Let the Madness Begin

Market Watch with Austin Schroeder

March 15, 2024

Let the Madness Begin

This week has been Championship Week. The one week in the year where teams battle for a place in the Men’s NCAA basketball tournament next week. Those ‘bubble’ teams are battling to keep their season alive, with the ones without a chance hoping for a start to a Cinderella run. On Sunday, we will officially know those who are in the tournament and the NCAA coined March Madness® begins on Tuesday with the First Four. Well for the grain markets March has a madness of its own. That ends with the Grain Stocks and Planting Intentions reports on March 28 (Sweet Sixteen weekend), but the market is going to begin placing bets for what the USDA will say over the next couple weeks. Are the underdogs (grain bulls and livestock bears) going to pull off some upsets, or are the seemingly dominant teams (grain bears and livestock bulls) from the last few months going to prevail? We’ll have to let the madness play out!

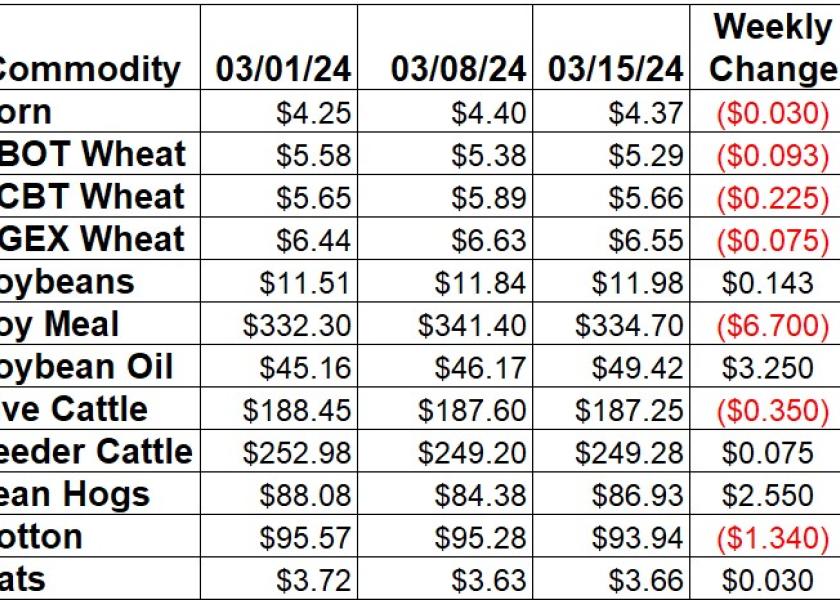

Corn slipped back lower this week, mainly on Thursday’s action, as May was down 3 cents (0.68%). December ended with a 1 ¼ cent loss. EIA showed ethanol production dropping off another 33,000 barrels per day to 1.024 million bpd during the week of 3/8. Stocks were trimmed back 269,000 barrels to 25.782 million barrels. Weekly Export Sales data showed bookings up to a 4-week high at 1.28 MMT during the week that ended on March 7. Shipped and unshipped export commitments for corn are now 76% of the USDA forecast, compared to the average pace of 82% for this time of year. Actual shipments are 42% of the USDA number, still 3% below the average pace. Friday’s Commitment of Traders report showed managed money slashing 40,867 contracts from their net short position as of 3/12. That left them 255,928 contracts net short as of Tuesday. Commercials flipped back to their natural net short position by a total of 42,492 contracts, with a bulk of that in increase in new shorts, implying producer selling. Their net short was just 31,068 contracts as of Tuesday.

The wheat market reverted to their seemingly natural bearish habitat. Kansas City led the bear charge this week as May was down 22 ½ cents (3.82%). MPLS spring wheat futures settled with a 16 ¼ cent change on the week (2.45%). Chicago was down 9 ¼ cents (1.72%). Thursday’s Export Sales release saw wheat bookings dropping to 83,804 MT for the week that ended on 3/7, a MY low. That was mainly due to Chinese cancellations, which saw another 264,000 MT cancelled on Monday. The US wasn’t the only one receiving the cancellation notices, as they reportedly cancelled ~1 MMT of Australian wheat purchases. US export commitments are now 96% of the new USDA full year export projection, 1% below the 5-year average pace and 4% larger than the same point last year. Actual shipments are running a little slower, with 68% of the USDA forecast fulfilled compared to the 75% average. The weekly Commitment of Traders report showed spec traders in Chicago wheat futures and options adding 13,331 contracts back to their net short as of 3/12. That left them with a net short position of 78,870 contracts. In KC wheat, managed money trimmed 5,339 contracts from their net short, at 35,547 contracts as of Tuesday.

Soybeans extended their ascent higher this week, as May was up 14 ¼ cents since last Friday (1.2%). Meal was of no help to the bulls, down 1.96%, though bean oil saw a massive 7.04% rally (3.25 cents). Export Sales data from Thursday was okay for beans, as the 375,980 MT for the week of March 7 was lighter from the previous week, but still the second largest we’ve seen in the last 7 weeks. Export sale commitments for soybeans are now 85% of USDA’s forecast total, 6% below the 5-year average pace. Accumulated shipments are 74% of that total, below the average pace of 75%. Even as the export program may not be as solid, we are crushing at record pace, with NOPA showing members’ crush at 186.2 mbu during February. That was a record for the month, up 12.56% from last year, and slightly above January on 2 fewer days. Soy oil stocks were 1.69 billion lbs, as 12.2% climb on the month but still 6.6% below last year. This week’s Commitment of Traders report tallied spec funds pulling off of their record net short in soybean futures and options as of Tuesday by 16,862 contracts. That took their net short to 155,137 contracts by March 12. The commercials large net long was backed off by 17,195 contracts to 53,193 contracts as of last Tuesday.

Live cattle saw back and forth trade this week and ended with a net 35 cent loss since last Friday. Cash trade saw another week of strength, as cattle exchanged hands at $186 in the south and $187-188 in the north, up $1-3 on the week. Feeder cattle were just 7 cents higher on the week. The CME Feeder Cattle Index was up another 93 cents this week to $249.00. Wholesale boxed beef quotes continued their ascent this week. Choice boxes were up $4.86 to their highest level since September at $311.90, while Select was $4.97 higher to $302.40 nearing the peak from last June. Weekly beef production was back up 3.6% vs. last week but was still down 2.8% vs. the same week last year. Actual slaughter totals in the first several weeks of the year are down 5.5%, with production 4.3% lower as carcass weights have picked back up recently. Export Sales data was a little light on the beef total this week at 11,229 MT. Shipments were even with the previous week at 15,958 MT. Spec funds in live cattle futures and options continue to rebuild their net long, up another 3,947 contracts during the week ending on March 12. They took the net long position to 63,311 contracts as of Tuesday.

Hogs added a little premium back in this week, as April was up 3.02% since last Friday. The CME Lean Hog Index was another 71 cents higher this week at $82.19. USDA’s Pork Carcass Cutout was back up $1.36 this week (1.5%) this week to $93.47. The belly (-3.6%) was the only primal reported lower, with the picnic (5%) and loin (5%) the leaders to the upside. Weekly pork production was up 0.5% compared to last week but was 1.6% below the same week a year ago. Slaughter for the first few weeks of the year is now up 0.8%, with a 0.5% increase in production. Weekly Export Sales data showed pork sales at 24,854 MT, the second lowest this year. Export shipments were a 3-week high at 34,484 MT. Friday’s CFTC data showed spec traders in lean hog futures and options backing off 1,411 contracts from their net long as of Tuesday. That position was tallied 63,679 MT as of March 12.

Cotton continued the choppy action this week, with May down 134 points since last Friday. US Export Sales rebounded during the week of March 7, though were still low at 84,045 RB. New crop sales were a solid 112,728 RB. Old crop commitments are still running at a solid pace for 23/24 at 10.615 million RB, which is now 92% of USDA’s current cotton export forecast. That is 5% back of the 97% average pace for this point in the MY. Shipments backed off of the previous 5-week high but were still the third largest this MY at 293,782 RB, taking the MY total to 52% of the USDA forecast, 2% ahead of the average pace. The FSA trimmed the Adjusted World Price for cotton by 78 cents on Thursday, to 76.10 cents/lb. This week’s Commitment of Traders report revealed managed money spec funds trimming 3,201 contracts from their net long in cotton futures and options. They took that net position to 93,160 contracts as of Tuesday March 12.

Market Watch

We start next week with the weekly Export Inspections report on Monday morning. Skip ahead to Wednesday and EIA will release weekly ethanol stocks and production data. We will also get an announcement on interest rates following the Fed’s two-day meeting on Wednesday afternoon. Most are expecting rates to be left unchanged this month. The weekly Export Sales report is out on Thursday morning per normal. April corn, bean, and wheat serial options expire on Friday. We will also get the Cattle on Feed report on Friday afternoon.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2024 Brugler Marketing & Management, LLC. All rights reserved.