Keep an Eye on the Back Door

Market Watch with Alan Brugler

June 18, 2021

Keep an Eye on The Back Door

Companies and membership organizations often focus on new sales. How many new customers did we get? How many people joined? Their objective is to grow the number, toward greater profits or influence. Those “front door” efforts can be stymied by back door loss. How many customers left for a competitor because they didn’t like the new pricing or you ignored good customer service in favor of sales emphasis? How many members left the church because you changed the style of service while trying to attract new folks? I think we need to be a little more focused on back door loss in the ag commodities right now.

Here’s the rationale. Everyone knows the initial 2021/22 S&D balance sheets are tight for corn and soybeans and tightening for wheat. To keep ending stocks manageable and prices near current levels, we need trendline to above trendline yields for the US crop. Thus, there has been an intense focus on threats to those yields from heat, dryness or both. First in the Dakotas, and then in the IA/MN/IL area. Some of this is your typical summer weather market behavior, but the forecast to forecast price jerks are magnified when you really need the bushels. That is as opposed to having comfortable old crop stocks equivalent to 5-10 bpa already in the bin. The supply side in June is a front door issue. Where is the potential for mayhem? That the thief comes in the back door! Back door demand loss.

Price rationing is real. With prices at 8-year highs, end user buyers begin adapting. China feeds more wheat and rice instead of corn or cuts back soybean meal in hog rations. Other countries try to grow more domestically and import less. Expansion plans for green energy from ethanol or biodiesel are slowed by high prices for the corn or soy inputs. Congressmen (or women) with oil refineries in their districts lobby their own Administration to issue hardship waivers so they can sell more crude oil based products rather than pay up for biofuels or RINs. This week’s drop in soy oil and other veg oils is instructive as we see what it did to soybean prices. If you are a weather bull, please keep in mind that prices can go down at the same time yields are, IF there is enough back door loss on the demand side of the balance sheet.

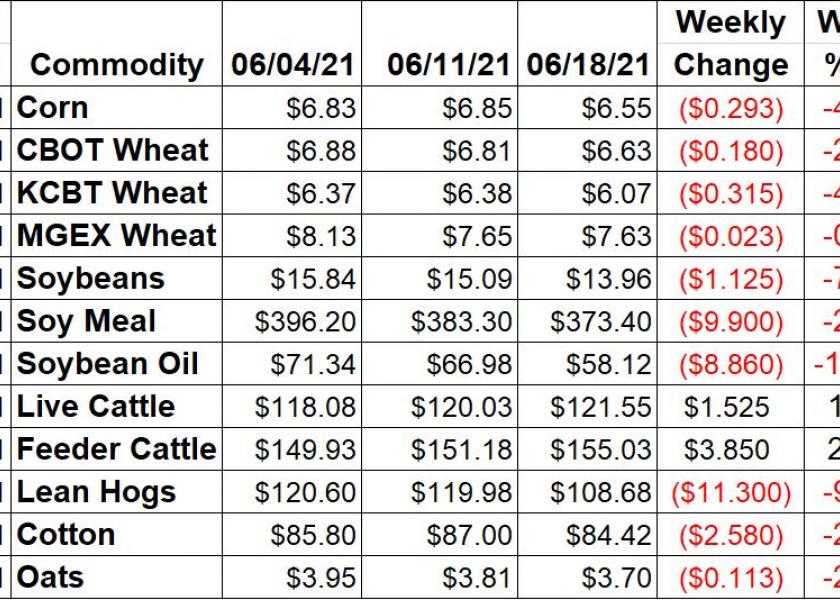

Corn futures dropped 4.3% this week, despite a valiant attempt on Friday to erase the damage from the limit down day on Thursday. USDA indicated the crop is ahead of normal maturity, with 96% emerged vs. the 91% average. That’s the end result of rapid planting progress. Crop condition ratings dropped for the week, with 4% fewer acres rated good or excellent. Looking at all the ratings, the Brugler500 Index was down 6 points to 374 vs. 380 the previous week. The 10 year average rating for that week is 376. Cumulative export shipments have reached 2.148 billion bushels. Unshipped old crop sales commitments are both an opportunity and a liability, with more than 14.743 MMT (580 mbu) still on the books. Advance commitments for next year are record large.

Wheat futures were all lower. KC HRW eked out a 0.24% gain the previous week, but failed to dodge the bullet this week. Nearby July was down 31 ½ cents, 4.9%. Chicago SRW was down 2.6%. Minneapolis spring wheat was better supported by ongoing heat and dry weather in the Dakotas, Montana and Minnesota. It still lost 2 ¼ cents per bushel. Weekly US wheat export sales through June 10 were comfortably within the range of estimates, at 287,100 MT. New crop commitments are 24% of the June WASDE estimate for the marketing year. The 5 year average would be 25% for this date.

Soybean futures sank 7.5% this week on top of a 4.8% decline the previous week. Soy Meal was down 2.6% for the week, with bean oil down a shocking 13.2%. That was THE main reason for the soybean weakness. Malaysian Palm oil futures were down 3.3% for the week, starting with a 7.7% loss on Monday and then fighting their way back. While cheaper competing oils were a problem, the potential loss of biodiesel and renewable diesel use was a bigger issue for the BO. Congressmen from several states with oil refineries were lobbying the EPA and the Biden team for waivers of mandated use.

Soybean planting across the US has moved right along with 94% of the crop in the ground as of last Sunday, vs. 88% average. Crop conditions were rated 62% good/ex, down from 67% the previous week. NOPA soybean crush for May was about 2 million bushels smaller than the average trade estimate. Oil yields were up, as crushers concentrated on maximum extraction at then record high prices. NOPA Soy oil stocks were lower. Soybean export sales were just about non-existent, with one 65,300 MT vessel of old crop sold, and 6,500 MT for 2021/22. World buyers are focused on cheaper South American offerings.

Live cattle futures managed a gain of $1.525 on the week, a 1.3% gain despite a nasty Thursday sell off that had some contracts down $3.00 or more. Cash trade was firmer this week, with mostly $122-124 reported Friday. Feeder futures were up $3.85 for the week, thanks to cattle futures gaining while corn prices were simultaneously dropping. The CME feeder cattle index is $141.28, up $1.05 from the previous week. Wholesale beef prices were down again this week. Choice boxes dropped $14.28 (-4.2%), with Select down $21.60 per 100 pounds (-7.1%). Weekly beef production was 1.9% larger than the same week in 2020. YTD beef production is now 6.4% above year ago on 5.6% larger slaughter. Average carcass weights have been coming down. Estimated weekly FI slaughter was 663,000 head vs. 665,000 last week and 646,000 a year ago.

Lean hog futures plunged 9.4% this week, adding to perceptions that the multi-month bull party is over. The CME Lean Hog index was up $1.77 this week @ $121.68. The pork carcass cutout value dropped $11.89 for the week, a 9% loss. All of the primals were lower, with loins seeing the least deterioration. Weekly pork production was up 0.2% from the previous week. Pork production is now 1.9% higher YTD vs. last year, with 1.4% more hogs slaughtered. Weekly pork export sales were up 49% from a very low base, with Mexico, Japan and South Korea notable. Shipments were 38,100 MT. China is taking less as they get their hog herd rebuilt, about 8,800 MT this week. Cash pork prices within China continue to decline as herd rebuilding continues. Some Chinese producers also kept hogs to heavier than normal weights while waiting for prices to rebound and are now having to dump them into the market.

Cotton futures sank 3% this week as planting progress accelerated, the dollar rose to a multi-week high, and the markets threw a taper tantrum after the Fed indicated it might be so bold as to hike interest raes in 2023. Planting of the US cotton crop caught up and surpassed the 89% average pace at 90%. Of course, fewer acres are intended for cotton this year. The weather has been a challenge, with a tropical storm dumping copious amounts of rain on Delta and Mid-South fields. USDA indicated 45% of the crop was in good or excellent condition, slightly better than the 43% from a year ago. Cotton export sales commitments are 105% of the full year WASDE forecast. They would be 110% on average, due to rollovers and deferrals. Export shipments are 10% larger than year ago at this point, but outstanding commitments are 43% smaller. The marketing year ends July 31.

Market Watch

Summer officially began on Saturday, but we’ve been trading weather forecasts for a while. Sunday night action is expected to be fueled by any surprises in the 6-10 and 8-14 day model runs, or by hits and misses in the expected rains for the WCB (Western Corn Belt). The weekly Export Inspections and Crop Progress reports will be in their normal Monday release slots. EIA ethanol data will be out on Wednesday, with USDA weekly Export Sales data out on Thursday. Livestock traders get some fresh grist for the mill, with the quarterly Hogs & Pigs report scheduled for Thursday and the monthly Cattle on Feed report due on June 25. Friday will also mark the expiration of the July grain futures options.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2021 Brugler Marketing & Management, LLC. All rights reserved.