Few things are more important to a farmer than harvesting his crops, yet farmers in the Ukraine are taking measures to prevent that very action. Many are now destroying harvest equipment to keep the Russian army from confiscating the wheat currently ripening in fields.

“Some of our clients in the Ukraine have been actually damaging their combines, so the Russians can’t combine the wheat,” says Dan Basse, president of AgResource Company.

“It’s a war zone. It’s messy. It’s a shame, and our hearts bleed for the Ukrainians who are being harmed,” Basse told AgriTalk host Chip Flory on Monday.

Little Fuel To Be Had

In recent days, the Russian army has bombed refineries, seaports and many other parts of the country’s infrastructure, crippling it and turning it into rubble. Basse estimates that at least three, maybe four, of the seven major export terminals out of the Ukraine have sustained such major damage months of work would be required to repair them.

The destruction means that even if farmers have kept their equipment intact, many are unable to access much needed diesel to fuel the harvest.

“If you were to place a diesel order today in the wheat areas, which is really central and western Ukraine, you would find that it’s probably four to six weeks to get delivery on it,” Basse says.

The delay means some of the crop will likely remain in fields too long, damaging its quality and viability, and some of the crop won’t be harvested at all.

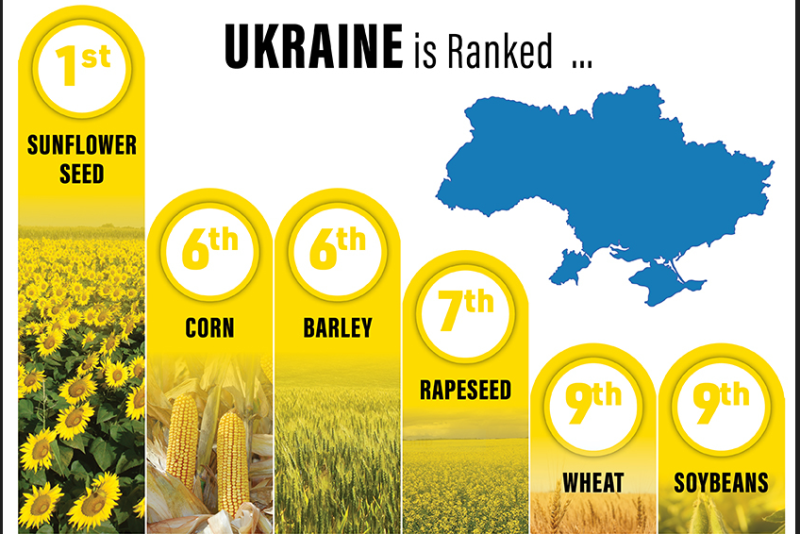

That reality would mean supplies of wheat would take a significant hit in the global marketplace. It’s also why Basse challenges the USDA’s current prediction that Russia will export 40 million metric tons (mmt) of wheat this year and somehow compensate for the shortfall from the Ukraine.

“A lot of the people I talked to in Europe have that number closer to 30 mmt, which would leave the world short 10 mmt of wheat,” he says. “As Russia begins its harvest, we’ll start to understand that it is not going to have a big export campaign. I’m afraid it’s a pipe dream, if you will, I just don’t think logistics will allow it.”

What countries will be shorted of wheat and, potentially, other grains? Basse says he is still working to figure that out. For now, he believes the shortfall is likely to occur in countries such as Bangladesh, Pakistan and/or parts of Southeast Asia. He doesn’t believe the U.S. will be in that mix.

“There will be some shortages, and it seems to me that if I’m an end user, I probably should be taking some forward coverage,” he says. “We think (demand destruction) will be shifted forward, because people are still eating about the same amount of calories as it sits today at these current prices.”

Seasons Of Loss

As for Ukranian farmers, Basse is worried what will happen to some of them if crops can’t be harvested and sold.

“Financing is running out. I will tell you that as I talk to my friends and clients, we will have farmers that go bankrupt. And then of course, as that happens, we will really have issues with the next wheat crop and the next corn crop. So, I’m actually more concerned about 2023 production than I am about 2022.”

In the meantime, he believes Putin will continue to wage war, inflicting as much “pain and harm and psychological damage on Ukrainians as possible.”

“Ukrainians are such a proud people, as long as we keep sending them weapons, they will fight to the last man standing. That is how angry and riled up they are,” Basse adds. “So that’s why when we talk about this war going on, as long as the West keeps sending weapons, the war will go on.”

Listen to the complete discussion on AgriTalk between Basse and Flory here: