Which Country Imports the Most U.S. Wheat?

Did you know about half of all wheat grown in the U.S. is exported? USDA’s Economic Research Service (ERS) estimates 21 million metric tons of wheat was shipped out of U.S. ports in 2022, totaling $8.49 billion.

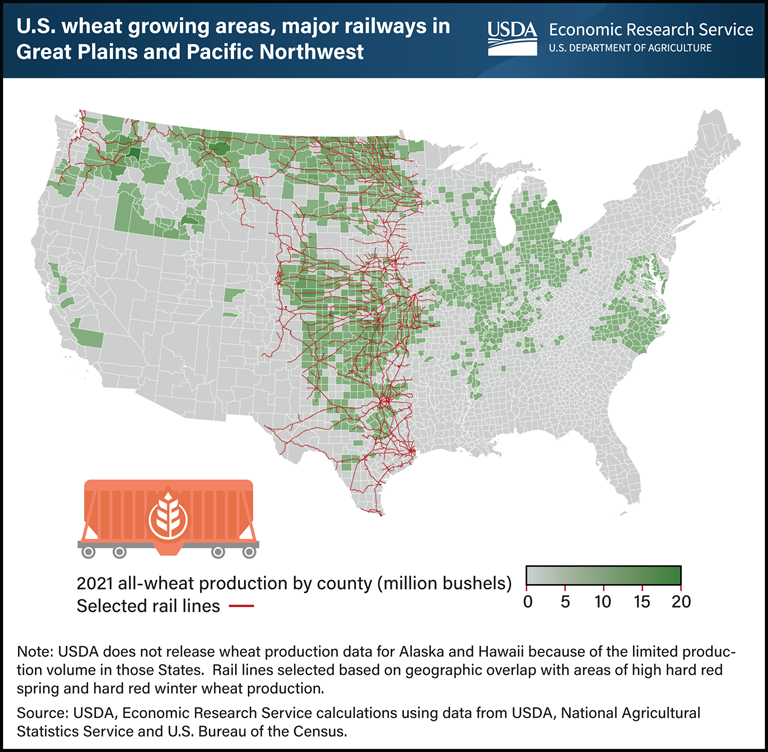

The Mississippi and Columbia-Snake rivers help push grain by barge to export facilities in the Gulf and Pacific Northwest. However, the region between these two rivers instead relies heavily on rail to move grain, with USDA finding 50% to 60% of all wheat exports from 2014 to 2019 were moved to ports by rail.

The biggest export markets for U.S. wheat in 2022, particularly hard red winter, was Mexico followed by the Philippines and Japan. However, non-tariff trade barriers could push The Philippines and Japan out of the top three, according to the U.S Trade Representative’s (USTR) 2023 Foreign Trade Barriers report.

USTR is required to annually review the “operation and effectiveness” of U.S. trade agreement to ensure compliance. Here’s what the 2023 report unearthed from the biggest importers of U.S. wheat.

Where Does Japan Stand?

Japan imported $912.38 million worth of U.S. wheat in 2022, and this week, Japan sought 78,732 million tons of milling wheat in its weekly tender.

But USTR says the U.S. regularly monitors Japan’s wheat trade for its potential to distort trade as a result of its system.

So, what does Japan’s trade landscape look like?

Japan requires wheat to be imported through its Grain Trade and Operations Division to secure the lowest tariff rate. It then resells the wheat to Japanese flour millers at prices substantially above import prices through a markup, according to USDA.

USTR’s findings come as the U.S. and Japan finalized trade deals in ethanol and critical minerals last week.

"One week, two deals. Our two countries are making a better future," said Rahm Emanuel, U.S. ambassador to Japan.

The trade landscape in The Philippines looks much different, however.

Imports in The Philippines

The Philippine Department of Agriculture (DA) uses the Sanitary-Phytosanitary Import Clearance (SPSIC) system to restrict certain ag imports during peak harvest times. Through this system, the DA requires importers to obtain an import permit, which is only active for 15 to 90 days.

According to USTR, the SPSIC permit for wheat is bound by a 20-day expiration and can put up a trade wall.

“The length of validity and issuance appear to be based on the political sensitivity of the products rather than on sanitary… risk,” USTR said in the report.

So, what does the USTR intend to do about these non-tariff trade barriers?

Keeping an Eye on Trade Barriers

Understanding the full scope of non-tariff trade barriers in countries such as Japan and The Philippines is difficult because there’s no way to quantify the additional costs of the restrictions, according to USTR.

However, USTR says it intends to address each country about the wheat trade constraints.

“The United States continues to urge Japan to remove a broad range of barriers to U.S. exports, including barriers at the border as well as other barriers to entering and expanding the presence of U.S. products and services in the Japanese market,” USTR said in the report.

This could be carried out through enforcement of the U. S.–Japan Trade Agreement (USJTA), which allows more than 90% of U.S. ag exports to Japan to be duty free or receive preferential tariff access.

The U.S. and The Philippines will likely sort their wheat trade differences through the Trade and Investment Framework Agreement (TIFA) that was signed into law in 1989.

“This Agreement [TIFA] is the primary mechanism for discussions of trade and investment issues between the United States and the Philippines,” USTR said in the report.