Old Traders and Bold Traders

Market Watch with Alan Brugler

October 29, 2021

Old Traders and Bold Traders

There is a famous market axiom that says, “There are old traders and there are bold traders, but no old bold traders”. The big, flashy bets get the headlines, and one in a while they pay off. Think Soros betting against the British pound or Tesla buying all those bitcoins for their treasury (BTC set a new all time high on October 20). You tend not to hear of the big bets that went sour, and the thousands of traders who lost their stake and had to quit trading. For farmers, the big bold bet is on the cash market side. You are spending serious cash for the inputs, betting on the weather, and then watching price swings move your income all over the map. Trading that volatility for a nice safe cash sale with a modest profit margin is attractive to some, but anyone who did that last fall with soybeans spent most of the spring berating themselves for selling too cheap. We favor spaced selling to spread the risk, in our case using a Three Buckets methodology. Knowing when to price within those buckets takes preparation and study, of both fundamental and technical influences in the market. We’d be happy to assist you. ---Alan

Now for those fundamentals:

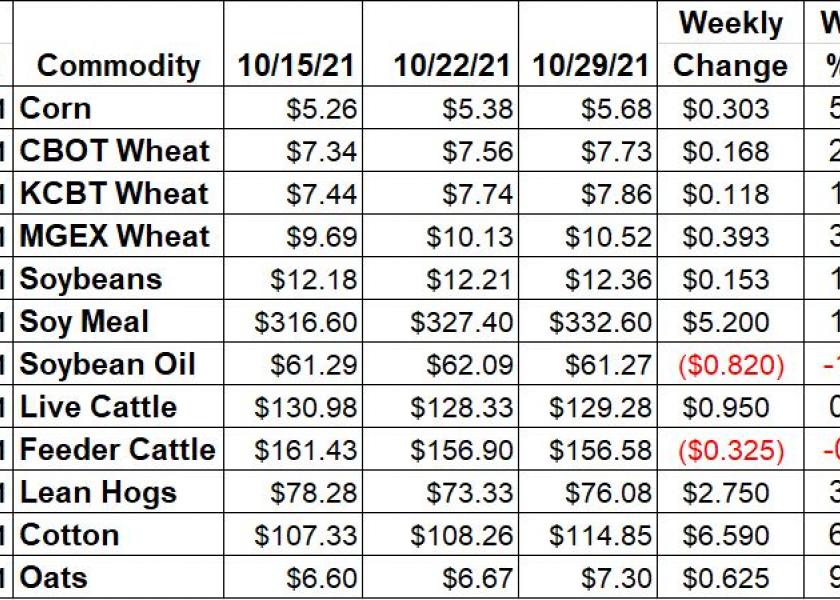

Corn futures rose 30 ¼ cents this week, adding another 5.6% to the 12 ¼ cent advance made the previous week. Weekly corn export sales were disappointing, down 30% from the previous week at 890.400 MT. Chinese futures prices traded in the $10.30’s most of the week, which would make room for imports. However, they appear inclined to support the local market during harvest. That took the total of shipped and unshipped sales to 29.785 MMT, 3% below vs. last year at this time and now 47% of the current USDA full year forecast. Ethanol production is a shining beacon for the bulls, with weekly corn consumption likely over 111 million bushels. That’s going into the plant, but of course there are DDG’s, corn oil, CO2 and wet mill products coming out the back end in addition to ethanol. Friday’s Commitment of Traders report showed managed money spec funds added 25,222 contracts to their net long in corn futures and options during the week ending October 26. That took them to a net long 244,790 contracts by Tuesday.

Wheat futures marched into some new life of contract highs this week, with MPLS spring wheat gaining 3.9% and trading at the highest value since 2011. KC HRW is somewhat substitutable for the HRS, and rose 1.5%. Chicago SRW was up 2.2% or 16 ¾ cents. Weekly Export Sales totaled only 269,300 MT for the week ending October 21. US FOB prices are above most of the world, and ocean freight is being monopolized by soybeans. Total commitments for wheat exports are 12.751 MMT, which is now 54% of the USDA forecast vs. the 61% average pace for this date. The weekly CFTC Commitment of Traders report showed spec funds in CBT wheat shrinking their net short position by 9,119 contracts between 9/19 and 9/26. They were still net short 8,619 contracts on Tuesday. In KC HRW, the funds added another 5,583 contracts to their already sizeable long for the week, taking it to 52,973 contracts. There are ZERO reportable level managed money shorts in MPLS spring wheat. The funds were net long 17,291 contracts as of Tuesday.

Soybeans trailed corn and wheat most of the week, but still settled 1.3% higher for the week. Soybean meal was showing signs of life, up 1.6% for the week. Soy oil backed off by 1.3% due to profit taking. USDA’s Export Sales report indicated exporters sold only 1.183 MMT of soys during the week of October 21. That was down 59% from the marketing year high set the previous week. China accounted for the majority of the sales, but still isn’t buying at the pace needed to meet USDA’s forecast for them. Total US export commitments are now 30.452 MMT, still 35% smaller than year ago. US Exporters have now booked 54% of the USDA estimate vs. the average 56% pace for this date. Commitment of Traders data released on Friday showed spec funds in soybean futures and options cutting adding 5,746 contracts to their net long position from October 19-26. That increased the net long to 23,911 as of Tuesday.

Live cattle futures gained 0.7% for the week, rallying sharply following the bullish Cattle o Feed report and then giving some of it back ahead of the October contract expiration on Friday. December futures still carry a premium to the cash market, looking for the latter to rally. Cash cattle sales confirmed by USDA were mostly $126 in the South and mostly $126-$127 in the North. Feeder cattle futures were down 0.2% due to the sharp increase in feed costs and modest net gain for the cattle. The CME feeder cattle index is $155.88, up $0.77 from the previous week. Wholesale beef prices were higher this week. Choice boxes were up $3.90 (+1.4%) per 100 pounds, with Select up $0.26/cwt (+0.1%). Weekly beef production was up 1.2% for the week and 3.4% larger than last year. YTD beef production is now 2.8% above year ago on 3.2% larger slaughter. Weekly Export Sales data showed a marked improvement to 19,200 MT in beef bookings for the week ending 10/21. The weekly Commitment of Traders report saw spec funds trimming 1,816 contracts from their net long position. They were net long 42,911 contracts in live cattle futures and options as of October 26.

Lean hog futures rallied 3.8% for the week, with the bulk of the move on Thursday. The CME Lean Hog index fell $4.13 to $80.70 as of 10/27. The pork carcass cutout value was down $1.75 or 1.8%, this week to $96.52. Weekly pork production was down 1.4% from the previous week, and 7.2% lower vs. the same but COVID distorted week in 2020. The YTD pork production is 2.1% smaller YTD vs. last year, on 2% smaller slaughter. Weekly pork export sales for the week ending 10/21 were up 41% from the previous week at 29,500 MT. China was again missing from the top buyers. Pork shipments were 32,800 MT, with China shipping a token 3,500 MT. Spec funds trimmed back their large net long position in lean hog futures and options by another 17,727 contracts this week. According to Commitment of Traders data their net long position was 44,673 contracts on 10/26.

Cotton futures shot up 6.1% and are now challenging their life of contract highs. They are still far below the 2011 peak, which was above $2. Export bookings for the week ending Oct 21 totaled 360,800 RB for upland, with another 20,000 in the August 2022 or later time slot. Unshipped sales on the books are 11% larger than last year. Exporters have now sold 57% of the USDA projected total for the year, vs. the average pace of 58%. The week’s AWP for cotton was 93.37 cents/lb, up by 57 points. Friday’s Commitment of Traders report showed managed money spec funds trimming back their net long in cotton futures and options by 4,291 contracts for the week of 10/26. They were net long 77,136 contracts on Tuesday close of business.

Market Watch

We start Monday with November soybeans now in delivery status. We’ll see USDA Export Inspections in the morning and the Crop Progress report in the afternoon. As the first weekday of the month, we’ll also see the USDA Fats & Oils, Grain Crushings and Cotton reports. The FOMC will be meeting on Tuesday and Wednesday and is expected to formalize tapering of their bond and MBS buying programs due to inflationary pressures. On Wednesday EIA will also put out ethanol production and stocks data. On Thursday FAS will release their weekly Export Sales report.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2021 Brugler Marketing & Management, LLC. All rights reserved.