Speer: Better Business Means Better Markets

“The market is broken.” That’s been the focus of my previous several columns. The first discussion noted both the fed and feeder market are “more responsive and now moving faster than ever.” The second column provided some further context: “…last time, higher prices were spurred by declining production; this time, it’s different – bigger volume AND higher prices.” Accordingly, the market doesn’t provide any indication to support the claim of being “broken”.

Nevertheless, following the first column one reader asked, “…how does the market “functioning” the way one in theory would expect [it] to necessarily translate into an efficient market for producers? The market is definitively efficient for the packer.” The implication being even IF the market isn’t “broken”, the deck remains disproportionately stacked against producers.

With that, let’s turn our attention to feeder cattle. The first column highlighted the CME’s feeder cattle index and the current run that’s now shot past $180 – adding more than $65/cwt in just 28 months since the spring, ’20 low. And as reminder, on the way to $180 in ’14, the market required 42 months to cover the same territory. But for some, that’s not evidence enough. Therefore, it’s important to take a bigger view over time.

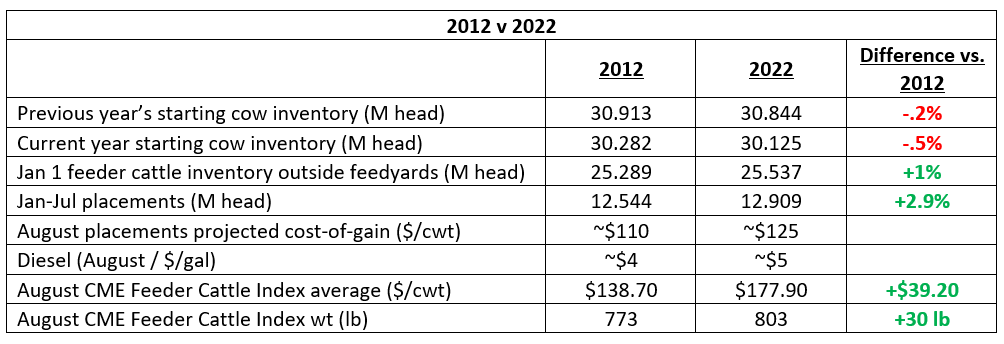

The table below provides some context between now and ten years ago. Coincidentally, the inventory setup is nearly identical; an appropriate apples-to-apples comparison. But now consider some of the current headwinds that didn’t exist in 2012. Most notably, fuel prices and projected feedyard costs. Sure, corn is actually cheaper this year compared to 2012 – but every other cost is higher (i.e. labor, natural gas, medicine, interest).

Those headwinds get priced into the cost of replacements; not to mention year-to-date placements have been more aggressive in ’22 versus ’12 (thus, cattle feeders should be less hungry for replacements). Despite that, the August feeder cattle index is nearly $40/cwt ahead of 2012 (on calves that weigh 30 lb more).

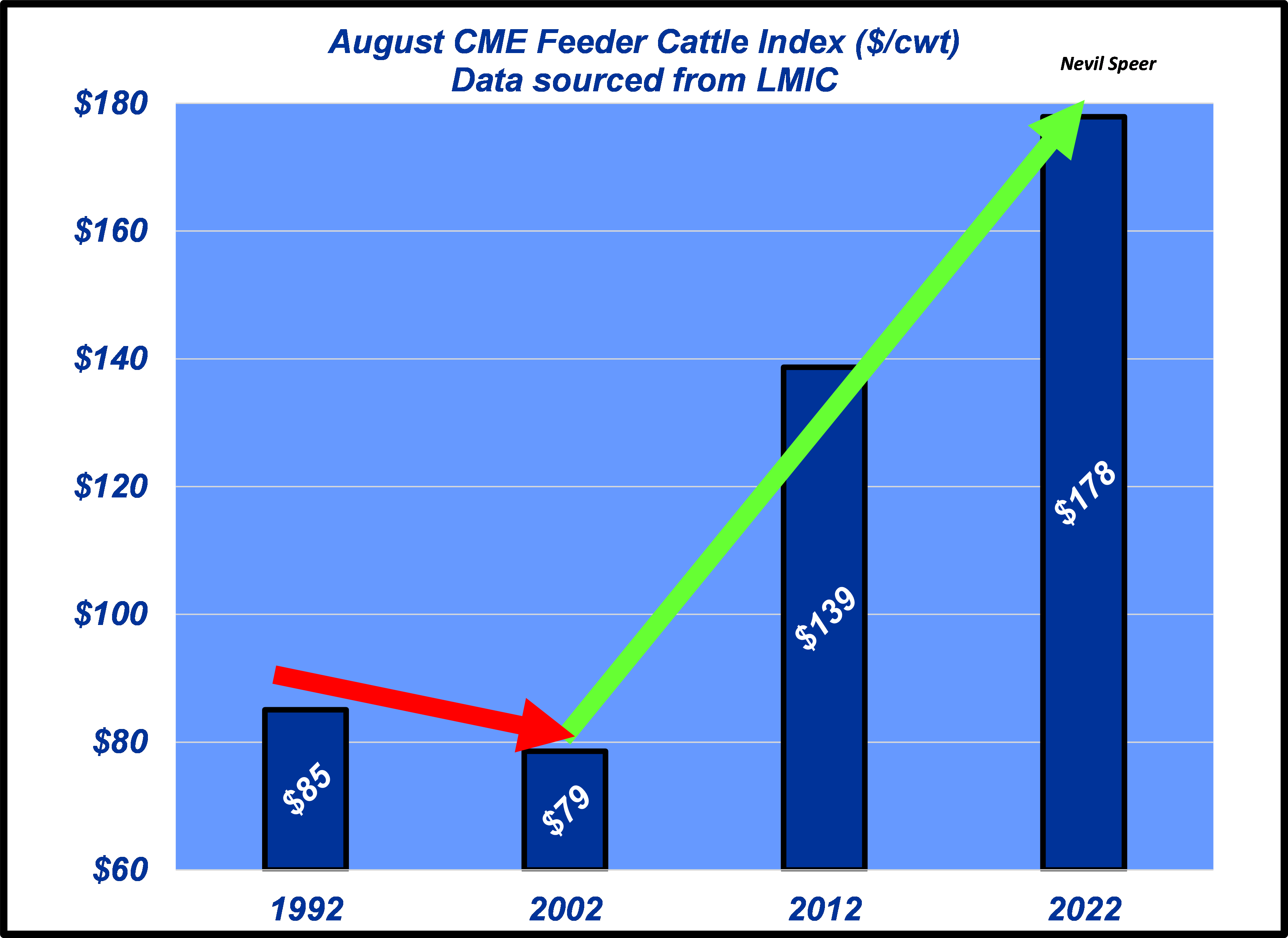

Sticking with the “producer” / feeder cattle sentiment, the reader’s email also noted, “Sure the recent market activity means it’s not always awful, but that’s the exception that proves the rule.” Let’s step back even further to weigh that assertion. The attached graph highlights a decade-over-decade comparison since 1992; in other words, it outlines “producer” prices ten, twenty and thirty years ago.

Are higher prices in ’22 an “exception”? The trend is what matters. Since 2002 feeder cattle prices have been higher in each decade; tacking on $100/cwt over the past twenty years. That’s a sharp contrast to the ’92-to-’02 time period when beef demand bottomed out and feeder prices did too. (The same principle plays out for 500-lb calves as outlined in a previous column: Is Fair What We Really Want?).

To that end, I had opportunity this past week to attend the Certified Angus Beef Feeding Quality Forum in Kansas City. The event included honoring Randy Blach, CattleFax CEO, as recipient of this year’s Industry Achievement Award (truly, a fitting tribute). Part of his comments emphasized the beef industry’s progress during the past 25 years and then underscored further opportunities as it relates to consumers; specifically, he noted, “The business is getting better.”

Indeed! Investment in better genetics, management, research, and promotion have all proven to make a difference towards bolstering demand. Consumers have more awareness of, and access to, high-quality beef products than ever. As such, none of what we’re witnessing is just happenstance – it’s the result of an enduring commitment to continuous improvement. Those efforts are paying off: better business means better markets.

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.