If This Tax Provision Expires, Total Federal Estate Taxes for Farm Estates Would Double to $1.2 Billion

The 2017 Tax Cuts and Jobs Act (TCJA) introduced significant changes to Federal individual income and estate tax policies, including a temporary increase in the estate tax exemption amount from $5.49 million to $11.18 million in 2018.

This increase is scheduled to revert to pre-TCJA levels, adjusted for inflation, by the end of 2025, lowering the exemption to $6.98 million per deceased person in 2026. The portability provision allows the surviving spouse to utilize any unused portion of the deceased spouse’s exemption.

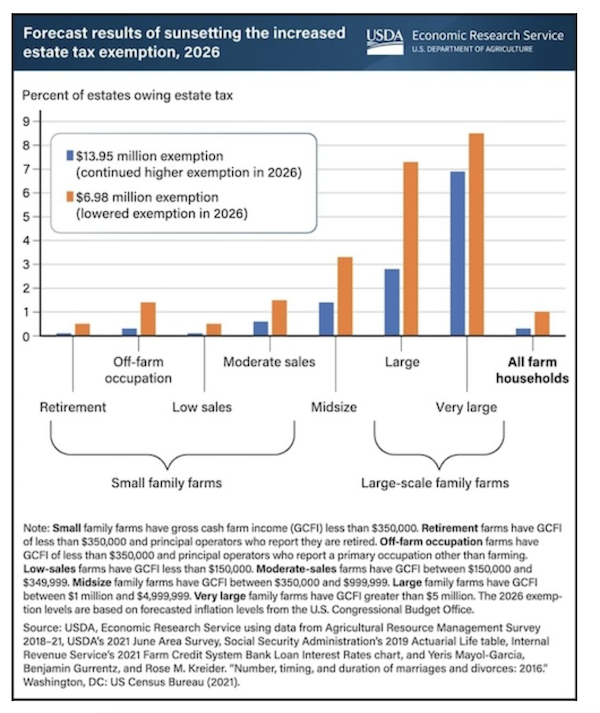

According to researchers at USDA's Economic Research Service (ERS), the expiring increased exemption would reach $13.95 million per person at the time of expiration. Consequently, the percentage of farm operator estates subject to taxation is expected to rise from 0.3 to 1.0 in 2026, increasing the number of taxed estates from 120 to 424 out of an estimated 40,883 estates.

Large farms with gross cash farm income between $1 million and $5 million would see the largest increase in the share of estates owing estate tax, rising from 2.8% to 7.3%. If the provision were to expire, total Federal estate taxes for farm estates are projected to more than double to $1.2 billion.