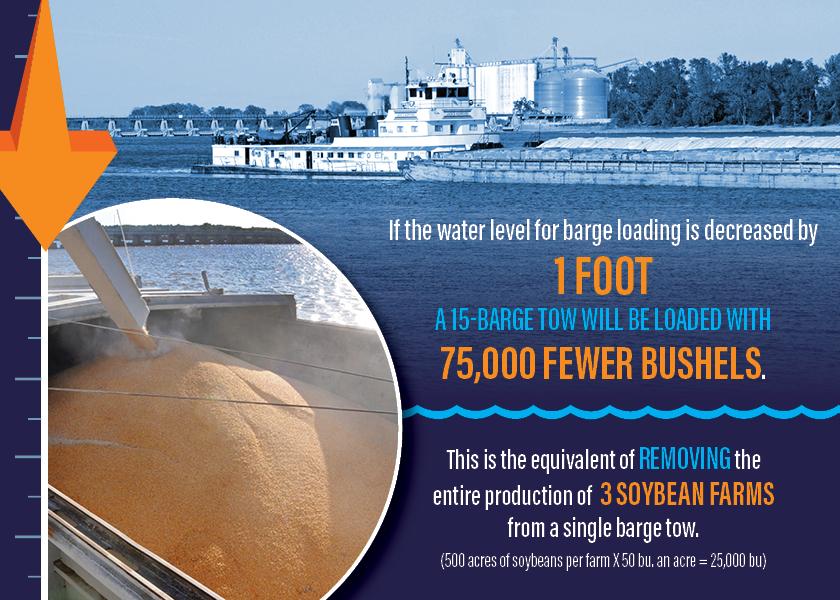

If the water level for loading is decreased by 1’, the 15-barge tow will be loaded with 75,000 fewer bushels.

“This is the equivalent of removing the entire production of three soybean farms from a single barge tow (500 acres of soybeans per farm X 50 bu. an acre = 25,000 bu.),” he says. “Under this scenario, 148 barge tows will be required (100 million ÷ 675,000 bushels per 15 barge tow).”

Channel Width Constraints

During drought conditions, the shipping channel becomes narrower, which necessitates reduced tow sizes, Steenhoek says.

“Barge tows south of St. Louis can often include 30 to 40 barges,” he says. “A reduced maximum to 25 barges is therefore significant. Having to load barges lighter and restricting the number of barges results in needing more roundtrips to accommodate a given amount of volume. The expected result of this is higher barge shipping rates.”

Last year in late September, the cost to transport one ton of soybeans, from St. Paul to St. Louis was $38.30 per ton, according to USDA. This year, that cost is $51.02 per ton — a 33% increase.

“Unfortunately, precipitation over the next month is expected to be limited – further exacerbating the shipping challenges,” Steenhoek says.