Speer: Exports Benefitting Producers – More All The Time

The testiest feedback from readers always involves international trade. For instance, a state beef council member recently emailed me including this observation:

[The beef industry is comprised of] two distinct segments. Cattle producers up to slaughter and beef processors and merchants after slaughter. Beef processors do not produce beef, cattle ranchers and cattle feeders do. To say anything different confuses readers continually. Case in point: Your articles about the importance of beef exports to beef producers. It is obvious that most of the profits per head of beef exported is ending up in the bank accounts of beef processors and exporters not the actual beef producers as stated above.

He concluded by directing me to, “consider the points of view [he is] expressing as [his] ability to ‘sort facts and think critically’.”

So, let’s test those assertions and see where we end up.

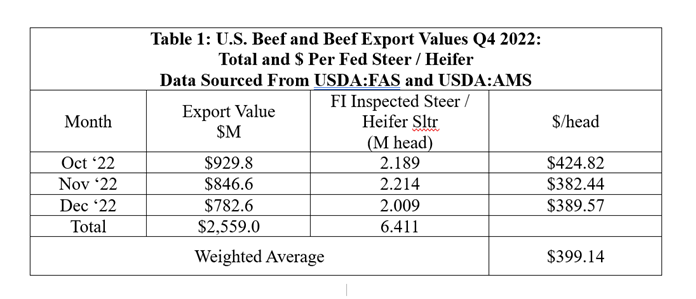

International Trade: For starters, Table 1 outlines monthly beef export value. To keep it simple, we’ll focus just on Q4 2022. Remember, the complaint being, “most of the profits” from exports go to the packer; “actual beef producers” aren’t really receiving the ~$400/hd export kicker outlined below.

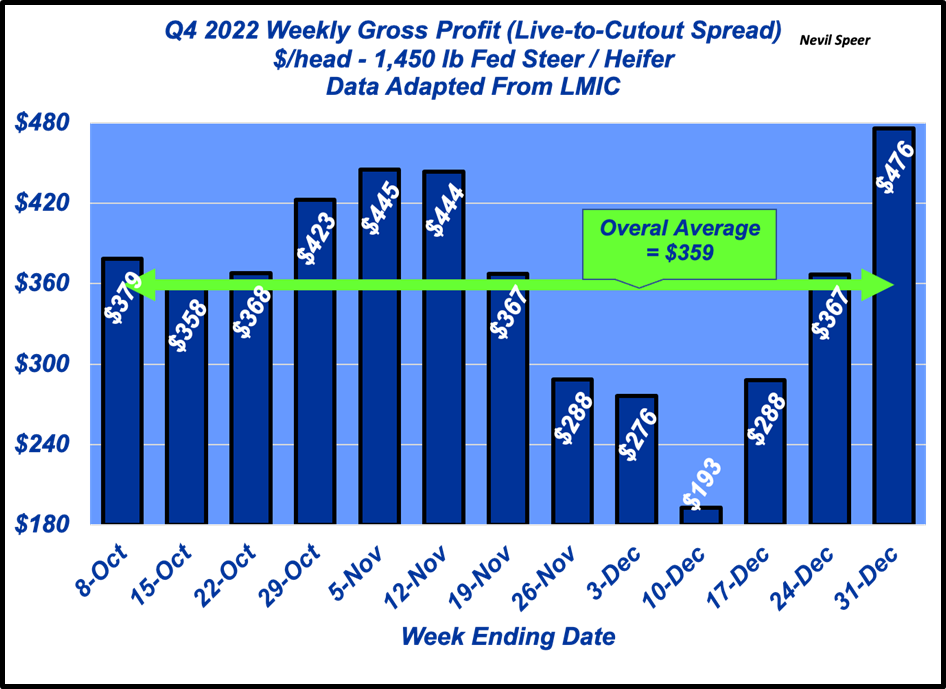

Gross Profit: Next, let’s turn to some basic industry economics. The first graph highlights weekly packer gross profit (otherwise referred to as the live-to-cutout spread). It represents sales (cutout and drop) less cost-of-goods sold (cattle). Q4 average was ~$360/head.

That value does NOT account for costs associated with owning and operating a processing plant (roughly $300-to-$350/head - see Altruistic Seller). Subtracting that expense from gross profit gets us to net profit.

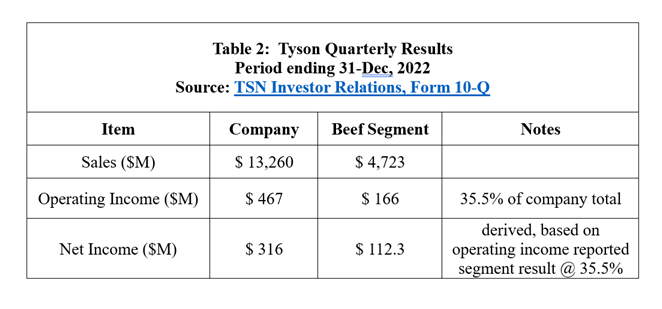

Tyson: Now let’s come at the topic from a business perspective – and do it through the lens of Tyson. The data is easily accessible, being a publicly traded company. Table 2 details the company’s most recent 10Q filed with the SEC (reflecting Oct, Nov and Dec results).

Net profit isn’t reported by business segment (i.e. beef, pork, chicken, prepared foods, international/other). However, we can back into some estimates. Beef segment operating income (reported) was $166M or 35.5% of company’s total operating income. Carrying that contribution percentage through to the bottom line, quarterly net income attributable to the beef segment is $112.3M.

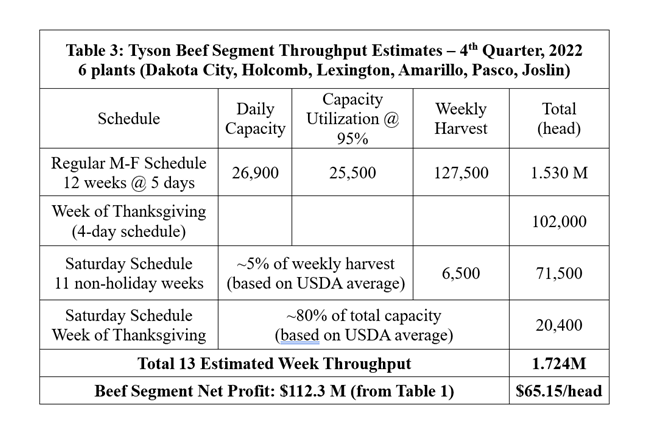

Table 3 provides beef throughput estimates for the company. During the final three months of 2022, Tyson processed roughly 1.724M head (representing ~27% of total fed steer / heifer slaughter detailed above - in line with Tyson’s respective percentage of total industry capacity). And based upon segment net profit of $112.3 m head (detailed above), that translates to net profit averaging ~$65/head.

Sorting Facts, Thinking Critically, Striking Out: As noted above, Q4 gross profit was ~$360/head across the industry. And alluded previously, after subtracting $300/head for operational / administrative costs and you’re left with ~$60/head net profit. The industry and company numbers are in alignment.

That said, the reader’s (mis)representation of international trade gets recorded in the scorebook as “K”:

- Strike 1: USDA’s reported drop and cutout values include international sales; they’re NOT on a separate ledger somewhere for only the packer to see. In fact, USDA’s weekly comprehensive boxed beef cutout even categorizes load count with a breakout for international versus domestic sales.

- Strike 2: Similarly, Tyson reports international sales by segment in a straightforward manner. The company’s Q4 beef total was $697M (or ~15% of beef sales).

- Strike 3: Clearly, the cutout plus the drop ultimately gets translated back into the fed market. That’s evidenced by Tyson’s beef segment net profit of $65 - a LONG WAYS from the $400 export premium.

Follow The Dollars: So, where did we end up? It’s evident there’s no stealthy, after-market profit windfall for packers. Any claim export premiums are going into the “bank accounts of beef processors” is misguided. The reader’s email seemingly amounts to nothing more than industry axe-grinding – he’s just mad about trade and packers and the Checkoff.

Export dollars are flowing back upstream to producers. That reality harkens a previous column highlighting the importance of international trade: “…the facts underscore the significance of the ongoing work by the Cattlemen’s Beef Board and USMEF. No matter how you stack it, the consistent - and ever-growing - return on investment is an amazing success story. Cattlemen are direct beneficiaries of those efforts.”

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.