Business As Usual

Market Watch with Austin Schroeder

June 9, 2023

Business As Usual

On Friday the USDA graced us with their monthly WASDE and Crop Production report updates. Now, in any given year, the June report gets a typical look, yawn and you are back to work. It’s usual for very few old crop adjustments ahead of a Grain Stocks report later this month, with exception to the export forecasts, which were tweaked. For new crop, WAOB sticks with acreage from the March Intentions report (barring any massive planting delays) and takes the June Acreage report into account in July. And as far as yield, we normally don’t see an adjustment until the NASS update in August, barring any weather shifts that would shift ideas. This month was no different. While we realize the condition ratings are off to anything but a great start, status quo says no changes are needed. We may not be setting ourselves up for a record yield with this start, but remember, it’s still June. The trade took this into account following the report release and had a few minute ticks of zig-zag action before going back to trading the norms of weather and whatever else is out there, business as usual.

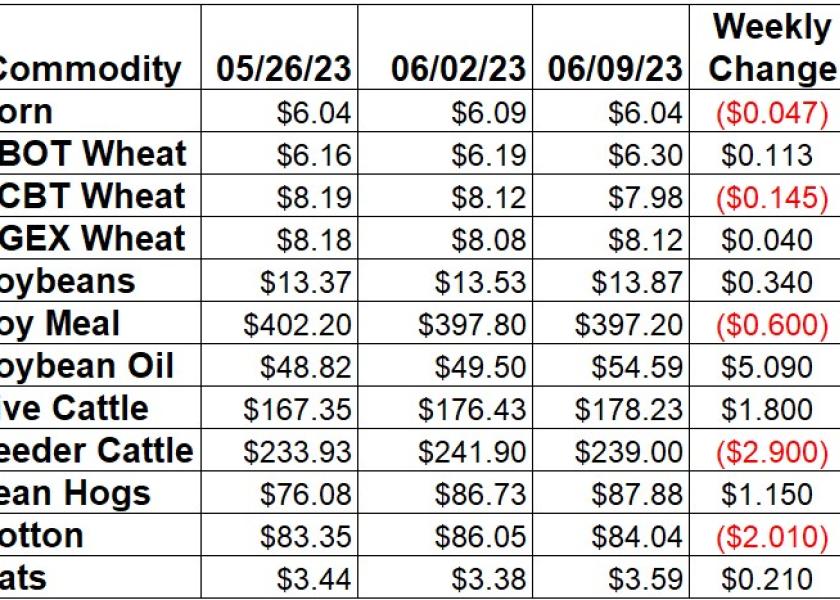

Corn spent much of the week bouncing, with July rounding things out down 4 ¾ cents since last Friday. New Crop December lost 10 ¾ cents on the week. Monday’s Crop Progress report showed 96% of the US corn crop planted as of June 4, with 85% emerging, both ahead of normal. Condition ratings were pegged at 64% gd/ex, down 5% from last week, with the Brugler500 index at 368, a 6 point drop. Weekly EIA data tallied ethanol production picking up another 32,000 barrels per day in the week ending on June 2, to 1.036 million bpd. Stocks climbed another 616,000 barrels to 22.948 million. Monthly trade data from Census had 5.06 MMT (199 mbu) in shipments during April. The weekly Export Sales report indicated another net positive book in the week of 6/1 at 171,709 MT, which was slightly below the week prior. New crop sales were not as lucky, with net reductions of 106,783 MT. We are now just 87% of the updated USDA old crop forecast, vs. the normal pace to be 99% sold by this date. The only major change to the balance sheet USDA made on Friday was a 50 mbu cut to 22/23 exports and 15 mbu reduction to imports to push carryout 35 mbu higher. This week’s Commitment of Traders report had spec funds trimming another 6,573 contracts from their net short position in corn futures and options in week that ended on June 6. That took them to net short a total of 44,492 contracts on that Tuesday.

The wheat complex continued the trend of mixed action across the three exchanges this week. Kansas City futures remained the constant weak spot, down another 14 ½ cents in July. Chicago narrowed the spread some more, with a 11 ¼ cent gain in that nearby contract. MPLS was a modest 4 cents higher on the week. The weekly Crop Progress report indicated the winter wheat crop at 82% headed, 1% above the average pace. Harvest was pegged at 4% complete, on pace with normal. Condition ratings improved another 2% at 36% gd/ex, with the Brugler500 index rising another 5 to 293 points. Initial spring wheat conditions were seen at 64% gd/ex, equating to a Brugler500 index of 368. The only major change to the US wheat balance sheet on Friday was to production, which was raised 6 mbu on an increase to HRW production. New crop stocks were up the same amount to 562 mbu. Export Sales data tallied 23/24 wheat bookings at 234,800 MT, as 877,400 MT was carried over from old crop. New crop export commitments are @ 3.81 MMT as of 6/1. That is 17% below a year ago and 18% of the USDA full year export projection, vs. the 24% average pace. April wheat exports were tallied at 1.506 MMT (55.3 MMT) by Census, bringing the total for the MY wheat and products to 718 mbu with just May data remaining. The weekly Commitment of Traders report showed managed money slicing back 7,524 contracts from their net short position in Chicago wheat to 119,474 contracts as of 6/6. In KC wheat, they trimmed 2,552 contracts from their net long position to 7,106 contracts.

Soybeans are back within reaching distance of $14, as nearby July was up another 34 cents (2.51%). New crop November pushed back above $12 with a 20 ¼ cent rally. The products were mixed again, extending the moves from last week. Meal was down another $0.60/ton, with bean oil up another 509 points (10.28%). The US soybean crop was reported at 91% planted as of June 4, 15% ahead of the average pace. The crop was also 74% emerged, 18% above normal. Initial conditions were tallied at 62% gd/ex or 362 on the Brugler 500 index, the second worst start since at least 2009. Census data from April showed 2.55 MMT (93.8 mbu) of soybeans shipped, the second largest all time for the month behind last year’s record. Thursday morning’s Export Sales report indicated bean sales ticking higher in the week ending June 1 to 207,236 MT. New crop bookings reported at 264,590 MT. USDA’s WASDE report on Friday showed a 15 mbu reduction to exports and subsequent increase to stocks to 230 mbu. Commitments for old crop are 94% of that new 2 bbu forecast total, compared to the 5-year average pace at 101%. CFTC’s Commitment of Traders report showed the large managed money spec funds in soybeans futures and options increasing their small net long by 13,452 contracts to 13,981 contracts by June 6.

Live cattle futures continue to chase cash, as June was up another $1.80. August was down $1.05. Cash trade propped up June, with a bulk of sales in the South at $185-186, a $6-8 jump. The North changed hands at $189-194 on the week, up $4-6. Feeder futures backed off this week, with losses of $2.90 in the front months August contract. The CME Feeder Cattle Index was $222.20, up a massive $14.16 this week. Wholesale boxed beef prices rallied again this week. Choice boxes were up another $23/cwt (7.4%), with Select boxes 5.1% higher ($14.78/cwt). Weekly beef production was up 8.1% from last week due to the holiday but was still 7% lower vs. a year ago. Year to date production is now down 4.8% on 3.5% smaller slaughter runs. Thursday morning’s Export Sales report tallied just 12,820 MT in beef sales during the week ending on June 1, a 6-week low. Shipments totaled 15,352 MT during the Holiday week, a 4-week low. Census export data tallied 267.6 million lbs of beef during April, a 3-year low. Commitment of Traders data showed spec funds pushing their large net long in live cattle futures and options to their largest in over 4 years to 114,637 contracts by 6/6. In Feeder cattle, they increased their net long by another 638 contracts to 18,070 contracts as of Tuesday.

Hogs saw some continued buying this week as June was held back by the index, up $1.15. The CME Lean Hog Index was up $4.17 to $83.80 this week. July futures extended the sharp gains helped by short covering, with a $4.97 rally. The pork carcass cutout was back up $3.67 this week, or 4.5%. All of the primals strengthened this week, with the belly (+8.9%) leading the way. Weekly pork production was back up 16% vs. the week prior due to the holiday. They were down 1.1% vs. the same week a year ago. YTD Pork production is up 0.5% on 1.3% larger slaughter. This week’s Export Sales report showed pork sales rising slightly from last week’s 12-week low to 25,473 MT. Export shipments dropped to the lowest since December at 25,057 MT. Census data for April indicated pork shipments of 580.6 million lbs, a 9.8% jump vs. last year. CFTC’s Commitment of Traders report indicated spec funds covering their record net short position by a net 14,937 contracts in the week ending on June 6, taking it to 16,173 contracts.

Cotton futures were in retreat mode this week, with nearby July down 201 points (2.34%). New crop December didn’t join in, as it slipped just 3 points. The early week Crop Progress report showed 71% of the US cotton crop planted as of 6/4, now 4% behind the 75% average pace. The crop was also seen at 6% squared, 4% behind normal. NASS indicated an improvement in crop condition rating by 3% to 51% gd/ex, or 346 on the Brugler500 index, a 5 point move on the week. Monthly export data from Census showed 1.55 million bales shipped during April. Weekly Export Sales data indicated the largest old crop cotton bookings since Sep 2021 at 480,399 RB during the week that ended on June 1. New crop was shown at 30,816 RB. Weekly Shipments increased to a 3-week high of 316,953 running bales (RB). Cotton export sales commitments are now 13% smaller than a year ago. They are 109.8% of USDA’s updated WASDE forecast (normally 113%). That was raised 400,000 bales to 13 million on Friday, which helped to trim old crop stocks by 300,000 bales to 3.2 million. New crop production was increased 1 million bales to 16.5, as abandonment was cut. Overall new crop stocks were up just 200,000 bales to 3.5 million. The FSA raised the Adjusted World Price for cotton by 247 points on Thursday, to 69.38 cents/lb. Friday’s Commitment of Traders updates showed managed money adding just 2,560 contracts to their very small net long in cotton futures and options to 4,070 contracts by Tuesday.

Market Watch

Next week begins with USDA’s Export Inspections and Crop Progress reports on Monday per normal. Tuesday is the release of CPI data, with PPI out on Wednesday and a FOMC meeting/rate decision rounding things out in the afternoon. EIA will release their weekly production and stocks report including ethanol that morning as well. June lean hog futures and options also expire on Wednesday. Export Sales data will be out on Thursday morning, with monthly NOPA data out at 11:00 am CDT.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2023 Brugler Marketing & Management, LLC. All rights reserved.