Cure or Disease, Which is Worse?

Market Watch with Alan Brugler and Austin Schroeder

September 23, 2022

Cure or Disease, Which is Worse?

No, this isn’t a COVID column, although you might suspect that from the title and debates over the past couple years about whether the vaccines were necessary for younger people and whether the side effect risk was “worth it”. We’re talking about the Fed’s cure for inflation, which is to keep giving the economy shots of higher interest rates until the fever (inflation) subsides. The Paul Volcker era Fed proved that even a severe case of inflation (14%) could be cured with enough rate hikes. It also demonstrated that recession was a likely (with some soft landing exceptions) side effect. That brings us to the commodity markets. Actual inflation often means more dollars chasing too few goods, a weaker dollar. The reduced buying power of the dollars boosts commodity prices in dollar terms. A lot of investment money has been going into commodities on that bet, along with data that shows commodities tend to outperform equities in a downturn.

But what happens when the Fed medicine kicks in? In this case, the higher interest rates are strengthening the dollar, with holders of a wide variety of currencies selling theirs and buying dollars to get the yield. Which sounds better, 3% return on the dollar asset or negative rates still available from a few central banks trying to stimulate investment? A stronger dollar implies fewer dollars to buy a given supply/demand relationship in commodities, and any recessionary component hobbles both stock market profits (the E in P/E ratio) or demand for goods. This is an over simplified discussion, but sort of explains this week’s deflating of prices for the stock market, gold, crude oil, cotton and some others. It’s a sign the medicine might be working. Before we get on to other things, we do need to remind you that these macro impacts can still be overshadowed by fundamentals of individual commodities. Of the 24 commodities in the old CRB index, 4-5 were typically going “the wrong way” at any one time due to yield, production, exports or other issues unique to that commodity at that time.

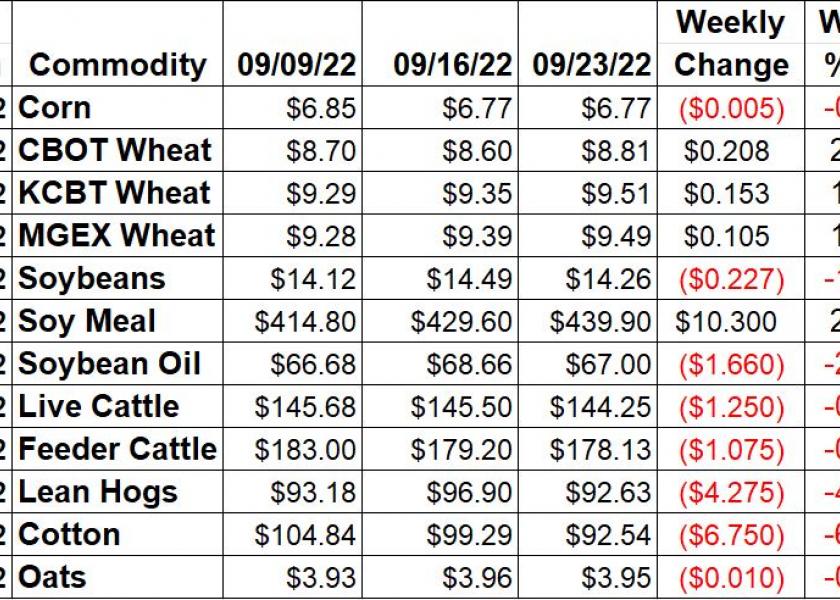

Corn erased the week’s early gains on Friday, as December futures were down just ½ of a cent net for the week. Monday’s Crop Progress report indicated 40% of the nation’s corn crop was mature, still 5% points behind the average pace. As for crop conditions, NASS showed a 52% good/ex rating, down 1% on the week. The Brugler500 index was down 3 points at 333. EIA data on Wednesday showed ethanol production falling 62,000 barrels per day to 901,000 bdp, the smallest implied corn use for that purpose since February 2021. Stocks dropped 342,000 barrels to 22.501 million barrels. Thursday’s Export Sales report was nothing to brag about, as sales totaled just 182,300 MT. Sales for the 22/23 marketing year have gotten off to a slow start, with shipped and unshipped sales just 22% of the current USDA forecast vs. the 30% average pace for the second week in the new MY. Outstanding sales are just half of what they were for same period last year. Friday’s CFTC Commitment of Traders report showed managed money spec funds adding 7,266 contracts to their net long in the week ending September 20. That left the managed money net long position at 247,909 contracts. Farmer selling picked up, with outright commercial short hedges increasing 10,686 contracts in the reporting week.

The Wheat markets were the near lone bright spot for the bulls this week. Chicago futures led the rally, with December up 2.41%. KC wheat was 1.63% higher on the week, despite Friday weakness. MPLS gained 1.12% since last Friday. Russia’s Vladimir Putin gave the market a spark on Tuesday with the partial mobilization of more troops in an escalation of the war with Ukraine. On Monday NASS reported 21% of the winter wheat crop was seeded, 4% faster than the normal pace, with 2% emerged. Export Sales data from Thursday showed just 183,500 MT of wheat was sold for export in the week ending 9/15. That took the total wheat committed for export to 47% of USDA’s current forecast, 5% behind the normal pace. CFTC data had SRW spec traders at 15,703 contracts net short on Tuesday evening. That was 4,683 contracts less bearish than the previous week. For KC wheat, the specs were 19,059 contracts net long, a build of 2,067 contracts in a week.

Soybeans saw some late week selling pressure, with November down 1.57% on the week. Meal was the strong spot, up 2.4% for the week, with soy oil down 2.42%. The weekly NASS Crop Progress update had 42% of the soybean crop dropping leaves as of 9/18, compared to 47% for the average pace. Harvest was 2% behind the average early pace, with 3% complete. Soybean condition ratings converted to a 344 on the Brugler500 scale from the NASS ratings, 3 points lower wk/wk. Thursday’s Export Sales report showed bean bookings totaling 446,400 MT in the week that ended on 9/15. Forward sales treated beans good, with 45% of the USDA forecast already met, 5% faster than the average pace. Managed money soybean traders reduced their net long in beans by 7,436 contracts this week, which looked smart by Friday night. They were net long 104,691 contracts as of September 20.

Live cattle were down $1.25 or 0.9% for the week, including position squaring ahead of the USDA Cattle on Feed report. USDA reported the bulk of cash trades for the week were $148 in the WCB, up by as much as $4, and $143 in the South, steady with last week on light activity. Feeder futures were down 0.6% for the week. The CME Feeder Cattle Index rose $3.33this week, to 180.15. Wholesale beef prices were lower this week. Select continued to drop faster than Choice, widening the spread back to $29.32. Choice was a net $3.77 (-1.5%) lower as Select dropped $7.34 (-3.2%). Thursday’s Cold Storage report showed continued high inventory levels, with 515.676 million pounds in the coolers on August 31. That is 124.3% of year ago and record high for August. Weekly CoT data showed managed money firms were adding 3,836 longs through the week that ended 9/20. That left the group net long at 73,223 contracts. On Friday night, USDA indicated Cattle on Feed September 1 numbered 100.4% of year ago, with larger than expected August placements offsetting a higher slaughter rate (106%).

Lean hog futures gave back more than they gained the previous week, down 4.4% or $4.275. The CME Lean Hog index stabilized this week at $98.01, up 24 cents from the previous week. The pork carcass cutout value, on the other hand, was lower. The cutout was down $5.46 (5.1%) for the week. Bellies were the drag, down 10.4%. USDA’s Cold Storage report on Thursday showed 532.039 million pounds in the coolers, 17.1% more than a year ago. CFTC reported managed money firms added 13,167 contracts to their net long in lean hogs during the week that ended 9/20. The buying left the group 64,664 contracts net long.

Cotton futures tumbled again this week to the lowest price is a month and a half, as December was down 6.8% on the week. Pressure hovered over the market all week with recession fears and the dollar posting fresh 20-year highs at the end of the week. Monday’s Crop Progress report indicated 59% of the country’s bolls were open by 9/18, 8% ahead of average. Nationally the crop was 11% harvested, matching the average pace. As for conditions, NASS data converted to a 281 on the Brugler500 Index. That was down another 4 points from last week. The Export Sales report showed a weak round of data for the week ending 9/15, with just 32,400 RB sold for 22/23 shipment and 13,300 RB for the next MY. Shipments were still fairly decent at 232,300 RB. The Commitment of Traders report had cotton spec traders at 42,093 contracts net long as of 9/20. That was a 6,040 smaller long than the previous week.

Market Watch

Traders will begin the week reacting to the Cattle on Feed report. Weekly Export Inspections data will be released on Monday morning, with the Crop Progress report that afternoon. Monday is also first notice day for the thin October cotton contract. Skip ahead to Wednesday and the EIA will release their weekly report showing ethanol stocks and production. On Thursday, we will see the weekly FAS Export Sales report in the morning, and a NASS quarterly Hogs & Pigs report in the afternoon. Thursday is also the expiration day for September feeder cattle futures and options. Friday rounds out the week with the often volatile September Grain Stocks report and Small Grains Summary from NASS.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information and an enrollment link for our consulting and advisory services.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2022 Brugler Marketing & Management, LLC. All rights reserved.