John Phipps: Is the U.S. Already Energy Independent?

U.S. Farm Report 03/26/22 - Customer Support

With the ongoing war in Ukraine, a recent U.S. Farm Report viewer asked about the U.S. and energy independence.

From Gary Morrison quoting The Watchman:

“The Department of Energy was instituted on 8/04/1977, TO LESSEN OUR DEPENDENCE ON FOREIGN OIL. AND NOW IT'S 2022 -- 45 YEARS LATER -- AND THE BUDGET FOR THIS "NECESSARY" DEPARTMENT IS AT $242 BILLION A YEAR. IT HAS 16,000 FEDERAL EMPLOYEES AND APPROXIMATELY 100,000 CONTRACT EMPLOYEES; AND LOOK AT THE JOB IT HAS DONE!

(34 years ago 30% of our oil consumption was foreign imports. Today 30% of our oil consumption is foreign imports.”

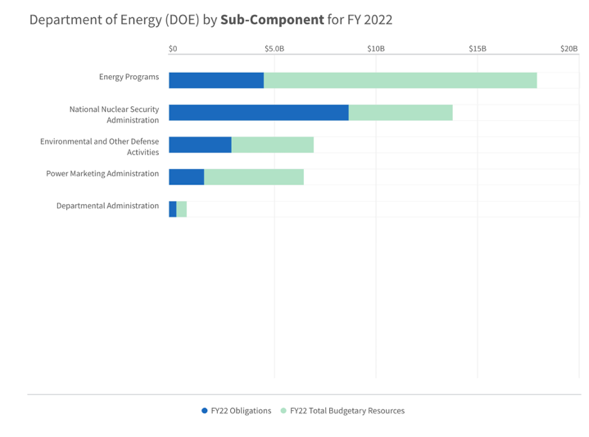

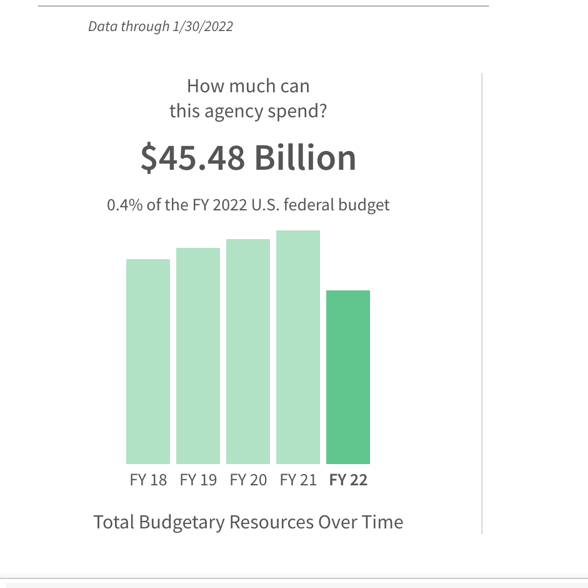

I checked on these assertions. The DOE is responsible for the U.S. nuclear weapons program, nuclear reactor production for the United States Navy, energy-related research, and domestic energy production and energy conservation. It was created during an oil crisis, which helped politically, but was soon dominated by nuclear responsibilities, especially after Three-Mile Island. You can tell by how their budget of $45B is allocated. The blue bars are government employees, the green are contractors, mostly 17 major research labs like Argonne, and Los Alamos. The term “contract employee” is misleading. Contractors are not employees. Ask and Uber driver. Much of the DOE budget is for programs like nuclear weapons research, fusion, and alternative energy.

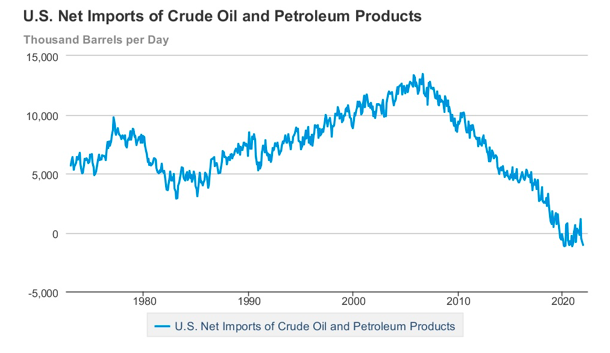

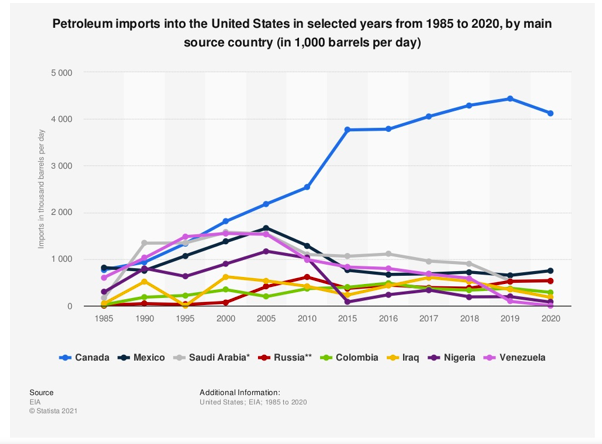

As for our dependence on foreign oil, I know you’ve seen this before, but I consider net petroleum exports to be the true measure of oil trade, and we’ve hovered about zero recently due largely to fracking and conservation measures. We export a significant amount of finished products like gasoline, while importing geographically advantageous crude from nearby countries.

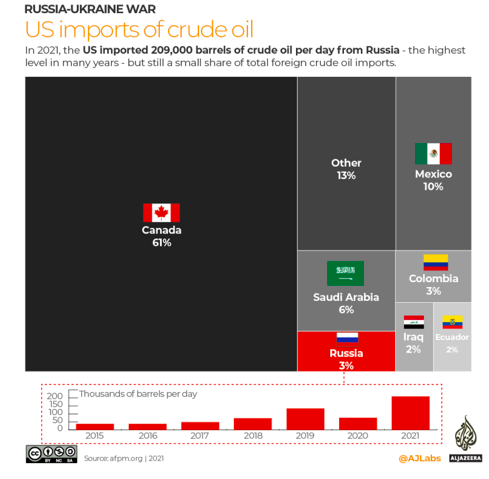

At any rate, in 1977, 83% of our oil imports were from OPEC countries, in 2021 it was about 8%. Seventy percent of our imports come from Canada and Mexico. The DOE is not about oil nearly so much as other energy sources and cleaning up nuclear reactors. Between research and market forces, the record of DOE, with a budget about .5% of the total federal budget and 1/5 that of the Ag Department, is not that bad. Oil independence is a questionable goal for a global commodity, but it did happen under DOE’s watch.