Biden's Proposed Tax Changes Could Cause Family Farms to Accrue Additional Debt, Study Shows

Estate Tax Survey 061721

The Biden Administration’s proposed tax changes could be costly for family farms. That’s the takeaway from a new report from Texas A&M University’s Agricultural & Food Policy Center (AFPC). The report looked into the proposed inheritance tax code changes currently being debated in Washington.

“There would be a significant tax liability across all the farms that we looked at, except for two, so 92 of the 94 farms,” says Joe Outlaw, co-director of Agricultural Food Policy Center and a Texas A&M economist. “The one for sure thing I can tell you is even with the projection of higher prices from FAPRI that we have right now, none of those farms can absorb this tax liability without having to refinance and go into debt. Not one. That's the take home.”

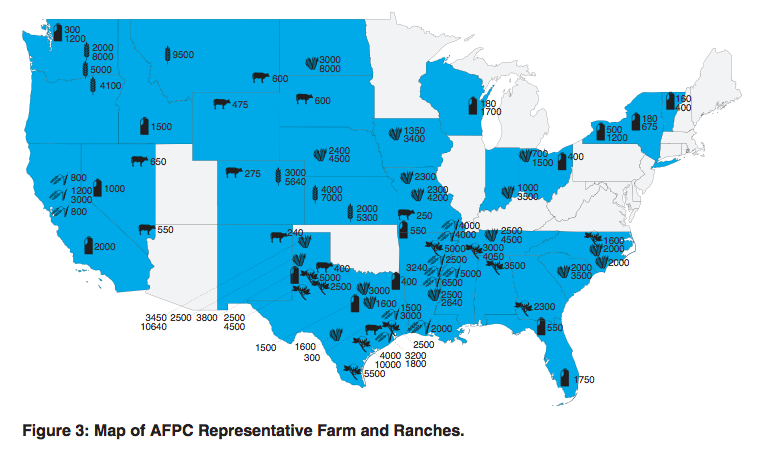

AFPC uses a database of 94 representative farms in 30 states. The data is then combined with a farm-level policy simulation model. The economists found all but two operations would be impacted by changes in the stepped-up basis, as well as inheritance tax. And the two farmers that look to be immune lease 100% of their land, with no owned farmland.

The results conflict with reports that say the possible tax changes wouldn’t have a have a widespread impact on family farms. The White House and USDA both say Biden's plan to eliminate stepped-up basis for inherited assets beyond $1 million per individual or $2 million per couple, would not affect inherited family farms or small businesses that remain in those families. Outlaw says AFPC’s research conflicts with those claims.

AFPC analyzed five scenarios, including the proposed Sensible Taxation and Equity Promotion (STEP) Act, which would eliminate stepped-up basis for capital gains taxes, as well as the 99.5% Act, a proposal that would lower the estate tax exemption to $1 million per individual. AFPC analyzed the tax changes separately, as well as combined.

According to the report, under current tax law, an intergenerational transfer of farm assets at death would see just two of 94 of the representative farms impacted by either estate or capital gains taxes, with an average incurred tax liability of $370,431. And when applied to the STEP Act in place, the same type of transfer would see 98% of farms impacted, with average tax liabilities of $726,104.

“Ninety-two of 94 farms, with an average tax liability due to losing a stepped-up basis of $726,000 per farm,” says Outlaw. “So obviously, $726,000 on average, you have some with a little bit and you have some with millions upon millions of dollars of tax liability. So, the question is, how do you go about having them pay for that?”

Outlaw says that’s where the issue of being able to absorb the added tax costs comes in. Under the AFPC’s modeling system producing accounting records that show even with higher prices, most farms don’t have the cash on hand to pay for it.

“In our modeling concept, we ask, ‘Do you have the cash on hand?’ These operations generally wouldn't have a short-term note and would just try to pay it out over time. And so, it increases their operating notes. It basically causes spiraling down of the business because they're financing more money and having to pay more debt service. So, with our analysis, it basically shows that it puts most people in a bind.”

The 99.5% Act would affect 41 of 94 (44%) of farms, with an average tax liability of $2,166,415. Outlaw says when you combine the two policies, it also resulted in an equal or higher tax liability overall, affecting 98% of the farms in the study.

“If you combine the both tax proposals together, it would impact 92 of 94 farms, with an average across all those, again, averaging a lot of big numbers of $1.4 million per farm. Those are significant numbers,” says Outlaw.

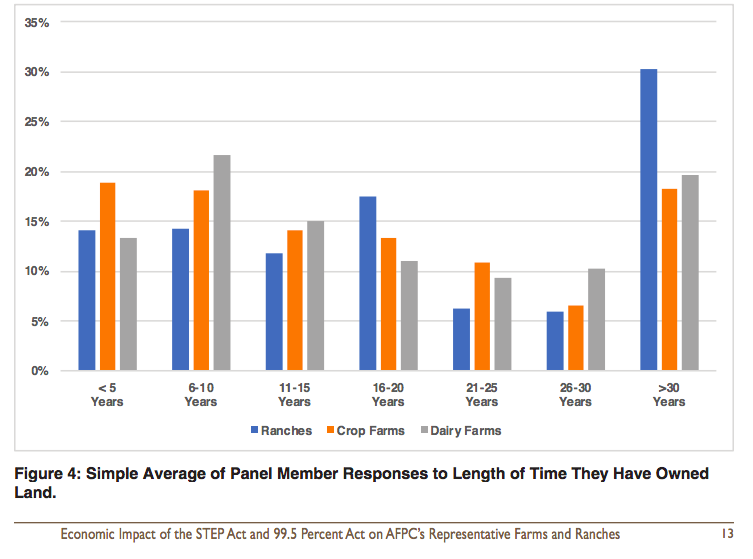

In addition to the added tax burden, the economists found the proposed tax changes will impact land that's been in a a family for multiple decades.

“A lot of our farms in this country have land that has been in their family for a long time,” Outlaw adds. “We had significant amounts of our producers who told us 20% to 30% of their own land holdings have been owned for more than 30 years. If you look at what the basis on that land would be, there would be a lot of tax on that land.”

AFPC’s analysis is derived from the same group of farmers each time, with a good representation of U.S. farming and ranching operations.

“We want to represent the Corn Belt,” Outlaw says. “They aren't an individual specific farm, they are developed to represent an area. And we have been monitoring those some of them for 36 years.”

While this specific study was done at the request of Republicans leaders on the Senate and House Agriculture Committees, Outlaw says the research is apolitical with both Democrats and Republicans asking the economists research possible impacts of policy proposals on U.S. farmers and ranchers. He says the Center has been a resource for policy makers for more than 30 years. As a partnership with the University of Missouri’s Food and Agricultural Policy Resource Institute (FAPRI), the groups have done analysis for Congress, which includes exploring potential outcomes of Farm Bills as legislators craft the policy every four years.

Related Stories:

Paul Neiffer: What the STEP Act Might Mean to You

John Phipps: A Major Misconception about Stepped-Up Basis and Farmland Inflation