Being Thankful

Market Watch with Alan Brugler and Austin Schroeder

November 18, 2022

Being Thankful

You may have noticed that there is a bit of a campaign going on in America to get folks to express gratefulness. This might be a reaction to the political polarization we’ve experienced, trying to get people to come back to the middle. We’re urged to list 3 or 4 or 5 things each day we are thankful for, with psychological study data to convince you it is good for you to do so. The push is certainly widespread in Christian media, and well timed as we head into the one day on the US calendar expressly devoted to thankfulness and being grateful, i.e. Thanksgiving. When I went looking for Thanksgiving quotes to tie into this article, a great many of them were tied to gratefulness.

From an ag standpoint, we do have some things to be grateful for this Thanksgiving. Corn producers can be grateful that spot corn futures are $6.67 this year vs. $5.71 at this point in 2021. Feed users might not be so thankful for that! Spot Soybeans are up $2.06 per bushel in 12 months, at $14.57 vs. $12.51. Cow/calf operators have had a rough year because of drought hurting pasture and hay production, but live cattle futures at $151.28 on Nov 15 were up 14.8% from the same Tuesday last year.

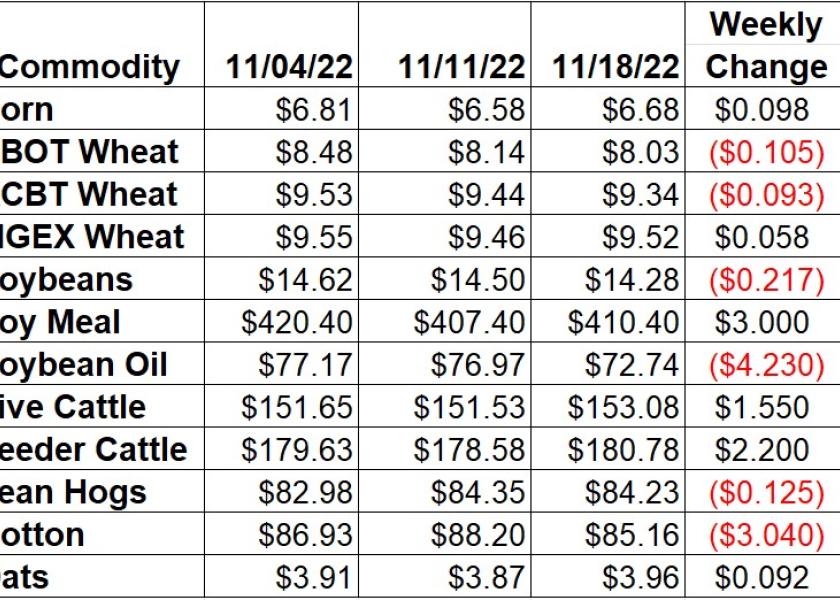

Corn futures saw a rebound this week, as December was up 1.48%, or 9 ¾ cents, from last Friday. The US corn harvest was 93% complete as of last Sunday, 8% faster than the normal pace according to NASS. Ethanol production averaged 1.011 million barrels per day per EIA, down 40,000 bpd in the week that ended on November 11th. Stocks dropped 894,000 barrels lower to 21.298 barrels, the lowest since last December. Export buying was supportive this week, as daily announcements tallied 2.2 MMT sold to Mexico (1.47 MMT for the 22/23 MT and 0.62 MMT for 23/24). Thursday’s Export Sales report saw a large jump in corn export bookings to 1.17 MMT during the week of 11/10, the largest one week buying spree since April. Export commitments now total 15.9 MMT, just 29% of the USDA full year projection. That would normally be 45% of USDA’s forecast by now. The Commitment of Traders report showed a sharp decline in spec fund net longs for corn, dropping 60,831 contracts in a week. They were still net long 176,831 contracts of futures and options as of November 15.

Wheat was mixed across the three exchanges this week. Chicago was again the weakest, down 1.29% (10 1/2 cents). Kansas City HRW contracts were 0.98% lower (9 ¼ cents). MPLS, however, was up 0.61%, or 5 ¾ cents. Crop Progress data showed the US winter wheat crop at 96% planted, with emergence at 81%, now even with normal. Condition ratings improved 2% to 32% gd/ex, with the Brugler500 index 5 points higher at 291. Export Sales data release on Thursday pointed to 290,300 MT of wheat export bookings in the week ending on November 10th, a 4-week low. Total export commitments have crept along to 12.865 MMT for wheat and products, which is now 61% of the USDA forecast vs. the 67% average pace. The managed money crowd reduced their CBT wheat net short 3,878 contracts in the week ending 11/15, taking it to -46,780 contracts. Their net long in KC HRW shrank 3,152 contracts to +21,281 as of 11/15.

Soybeans dropped another 1.50% on the week, a 21 ¾ cent move to the downside. Soybean oil was a large reason for the weakness, as December BO was down 5.5% or 423 points. Meal strength held up the products, with a $3 (0.74%) gain. Soybean harvest has all but wrapped up across the country, with NASS showing progress as of 11/13 at 96% complete. That is 5% ahead of the average pace and the final tally for beans in this year’s Crop Progress reports. Weekly Export Sales data showed the largest weekly total since September 2020 at 3.03 MMT of soybeans booked in the week that ended on 11/10. Export commitments have jumped out to 65% of the projected USDA total, now 4% faster than the 5-year average. They are also 4% above last year at 35.98 MMT. Per CFTC, the commercials were getting less net short and the spec funds got less net long in the week ending 11/15, with the latter trimming their net long by 10,943 contracts to 92,965 net long.

Live cattle saw some strength this week, as December was 1.02% higher ($1.55). Cash cattle trade saw renewed strength ahead of the CoF report, with this week, with $151-152 seen in the south, and $154-155 in the north. Feeder futures joined the rally and led the way with a 1.23% gain on the week. The CME Feeder Cattle Index was down $0.10 from last week to $175.36. Wholesale beef prices were down this week. USDA Choice boxes were $4.07 cwt. (1.6%) lower and Select boxes were down $2.44 (-1.0%). Weekly beef production was up 0.6% from the previous week but 1.0% below the same week in 2021. Beef production YTD is up 1.4% on 1.6% larger slaughter. Export Sales data tallied beef bookings slipping mildly to 13,400 MT in the week of November 10, with 5,200 MT destined for Mexico. Friday’s USDA Cattle on Feed report showed lower than expected October placements (93.9% of year ago) and thus lower November 1 On Feed numbers (98% of year ago). The Commitment of Traders report showed the managed money spec funds getting out of 12,021 contracts in the week ending 11/15, dropping their net long to 50,160 contracts on that date.

Hogs trended sideways for much of the week, with December down just 0.15% or 12 cents. The CME Lean Hog index was $88.14, down 82 cents on the week. The pork carcass cutout value was $4.56 lower this week, or -4.7%. Hams were the weakest, down 7.8%. Weekly pork production was up 4.3% from the previous week but slipped 1.8% below the same week in 2021. YTD production is down 2.4% on 2.9% fewer hogs. Thursday’s Export Sales report showed pork bookings rebounding from last week’s MY low to 25,200 MT during the week that ended on 11/10. Mexico was the main buyer of 15,300 MT. Managed money spec funds increased their CFTC net long by 1,286 contracts for the week, to 55,800 contracts net long on 11/15/22.

Cotton futures pulled back off the recent rally, with December down 3.04 cents of 3.45%. Cotton harvest is progressing across the country, with 71% reported as if last Sunday, 8% faster than normal. USDA’s AWP for cotton was up 104 points from the previous week on Thursday, to 77.78 cents/lb. Weekly Export Sales data tallied 22/23 upland cotton bookings to just 25,100 RB, a MY low. Shipments were reported at 182,950 RB. Thus far in the MY, 8.8 million RB has been sold or shipped, which is still 75% of the USDA forecast, compared to the normal 66% pace. Friday’s CFTC report showed spec funds added 3,458 contracts to their cotton net long in the week ending 11/15, taking them to 17,660 net long.

Market Watch

The Thanksgiving week starts out with the weekly Export Inspections report on Monday morning, and Crop Progress report in the afternoon. USDA Cold Storage data will be released on Tuesday afternoon. Skip ahead to Wednesday and EIA will release weekly ethanol production and stocks data. It is also first notice day for December cotton futures. The markets and government will be closed on Thursday in observance of Thanksgiving. That pushes weekly Export Sales data to Friday morning. The markets open back up on Friday morning at 8:30 CST, with a shortened session. Friday will also mark expiration of the December grain options.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2022 Brugler Marketing & Management, LLC. All rights reserved.