How Dredging the Mississippi River Could Uncover $461 Million

And other reasons you should care about infrastructure

A complex series of railways, roads, bridges and waterways connects U.S. farmers to the rest of the word, but this system is deteriorating and threatens U.S. agriculture’s leading global position. Luckily some much-needed investments are in process, such as the Mississippi River Ship Channel Dredging Project. If the Infrastructure Investment and Jobs Act makes it way through Washington, D.C., more investment could be in the works.

Almost half a billion dollars is buried at the bottom of the Mississippi River. A massive effort is underway to dredge the lower Mississippi along its final 250-mile stretch, and the results could provide major financial benefits to U.S. farmers.

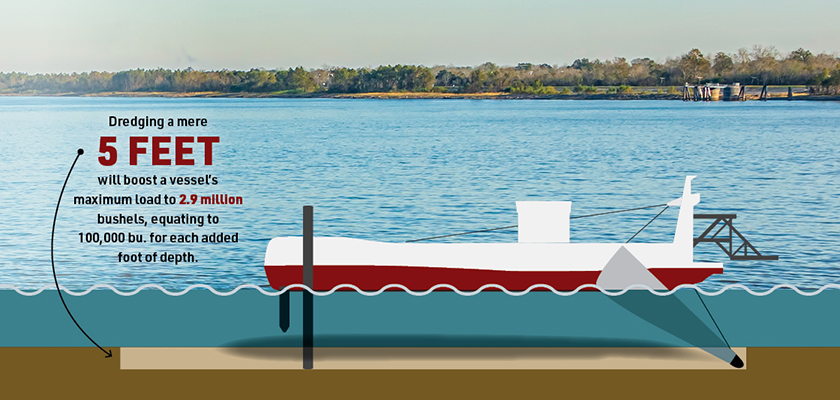

At ports along the mouth of the Mississippi, most ships loading soybeans can carry a maximum of 2.4 million bushels, and any additional weight in the hold puts the vessels in danger of scraping the riverbed. However, a mere extra 5' in depth allows a ship to squeeze in 2.9 million bushels, at a small increase in transport costs.

Translation: Digging the depth of the lower Mississippi from 45' to 50' could generate $461 million annually for the U.S. soybean industry — independent of supply and demand.

FLOATS ALL BOATS

Started in 2020, and scheduled for completion by 2022, the Mississippi River Ship Channel Dredging Project will cost roughly $270 million, and is expected to return $7.20 for every $1 spent, according to Corps of Engineers estimates.

“This project is a big deal for the export strength of U.S. agriculture in the future, and it’s also significant for farmers in the near-term,” says Mike Steenhoek, executive director of the Soy Transportation Coalition (STC). “This project is going to mean better prices for farmers at their elevators.”

At 2,350 miles long, the Mississippi River is an aquatic superhighway and drains 40% of the continental U.S. Carried along in the vast water flow is an ever-present sidecar of sediment, perpetually building along the river’s final run. The Southwest Pass, where the river approaches the Gulf of Mexico and it splits into multiple lanes, is one such area.

The lower Mississippi is the top port region of the U.S. in terms of freight volume. Soybeans rank as the No. 1 agriculture commodity export departing from the mouth of the Mississippi, with corn as a close No. 2. Any change in export logistics on the lower Mississippi — for the good or the bad — have a major impact on U.S. grain farmers.

THE FUNDING PUZZLE

Identifying the sediment buildup issue was easy, but finding enough greenbacks to fund a remedy was a far tougher knot. In 2016, Congress passed an updated version of the Water Resources Development Act. Prior to 2016, financial responsibility for a capital improvement was a 50-50 federal/non-federal split. However, the new law moved the numbers to 75% federal and 25% non-federal, opening the door for the state of Louisiana to tackle sediment problems.

However, the Midwest didn’t let the South carry all the water. The Soy Transportation Coalition entered the picture in 2018 and commissioned research to find precise answers about how sediment removal would affect ag commodity exports.

“This project is not just a Louisiana thing, but also key for Illinois, Ohio, Iowa and many other states,” Steenhoek says. “That’s why the United Soybean Board provided $2 million. It’s a great collaboration among Louisiana stakeholders, the Corps of Engineers and soybean farmers.”

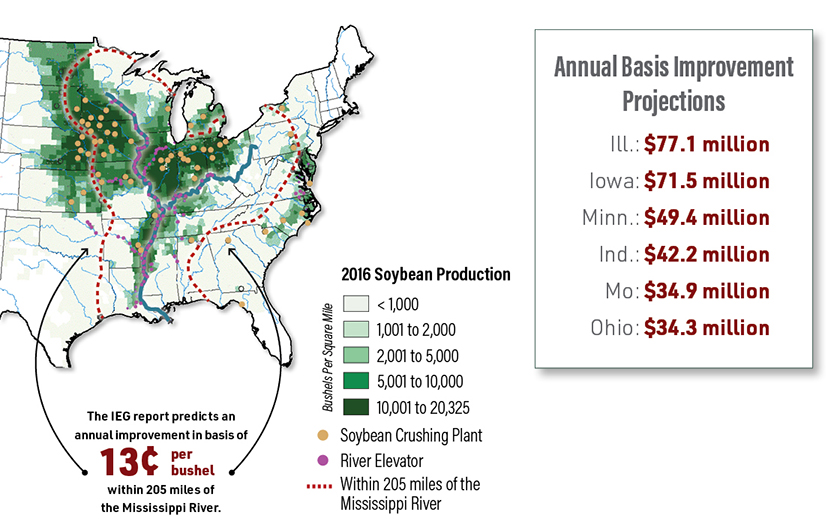

In 2018, commissioned by STC, Informa Economics Group (IEG) completed a report to answer the question: If the soybean transportation chain is improved due to a deepening of the river, to what extent will local basis improve for farmers?

“We quantified and found a total of $461 million in basis improvement,” Steenhoek says.

A BETTER PRICE

Transportation logistics and costs, up and down the Mississippi River, are a huge factor in basis prices, says Stephen Nicholson, Rabo AgriFinance senior analyst for grains and oilseeds.

“When basis prices shift at the Gulf it is soon reflected in interior basis levels,” he says.

While the study did not look at corn basis, Steenhoek says the project will cause similar improvements.

PERPETUAL INVESTMENT

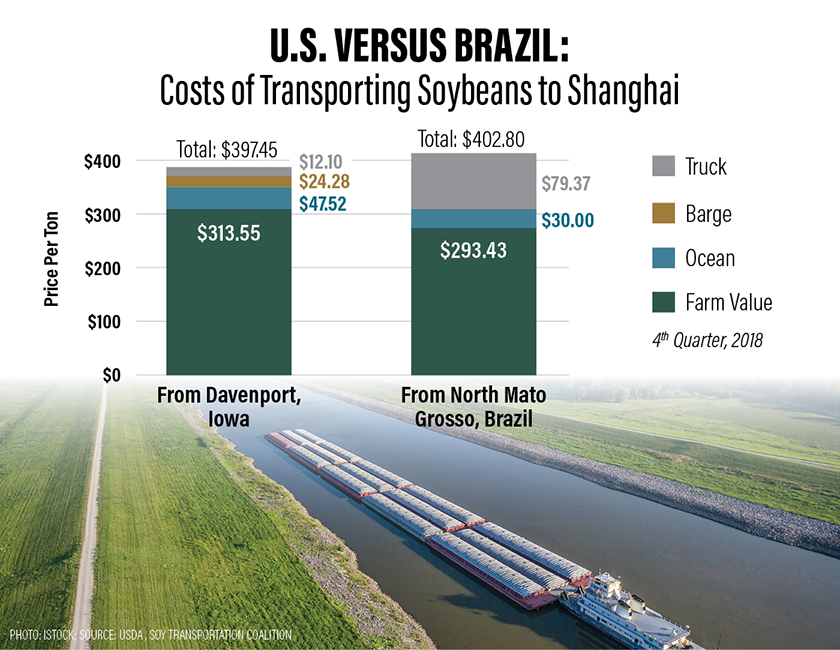

The pressing need for deeper waters in the U.S. is also heavily related to competition — particularly in South America.

“In the U.S., compared to our global competitors, we have higher input costs and higher land costs,” Nicholson says. “How do we stay competitive? One of the ways we are competitive and they are not is our great river system.”

Yet, the U.S. farmers’ infrastructure advantage over other countries is disappearing, per the IEG report: “Multinationals have entered the Brazilian grain and soybean handling system, investing heavily on grain and soybean collection infrastructure, including barge equipment, barge loading elevators, rail network capabilities and export elevators.”

Steenhoek emphasizes the need for perpetual investment in the U.S. transport framework: “Great nations and great industries continue to invest in themselves. Look at our competitor’s improvements in Brazil to store and transport. Yes, they’re behind us in quality of infrastructure, but they’re sure making progress.”

While Brazil currently relies on expensive truck transport, the U.S.’s multiple transportation modes only have a slight competitive advantage in shipping costs.

HOSE AND HYDRANT

And what will the Corps do with all the sediment pulled from the bottom of the river? The dirt will be used as an environmental antidote. Louisiana has long struggled with shoreline erosion, but river sediment removal will help build resiliency for the Pelican State coastline, including an increase in wildlife habitat.

In conclusion, Steenhoek uses a bare-bones metaphor of a hose and hydrant to highlight the significance of the Dredging Project for U.S. farmers.

“What sometimes gets ignored in agriculture is the connectivity between supply and demand,” he says. “That’s why this project is such a big deal: It allows us to accommodate strong demand and positions us for farmer success. If our infrastructure can’t fully connect supply and demand, then we’re attaching a garden hose to a fire hydrant.”

Infrastructure Report Card

For 2021, the American Society of Civil Engineers gave U.S. infrastructure a C-. This was an upgrade from 2017’s D+. Here are the grades by category:

Bridges = C

Of the 617,000 bridges, 42% are 50 years old and 7.5% are structurally deficient.

Roads = D

40% of the U.S. road system is in poor or mediocre condition.

Railroads = B

Largely privately funded, freight railroads are investing $260,000 per mile.

Ports = B-

Ports plan to spend $163 billion, from 2021 to 2025, in efficiency enhancements.

Inland Waterways = D+

The system has a $6.8 billion backlog in construction projects and lock closures. Delays cost up to $44 million per year.

Chris Bennett, a son of the Mississippi Delta, is drawn to the stories important to farmers, innovation and those traveling an odd trail.