If Yields Are As Low As The Pro Farmer Tour Indicates Then $9 Corn Is A Possibility

Missed a recent article by Jon Scheve? Get it sent to you directly every week. Send a request by email: jon@superiorfeed.com

Market Commentary for 8/31/22

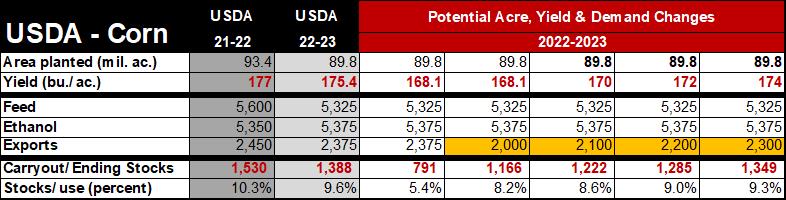

The recent Pro Farmer Tour estimated a national yield of 168.1. If this happens prices will skyrocket much higher, because the lower yields would decrease carryout, and demand would have to be rationed.

However, in 8 of the last 10 years, the Pro Farmer’s corn yield estimate was between 2 and 6 bushels below the final USDA yield estimate posted in January. The market seems to be disregarding the Pro Farmer estimate though, and instead, is trading something closer to the August USDA production estimate. Weather data throughout the corn belt, along with satellite imagery, is indicating that yields are likely still in the mid 170’s.

Estimating Upcoming Price Potential Using the Stocks to Use Ratio

Comparing the stocks to use ratio between crop years is a common measure for determining how tight carryout is compared to other crop years. It essentially accounts for yield and demand inflation over time. It is calculated by taking final carryout divided by total usage.

In 2012, the stocks to use ratio fell to 7.4%, the 2nd lowest ratio ever, behind only the 1995 harvest that had a 4.9% ratio. In both years prices rallied significantly to thwart demand. From 2013 to 2021, the stocks to use ratio did not fall below 9.2%, except for the 2020 crop year when it fell to 8.3% and prices traded above $8. Otherwise, from 2013 to 2021, the stocks to use ratio ranged between 9.2% and 15.7% with prices trading between $3 and $5.

Supply, as measured by the national yield, is the quickest variable change that can impact the stocks to use ratio. Additionally, any price increase would likely slow demand, so focus must be on feed, ethanol, and exports. In the latest USDA report, the combined feed and ethanol demand estimate for the coming year is right in the middle of the range seen over the last 8 years. This means export demand is probably the category that could be most affected. This makes sense because the US competes with other corn producing countries for the world’s business.

The following chart includes several different yield potential scenarios between what Pro Farmer published, and the latest USDA estimate. The stocks to use ratios are then calculated at the bottom.

All demand and carryout values in ‘000

All demand and carryout values in ‘000

This chart indicates that a major production decrease could mean an extremely tight stocks to use ratio and would warrant a major price rally to slow demand. It seems likely that if yields decrease substantially, exports will fall as prices would rally. Even small cuts to production could mean much less corn being exported as shown in the orange highlighted section. Basically, any yield reduction may mean tighter carryout and better prices.

Bottomline

Looking just at USDA estimates, corn values in the $6’s seem well supported. However, if the yields are as low as the Pro Farmer estimates published last week, then prices will need to trade much higher, possibly to new record values.

Want to read more by Jon Scheve? Check out recent articles:

Corn Basis Is Imploding Around The Country

The Corn Market Has Upside Potential And Depending On Weather Beans Could Still Be Explosive

Having A Risk Management Strategy Makes Big Market Drops Easier To Handle

Sales At Lower Values Can Pull Averages Down Quickly

Shifting Sales Between Crop Years Nets A 90 Cent Profit

Jon Scheve

Superior Feed Ingredients, LLC