Gotta Start Somewhere

Market Watch with Austin Schroeder

March 1, 2024

Gotta Start Somewhere

If the bulls are going to get anywhere in the grain market, they need to hold some of the lows they keep putting in. Take a page from the cattle playbook from back in December. Over the past several weeks they’ve done a pretty poor job of holding much of anything. However, we actually saw some relief this week, specifically in the corn and bean market, as month-end short covering helped to give the bulls something to brag about going home this weekend. Now, if only wheat could get the message! But, I guess, you gotta start somewhere!

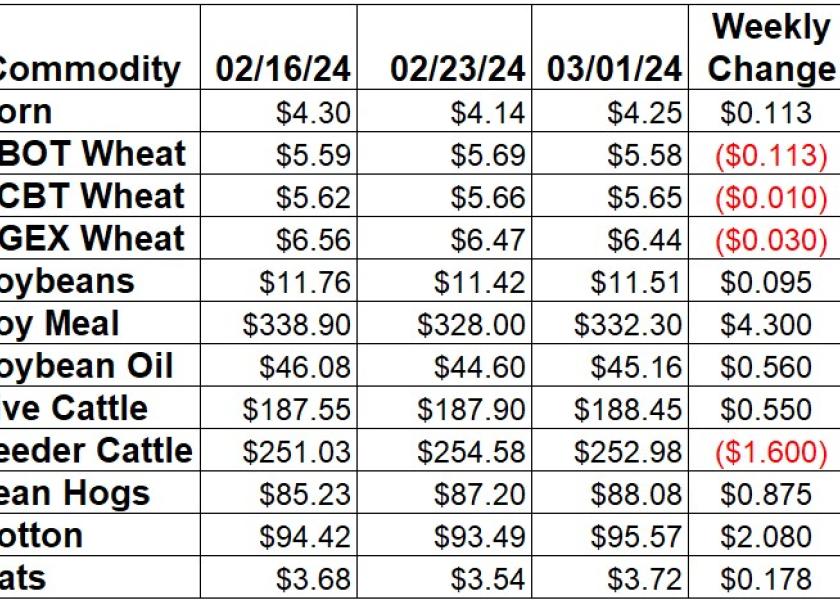

Corn got the help of month end profit taking this week, as May was up 11 ¼ cents, for a 2.72% move. EIA showed ethanol production back peddling a little, down 6,000 barrels per day to 1.078 million bpd during the week of 2/23. Stocks were up 520,000 barrels to 26.022 million barrels. The monthly Grain Crushings report showed 433.6 million bushels of corn used for ethanol production during January. That was down 1.67% from last year and a 10.4% drop from December as several plants slowed production during the Jan. cold spell. The weekly Export Sales report showed bookings back up from the week prior to 1.082 MMT during the week that ended on February 22. Shipped and unshipped export commitments for corn are now 71% of the USDA forecast, compared to the average pace of 78% for this time of year. Actual shipments are 38% of the USDA number, still 3% below the average pace. Friday’s CFTC data release showed managed money covering a decent amount of their previous record net short position, slashing it by 45,474 contracts. That left them 295,258 contracts net short as of 2/27. Commercials cut their record net long position by 36,209 contracts to 22,133 contracts as of Tuesday.

The wheat market was in the red this week, mainly on the Friday weakness. Chicago was the leader, down 11 ¼ cents, or 1.98%. Kansas City futures saw a penny loss for the Friday/Friday move. Minneapolis spring wheat was down 3 ½ cents since last Friday for a 0.46% loss. Pressure continues to come from the other major world exporters, with Black Sea offers still on sale. Export Sales data saw wheat booking bouncing from last week’s 6-week low to 327,300 MT for the week that ended on 2/22. That took export commitments to 92% of the USDA full year export projection, 2% below the 5-year average pace and 6% larger than the same point last year. Actual shipments are running a little slower, with 63% of the USDA forecast fulfilled compared to the 71% average. The weekly Commitment of Traders report showed spec traders in Chicago wheat futures and options taking their net short back down 12,194 contracts as of 2/27. That left them with a net short position of 56,326 contracts. In KC wheat, managed money added another 215 contracts to their net short, at 41,122 contracts as of Tuesday.

Soybeans bounced around this week but saw some strength on Friday to close out the week with a 9 ½ cent gain. The product values were supportive as soybean meal was $4.30 higher on the week, with soy oil up 56 points. USDA’s Fats & Oils report from Friday showed 194.81 mbu of beans crushed during January, ending the streak of monthly records. Soy oil stocks were up 11.2% from the previous month to 2.03 billion lbs. The weekly Export Sales report saw soybean bookings lift off the week prior’s MY low to just 159,700 MT for the week of February 22. That was still relatively disappointing to the bulls but understandable with Brazil FOB prices are still ~$1-1.50 below US offers. Export sale commitments for soybeans are now 83% of USDA’s forecast total, 5% below the 5-year average pace. Accumulated shipments are 70% of that total, below the average pace of 72%. This week’s Commitment of Traders report showed spec funds taking their net short in soybean futures and options to the second largest on record as of Tuesday to 160,653 contracts. That was a 23,976 contract addition during the week ending on 2/27. Commercials were back near their record net long, increasing the current position by 29,083 contracts to 64,477 contracts, was of last Tuesday.

Live cattle rallied on Friday to take away a week of weakness, as April was up 55 cents since last Friday. Cash trade was active a little earlier this week, as action was fairly steady, centering near $183, and ranging $183-184.50 across the country. Feeder cattle bulls weren’t as lucky, as March saw a $1.60 loss. The CME Feeder Cattle Index was up another $2 this week to $247.00. Wholesale boxed beef quotes shot higher this week narrowing the Chc/Sel spread to $9.54. Choice boxes were up $4.67 (1.6%) to $305.28 to their highest level since October, while Select was $9.43 higher (3.3%) to $295.74 the highest sine. Weekly beef production was up 1% vs. last week but was 3.2% below the same week last year. Actual slaughter totals in the first several weeks of the year are down 5.3%, with production 4.2% lower. Export Sales data showed 12,200 MT of beef sold in the week of 2/22, with shipments at 15,900 MT, a slight improvement from the previous week. Cold Storage data showed 475.36 MT of beef in warehouse cooler/freezers as of January 31, down 11.17% from last year. Spec funds in live cattle futures and options continue to rebuild their net long, with another 4,2881 contracts added to the overall net position. They took the net long position to 54,821 contracts as of Feb 27.

Hogs maintained some of the recent bullishness this week as April was up 87 cents since last Friday, a 1% move. The CME Lean Hog Index was another $1.37 higher this week at $80.15. USDA’s Pork Carcass Cutout was up $3.29 this week (3.6%) this week to $94.45. The belly (10.6%) the leader to the upside, with the ham the only primal reported lower (-0.8%). Weekly pork production was down 1.4% compared to last week but was 0.6% larger vs. a year ago. Slaughter for the first few weeks of the year is now up 1.1%, with a 1.3% increase in production. USDA’s weekly Export Sales report showed pork export bookings rebounding to 32,400 MT. Actual export shipments also backed off the previous week’s total to 33,200 MT. NASS released Cold Storage data on Monday, showing 468,037 MT of pork stocks at the end of January, down 9.84% from 2023 and the third lowest total for that month since 1999. CFTC data showed spec traders in lean hog futures and options continuing to add to their net long, up another 14,891 contracts to the largest net long since last Sep 2022 at 63,064 contracts as of Tuesday.

Cotton had several limit moves this week, starting with limit up and ending with limit down on Friday. Still, May was up 208 points on the week. US Export Sales dropped off in the week of 2/22, likely affected by recent price action, as FAS reported just 40,000 RB for upland cotton sales. They have still been running at a solid pace, as commitments for 23/24 are 10.477 million RB, which is now 91% of USDA’s current cotton export forecast. That is 2% back of the 93% average pace for this point in the MY. Shipments backed off from the previous week’s MY high to 267,100 RB during that week, taking the MY total to 46% of the USDA forecast, matching the average pace. The FSA raised the Average World Price for cotton by 2.35 cents on Thursday, to 77.47 cents/lb. This week’s Commitment of Traders report revealed managed money spec funds adding another 7,959 contracts to their net long in cotton futures and options. They took that net position to 93,038 contracts as of February 27, the largest since October 2021.

Market Watch

We start next week the weekly Export Inspections report on Monday morning. Skip ahead to Wednesday and EIA will release weekly ethanol stocks and production data. Wednesday is also the last trade day for March cotton futures. The weekly Export Sales report is out on Thursday, with monthly Census data for January out as well that morning. Finally on Friday USDA will release their monthly WASDE report.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2024 Brugler Marketing & Management, LLC. All rights reserved.