Changing Relationships

Market Watch with Alan Brugler and Austin Schroeder

December 2, 2022

Changing Relationships

Relationships between people aren’t static. You date somebody, they dump you. You marry somebody, sometimes there is a divorce. The Senate just decided it needed to pass a bill about same sex and interracial marriages before the courts come up with a different definition. The bill would also repeal the Defense of Marriage Act passed back in 1996. A certain former acting Big 10 head coach found himself under arrest after a shift in his relationship with a significant other. Market relationships change too. Soy oil was a darling of the green energy crowd, but they dumped it this week after EPA revealed it wasn’t quite as enamored with green energy (or at least the ag kind) as those investors believed. A number of markets have been courting the US dollar, thinking that a weaker dollar means more exports and/or higher domestic prices in dollar terms. They were jilted. The dollar sold off on Wednesday, Thursday and Friday, but went to a bar instead of taking the grains to the bull’s dance.

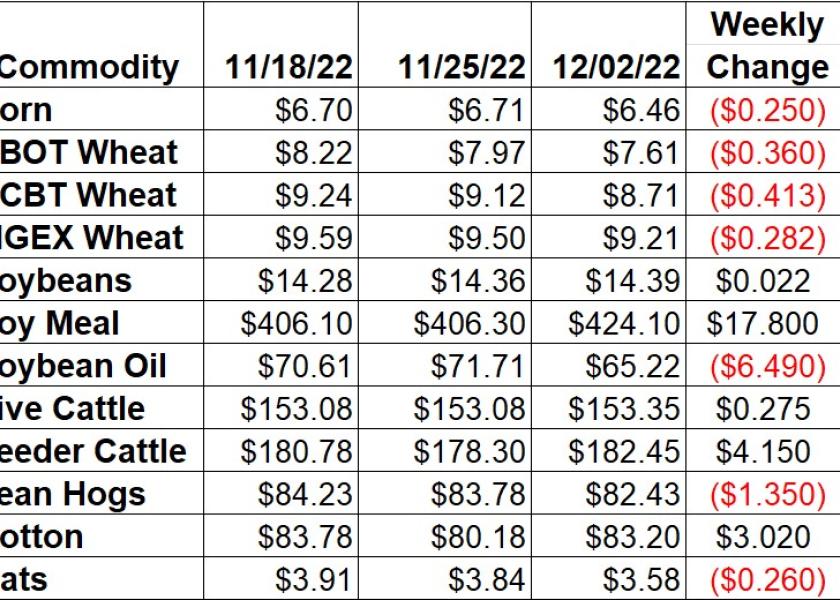

Corn futures had a late week collapse that sent March down 3.72% or 25 cents on the week. Wednesday’s EIA report indicated production slipping 23,000 barrels per day to 1.018 million bpd during the week that ended on November 25. Stocks had another buildup of 105,000 barrels to 22.934 barrels. Export Sales data showed corn sales of 602,700 MT for 22/23 in the week that ended on November 24. Export sale commitments (both shipped and unshipped) now total 18.352 MMT. That is just 34% of the USDA full year projection, which would normally be 49% by now. Commitment of Traders data from the CFTC on Friday showed managed money in corn futures and options adding 20,864 contracts to their net long position in the week ending on November 29. They took that position to 191,631 contracts as of Tuesday.

Wheat headed lower across the complex on the week. Both KC (-41 ¼ cents) and CBT (-36 cents) were down 4.52% since last Friday. MPLS spring wheat was down 2.98% or 28 ¼ cents. A delayed and final Crop Progress report showed the US winter wheat crop was 91% emerged, 1% above the normal pace. Condition ratings were improved 2% to 34% gd/ex, with the Brugler500 index 15 points higher at 304. Thursday’s Export Sales report tallied just 115,500 MT of all wheat was booked for export during the week ending on November 24th, a MY low. Total export commitments (shipped and unshipped sales) have pushed along to just 13.533 MMT for wheat and products, which is now 64% of the USDA forecast. The normal pace would be for 71% of the wheat book to be sold. CFTC data from Friday showed spec traders adding 666 contracts to their net short position in Chicago wheat futures and options to 54,068 contracts. In KC wheat, they trimmed their net long position by just 179 contracts, taking it to 17,129 contracts.

Soybeans had a strong start to the week that helped to offset a collapse on Thursday, as nearby January was up 2 ¼ cents or 0.16%. Bean Meal rallied 4.38% in the Jan contract, a $17.80 move. Soybean oil was the weak spot, with a 9.05% loss (6.49 cents). On Thursday EPA released a proposal for targeted renewable fuel volumes for 2023, 2024 and 2025. The biomass-based diesel volume was proposed at 2.82, 2.89, and 2.95 billion gallons respectively, much lighter than most had been expecting. The bean oil market reacted accordingly. Weekly Export Sales data indicated soybean bookings just slightly above the 9-week low from last week at 693,800 MT. Soybean export commitments are 67% of the projected USDA total, now just 2% faster than the 5-year average. They are also slightly above last year at 37.298 MMT. Friday’s Commitment of Traders report showed spec funds adding 19,969 contracts to their net long position in soybean futures and options as of Tuesday to 102,104 contracts.

Live cattle futures stalled out again this week despite a discount to cash as Dec was up just 0.18%. Cash cattle trade was steady to $1 higher this week, with $155 reported in the south and $158-159 in the north. Feeder futures rallied back this week with gains of 2.33% for January. The CME Feeder Cattle Index was up $3.57 from last week to $178.40. Wholesale beef prices were down this week. Choice boxes dropped $1.90 (-0.8%) while Select product plunged $9.81 (-4.2%). Weekly beef production was back up 11.4% from the previous Holiday week but 3.2% below the same week in 2021 on lighter Saturday kill. Beef production YTD is up 1.4% on 1.5% larger slaughter. Thursday’s Export Sales reported beef bookings for the week of 11/24 at 15,400 MT. The lead buyer was China at 7,200 MT, with Japan buying 2,600 MT. Weekly Commitment of Traders data showed managed money trimming their net long in live cattle by 2,545 contracts to 59,844 contracts as of Tuesday the 29th.

Hogs saw some weakness on the week, as December was down $1.35 since last Friday. That was a bit deceptive, with February up $1.92. The CME Lean Hog Index was $83.24, down $2.93 on the week. Wholesale pork prices were up $1.31 this week (+1.5%), which helped the hog turnaround. The volatile picnic and belly primals added the value. Weekly pork production was up 17.2% on the week due to the holiday but was 3.7% below the same week in 2021. YTD production is down 2.5% on 2.9% fewer hogs. The weekly Export Sales report tallied pork bookings dropping to 20,100 MT in the week of 11/24. Mexico was the buyer of 11,800 MT, with Japan in for 4,00 MT. The weekly CFTC Commitment of Traders report tallied spec traders in lean hog futures and options cutting 12,793 contracts from their net long position as of November 29th. That tool their net long position to 41,484 contracts as of Tuesday.

Cotton held up nicely this week, with March rallying 302 points or 3.77%. The US Cotton harvest is nearing its end at 84% complete as of last Sunday, 5% faster than normal per the final Crop Progress report of 2022. USDA’s AWP for cotton was down 158 points from the previous week on Thursday, to 73.03 cents/lb. The Export Sales report showed an uptick from last week’s net reduction at just 16,500 RB for 22/23 upland cotton bookings. Shipments were reported at 139,500 RB. Thus far in the MY, 8.701 million RB has been sold or shipped, which is 74% of the USDA forecast, compared to the normal 70% pace. Commitments are losing the large lead they had on the average pace with the lack of sales. CFTC data released on Friday showed managed money spec funds in cotton futures and options cutting back 2,366 contracts from their net long position to 14,913 contracts as of Tuesday.

Market Watch

We start the first full week of December with the weekly Export Inspections report on Monday. It is also first notice day for December live cattle futures. Census will release trade data for October on Tuesday. Skip ahead to Wednesday and EIA will release the weekly ethanol production and stocks data. Wednesday is also the expiration of December cotton futures. Thursday will see the weekly Export Sales report published in the AM. Friday rounds out the week with the monthly USDA Crop Production and WASDE reports. If you are heading to the Nebraska Ag Expo in Lincoln next week, stop by booth #1212 on Tuesday, Wednesday or Thursday to talk markets with Alan, Austin, or Ryan!

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for family farms and ag related businesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2022 Brugler Marketing & Management, LLC. All rights reserved.=