Carrots and Sticks

Market Watch with Alan Brugler

September 16, 2022

Carrots and Sticks

It is part of popular culture that you can motivate people using either the carrot or the stick. Stubborn mules or horses could be motivated to pull the wagon or cart by dangling a carrot just out of reach in front of them. As Kentucky Derby watchers would know, you can also motivate with the whip (more durable than a stick). Argentina is applying the principle to soybean exports, offering a carrot (special currency conversion rate nicknamed the soy dollar) to get farmers to sell soybeans into the export market. Argentina needs the foreign exchange earned from the exports, but it is tough to get producers to sell beans in 70% inflation. They are also threatening the stick, i.e. inventory taxes or some other penalties if producers are still holding the beans after the soy dollar window ends. Some traders estimate that farmers sold 3.6 MMT or more in response to the soy dollar initiative, with China eagerly buying the beans in lieu of US offerings.

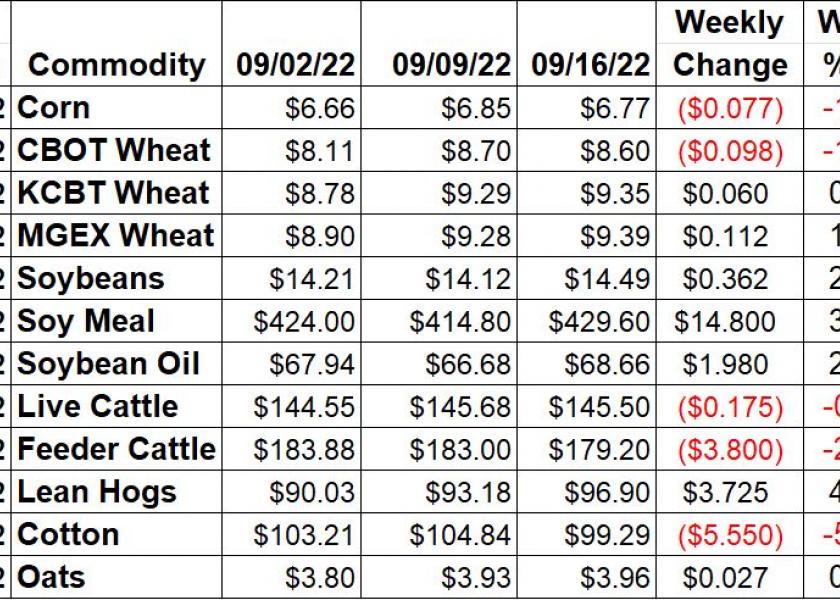

Corn rallied sharply on Monday following the USDA reports and spent the rest of the week giving back. For the week, December futures were down 7 ¾ cents of 1.1%. On Monday, USDA reduced their planted acreage estimate by 1.2 million acres and cut expected yield. After demand adjustments driven by the smaller crop, ending stocks were 169 million bushels tighter than last month. The expected cash average price was also bumped up a dime to $6.75. The NASS Crop Progress report showed a quarter of the national crop was mature, up from 15% last week and 5% points behind the average pace. Harvest progressed 5% through the week and is running 1% point ahead of average. As for crop conditions, NASS showed a 53% good/ex rating. The Brugler500 index was 336. That was down 2 points from last week. Friday’s CFTC Commitment of Traders report showed managed money spec funds adding 14,164 contracts to their net long in the week ending September 13. That left the managed money net long position at 240,643 contracts, a little over 1.2 billion bushels.

Wheat markets took turns as the bull leader and as the bearish influence. For the week, Chicago December futures were down 9 ¾ or 1.1%, tracking corn closely. KC wheat futures were 0.7% stronger Friday to Friday, and MPLS gained 1.2%. Russia’s Vladimir Putin spooked the market when he mentioned the Ukrainian export corridors were not working as intended, but a meeting with Turkey’s Erdogan on Friday didn’t appear to upset the status quo. Russian export sales do appear to be picking up. USDA deferred changes in the WASDE table until October, waiting for the Small Grains production report and September 30 Grain Stocks to firm up estimate. They did reduce the expected cash price from $9.25 to $9.00. CFTC data had SRW spec traders at 20,386 contracts net short on Tuesday evening. That was 1,045 contracts less bearish than the previous week. For KC wheat, the specs were 16,992 contracts net long, a build of 5,905 contracts in a week after extensive unwinding of their big long from 46,000+ back in May.

Soybean futures rallied more than 70 cents per bushel on Monday, and held on to 36 ¼ cent (2.6%) gains for the week after some profit taking eroded the earlier advance. Meal was up 3.6% for the week, and soy oil rose 3%. Nearly all of the latter came on Friday. The weekly NASS Crop Progress update had 22% of the soybean crop dropping leaves as of 9/11. That compares to 10% last week and is 6% points behind the average pace. Soybean condition ratings converted to a 347 on the Brugler500 scale from the NASS ratings. That was 1 point lower wk/wk. USDA surprised the trade on Monday with a drop in 2022 soybean acres and a 1.5 bpa drop in yield. However, exports were also reduced, so the 2022/23 ending stocks were revised downward to a snug 200 million bushels. Chinese demand continues to be a question mark, with USDA cutting projected soy imports from all sources to 97 MMT from 98 last month. As mentioned above, China was also shopping in Argentina for a number of cargos, to lessen dependence on US. Managed money soybean traders increased their net long in beans by 12,498 contracts this week. They were net long 112,127 contracts as of September 13.

Live cattle marked time, with a net loss of 0.1% for the week. Futures are still $3-4 above cash in the south, limiting buying interest a bit. Friday’s catch up trade in the cash market saw Northern cattle trade hands from $143-$145. USDA called the bulk of pricing as $143-$144 for the week in the North, compared to $142 in the South and $143 last week. Feeder futures were down 2.1% for the week, losing ground despite cheaper corn. The CME Feeder Cattle Index sank $4.42 per cwt this week, to $176.82. Wholesale beef prices were lower this week. Select continued to drop faster than Choice, widening the spread back to $25.75 – following along 2019’s trajectory. Choice was a net $4.86 (1.9%) lower as Select dropped $8.08 (3.4%). Weekly CoT data showed managed money firms were adding 7,500 longs through the week that ended 9/13. That left the group net long at 69,387 contracts. In feeder cattle, the funds flipped back to net short 981 contracts, with net selling of 2,455 contracts on the week.

Lean hog futures rallied smartly, up 4% for the week. The board has been anticipating a drop in the CME Index for months, but convergence has begun. The CME Lean Hog index continued to erode, down $2.49 for the week, to $97.77. The pork carcass cutout value, on the other hand, firmed this week on the improved export interest. The cutout was up $3.52 (3.4%) for the week. Hams were the star of the show, up 10.1% from Friday to Friday. USDA reported 25,067 MT of pork was sold during the week that ended 9/8. Accumulated shipments reached 1.018 MMT as of 9/8. CFTC reported managed money firms added 5,999 contract to their net long in lean hogs during the week that ended 9/13. The buying left the group 51,497 contracts net long.

Cotton futures plunged 5.3% for the week. It didn’t help the bulls that USDA found more harvested acres in Monday’s crop report and raised estimated US production to 17.59 million bales. Ending stocks were also adjusted upward from the squeaky tight 1.8 million bales in August to a more tolerable 2.7 million. Pressure late in the week came from the economy, with stock traders concerned about the Fed causing an eventual recession. Monday’s Crop Progress report indicated 49% of the cotton crop’s bolls opened. That is 10% points more wk/wk and is 8% points ahead of average. Nationally the crop is 8% harvested, matching the average pace. As for conditions, NASS data converted to a 285 on the Brugler500 Index. That was down from 294 last week. The Commitment of Traders report had cotton spec traders at 48,133 contracts net long as of 9/13. That was a 1,976 smaller long than the previous week.

Market Watch

The stock market sold off into Friday’s options expirations, but rallied into the close. This week, the macro traders just have to deal with the FOMC meeting on Tuesday and Wednesday, and an expected interest rate hike on Wednesday. Monday is “Respect for the Aged” day in Japan. Here in the US it is just a regular Monday with the weekly Export Inspections report released in the morning and the Crop Progress report at 3 PM CDT. On Wednesday the weekly EIA report will show us ethanol stocks implied corn use. On Thursday, we will see the weekly FAS Export Sales report in the morning, and a NASS Cold Storage report in the afternoon. Autumn (aka Fall) also officially begins on Thursday. Friday will feature the monthly USDA Cattle on Feed report and expiration of October grain options.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2022 Brugler Marketing & Management, LLC. All rights reserved.