Is a Comeback Story Now Underway in the Grain Markets?

U.S. Farm Report, Roundtable 1, 5/5/23

Grain farmers might have started their Cinco de Mayo celebration early on Friday, with grain prices seeing some big gains. Old crop corn prices were up nearly a dime at one point, but finished around 7 cents higher on Friday. The July soybean contract was trading 20 cents higher earlier in the day, but closed just under that.

What fueled the market on Friday? It started in the overnight trading with the forecast for wetter weather next week. On Friday, concerns about the Black Sea trade deal and thoughts it won't be renewed after the May 18 deadline also supported prices.

While some analysts think wheat prices could be starting to reverse course and find a bottom, there's still a lot of fundamental factors causing a battle in the grains.

Watching the Weather

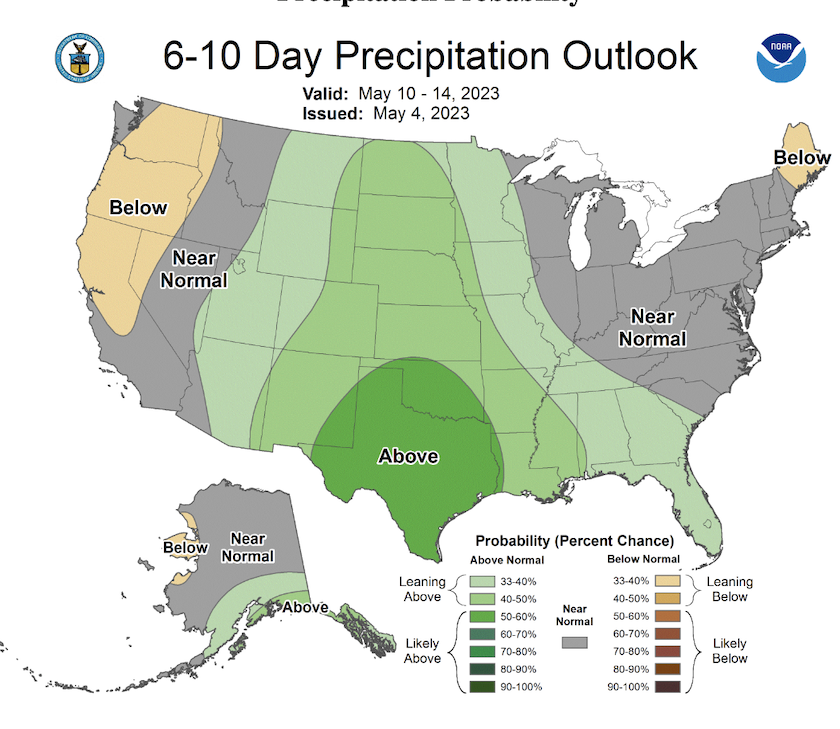

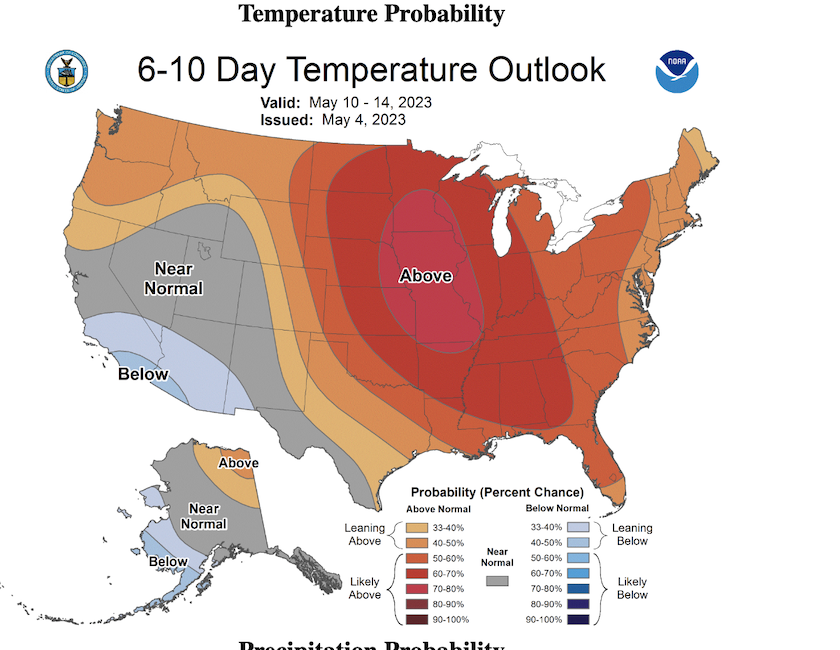

NOAA’s weather outlook for next week not only indicates wetter weather, but it also points to warmer temperatures for the majority of the country. That's good news for the Upper Midwest that’s been stuck in a rut of cold temperatures, preventing soils from warming up to plant. However, the precipitation outlook shows more moisture for the mid-section of the country, spanning from Texas all the way north into North Dakota.

USDA says soybean planning hasn’t even started in South Dakota or North Dakota, but as Alan Brugler of Brugler Marketing points out, commodity prices haven’t seemed concerned.

“I think the market is fairly comfortable with the planting phase right now,” Brugler says. “We've seen very rapid progress across Missouri, southern Illinois and Indiana, and we're starting to get some improved weather for areas a little further north.”

Brugler says there are some concerns about the lack of progress in the northern Plains and Minnesota, but it might already be priced into the markets.

“I think we've kind of gotten used to the idea that USDA will have to cut planted acreage. So, we're going to see a little bit of prevent plant there. Unfortunately, that seems to already be built into the price,” Brugler says. “Because we're comfortable with most of the Brazilian crop right now and the U.S. planting progress, the price has been under a little bit of pressure.”

The southern Plains also saw rain this week, a welcome sight for those needing that moisture to even plant a crop. Much more will be needed to aid crop production, but John Payne of hEDGEpoint Global doesn’t think it will prompt a switch in acres.

“I think the intentions are probably set,” Payne says. “If anything, milo would be a good one to plant anyway, just giving us non-GMO exposure. So, I don't think you're going to see a major change. Maybe, like Alan said, we will see some prevent plant in corn."

Slow Soybean Demand

While the market does consider planting issues in the U.S., there's fundamental concerns with demand. It’s also no secret old crop soybean stocks are tight. Brugler says it’s the demand for new crop soybeans that isn’t just poor, data shows it’s one of the worst on record.

“We just had export sales reported again this week, and the bookings for next year are the third lowest ever,” he says. “The only two years that were lower were ‘19 and ‘20. One was the trade war with China and the other one was COVID. So yeah, that's a pretty low endorsement for bullishness in beans.”

Brugler thinks part of the problem is the “short crop, long tail” concept.

“We were at 10-year highs last year. The market is expecting prices to revert back, and over time, things will get cheaper,” Brugler says. “The markets are very comfortable with the record crop Brazil had this past season. We're kind of grinding lower here and not wanting to commit too much, and that's not encouraging.”

Brugler says there is a case to be made for soybean demand for renewable diesel, but the infrastructure isn’t in place yet, which means the possible surge in soybean demand isn’t hitting yet.

“I can be more bullish on bean oil than I can on beans right now,” he adds.

Brazil’s crops are always a big factor, but today, it’s how inexpensive Brazil’s soybeans are compared with the U.S. that’s caused Brazil’s product to be in higher demand.

“I think the biggest issue Brazil has is that the pace of growth, acreage expansion hasn't been met by infrastructure,” Payne says. “You’ve essentially doubled production over the last 10 years, and the road and transportation access, and the amount of offloading vehicles that are available, haven’t double in growth.”

Payne says soybean supplies are strong, considering the good crop year farmers in Brazil just experienced, but he says there’s nowhere to go on the new sales.

“I could be real bearish on that aspect,” Payne says. “Obviously, supply exists. But if you want to be bullish, you can spin it to say, the beans that are stuck in Mato Grosso right now, those aren't competitive with the U.S. port anyway, they're not getting out. If you need beans in the short run, you’re going to turn to Brazil, but if you need an excess amount of what's planned, you're going to need to go to the U.S. because the line is going to be really long just to get it out of the ports like Paranaguá, not to mention that Argentina is going to be buying from Brazil as well.”