Money is Still Moving

Market Watch with Alan Brugler and Austin Schroeder

January 20, 2023

Money Is Still Moving

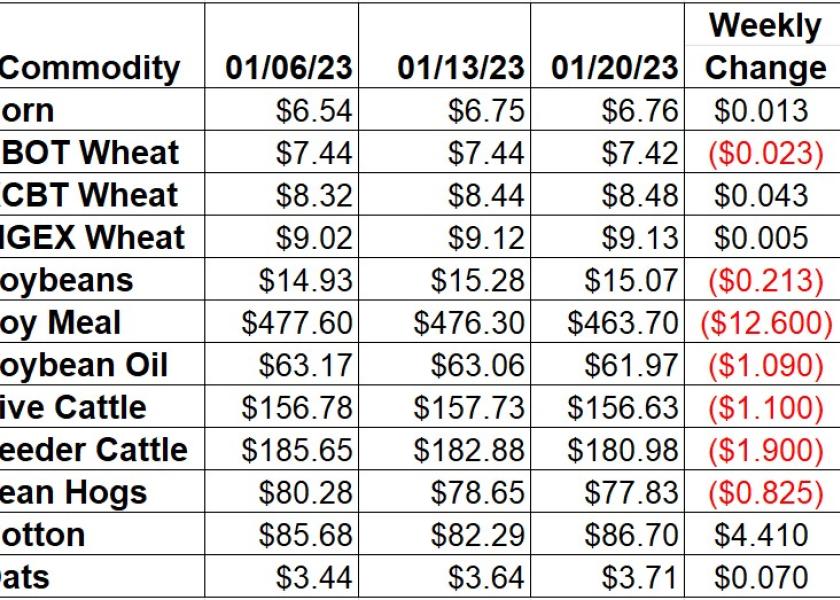

There was a lot of money moving in the financial system at the beginning of the year. We had some fairly big swings in the ag complex, due to the big funds changing asset allocations, selling some of last year’s winners and buying the losers. Then we had USDA throw out some fundamental numbers on January 12 and stimulate a few more moves. As motivational speaker Zig Ziglar once said, “Money isn’t the most important thing in life, but it’s reasonably close to oxygen on the ‘gotta have it’ scale. That’s definitely the case in investments. Cut off the buy paper and things will go down. Short sellers streamline the process by making longs prove they can back up their positions. With the exception of cotton the price swings this week were smaller, but the money was still moving around. We are reminded of another money quote, from Walter Wriston, “Capital goes where it is wanted and stays where it is well treated”.

Corn futures started off the week with a double digit rally, but movement Wednesday and beyond capped the weekly gain at just 1 ¼ cents. EIA data released on Thursday showed another increase in daily ethanol production (and corn use) of 65,000 barrels per day to 1.008 million. Meanwhile ethanol stocks were drawn down another 398,000 barrels to 23.402 million. The weekly Export Sales report finally gave corn something to write home about, with 1.132 MMT sold in the week of 1/12. That was the largest sales total since mid-November. Old crop corn export commitments (shipped and unshipped sales) are now at 23.128 MMT, which is down 46% vs. last year. That is also 47% of the USDA forecast, compared to the 61% average pace. Friday’s Commitment of Traders report indicated spec funds adding back 42,532 contracts to their net long position in corn during the week ending Jan 17. That put them net long 192,1387 contracts as of Tuesday night.

The wheat complex was mixed on the week, with Chicago feeling the weakest, down 2 ¼ cents. Kansas City was up just 4 ¼ cents since last Friday, with MPLS spring wheat just a half cent higher on the week. Weekly Export Sales data tallied wheat bookings at a 4-week high of 473,124 MT. Total wheat export commitments are now 15.619 MMT as of January 5. That is still 7% below year ago and 74% of Th USDA export projection, lagging normal pace by 9%. Actual shipments are 53% of the projected full-year total, 6% back of the average pace. Weekly CFTC Commitment of Traders data showed managed money spec traders adding another 1,955 contracts to their net short position in Chicago wheat futures and options in the week ending January 17. That took the net short position to 65,089 contracts. In KC wheat pared back 732 contracts from their new net short position to 7,291 contracts as of Tuesday.

Soybeans were in give back mode this week, as March was back down 21 ¼ cents from last Friday, a 1.39% drop. Soy Meal was the leader of the complex, with losses of $12.60 (2.65%), and soy oil down 109 points (1.73%). NOPA data released on Tuesday showed lighter crush during December than the trade had thought, at 177.5 mbu among its members. Export Sales data showed soybean export sales at a 5-week high of 986,196 MT in the week of 1/12. Commitments are now 45.39 MMT, or 5% larger than last year at this time. They are 84% of USDA’s newly revised forecast, 7% faster than the average paces. They need that buying pace to continue with Brazilian beans soon to come into the market. CFTC’s Commitment of Traders report tallied money managers increasing their net long position by 36,594 contracts in soybean futures and options during the week ending 1/17. They took that to the largest net long position since April at 168,298 contracts.

Live cattle futures slipped 0.70% lower on the week. USDA reported lighter cash trade this week, with most in the $155 range, down $1-2 from last week. Feeder futures were down 1.04% from Friday to Friday. The CME Feeder Cattle Index was $177.03, down $5 from last week. Wholesale boxed beef prices were down this week. Choice boxes on average dropped 1.8%. Select boxes were down 0.46%. The Choice/Select spread is frequently under pressure in January and February, and it dropped below $16 on Friday. A year earlier it was $10.80. Weekly beef production was down 2.4% from the previous week and 1.6% lower than the same week in 2021, as heavy snow totals across much of the Norther Plains made transportation difficult. The monthly Cattle on Feed report from NASS showed December placements down 7.96% at 1.804 million head, with marketings down 6.09% at 1.741 million head. That took the January 1 on feed total to 11.682 million head, down 2.95% from last year. Friday’s Commitment of Traders report showed spec funds trimming their net long position by another 6,817 contracts in live cattle during the week ending January 17. That backed off their larger net long position to 84,672 contracts by Tuesday night. In feeder cattle managed money flipped back to net short by 5,951 contracts.

Hogs tried to find some footing this week, as they slowed the recent bloodbath, down 1.05% on the week. The CME Lean Hog Index was down another $2.21 this week, to $73.28. The pork carcass cutout was down $1.65 this week (-2%). Pork bellies were up 7.6% for the week, but the other five primals were weaker. Weekly pork production was down 5.2% vs. the previous week, but also up 2.2% vs. the same week in 2022. CFTC’s weekly Commitment of Traders data showed managed money bailing out of another 12,072 contracts from their now small net long position. That dropped it to only 10,663 contracts net long as of January 17.

Cotton futures continued the see saw pattern this week, as they took back all of the previous week’s losses, with a 441 point rally on the week. The weekly Export Sales report had cotton bookings at the largest total since September 1 at 209,435 RB during the week that ended on 1/12. Cotton export shipments YTD have been 23% larger than last year, as unshipped sales commitments are 38% smaller. Total commitments are down 20% in total vs. last year and are 80% of USDA’s forecast total, 2% behind normal. Cotton Ginnings data from Friday indicated 13.707 million RB had been ginned by January 15. USDA’s AWP for cotton was up down points from the previous week to 72.43 cents/lb. The weekly Commitment of Traders report saw spec funds flipping to net short in the week ending 1/17, by a change of 11,040 contracts on the week. That took them to net short 1,930 contracts by Tuesday, their first net short position since May 2020.

Market Watch

Next week starts on Monday, with the Export Inspections in the morning. Skip ahead to Wednesday and EIA will release they weekly report showing ethanol production and stocks. Wednesday afternoon will also show the monthly Cold Storage report from NASS. Weekly Export Sales will be out on Thursday morning next week, with January Feeder cattle futures and options expiring that day as well. Friday is expiration day for February serial grain options.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2023 Brugler Marketing & Management, LLC. All rights reserved.