Speer: Trade Handwringing Barking Up Wrong Tree

My previous column was prompted by an email from a Montana rancher in response to some earlier observations regarding COOL. The primary focus being the role of international trade within the beef industry. The column highlighted several key items regarding beef imports and exports - all of which are working in the industry’s favor:

- The cumulative difference between import and export tonnage during the past six years is only 750M lb – just an extra 125 M lb/year in net beef supply.

- The vast majority of beef imports are lean trimmings that are blended with 50-50 trim to make ground beef. Without these lean trimmings, much of the fed market’s domestic trim would have little value.

- Beef exports established a new record in 2021 totaling nearly 3.45B lb.

- Following BSE, it wasn’t until 2009 the beef industry’s trade balance returned to positive territory – since then export value has outpaced imports by over $20B!

But that’s just the product side. Per the rancher’s email, we also need to address the animal side.

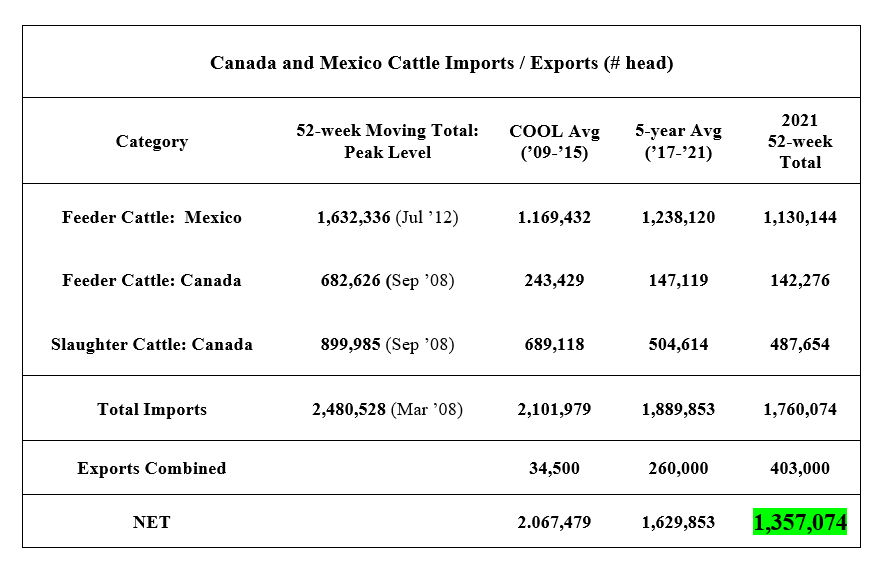

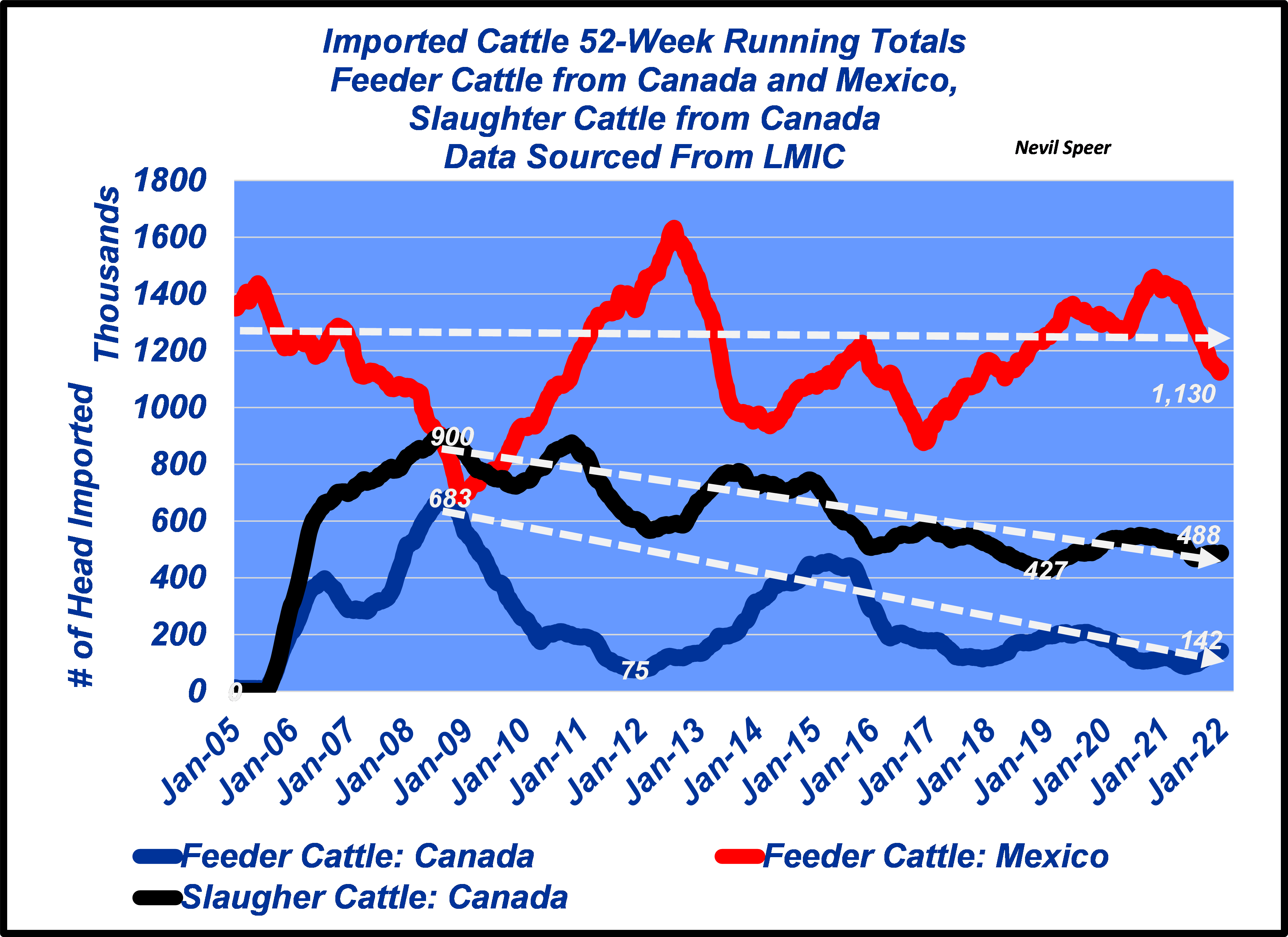

The first graph outlines 52-week moving totals for three separate categories since 2005 (getting beyond trade disruption resulting from BSE in Canada): 1. feeder cattle from Mexico, 2. feeder cattle from Canada, and 3. slaughter cattle from Canada. A couple of items of significance:

- Feeder cattle from Mexico ebb-and-flow but have generally remained flat since 2005.

- Feeder cattle from Canada peaked at nearly 685K head in 2008. Ever since imports have steadily declined and finished 2021 at only 142K head (roughly 20% of the peak).

- Slaughter cattle also topped out in 2008 (nearly 900K head); shipments in ‘21 totaled only 488K head.

- All three categories finished 2021 below the five-year averages (see table below).

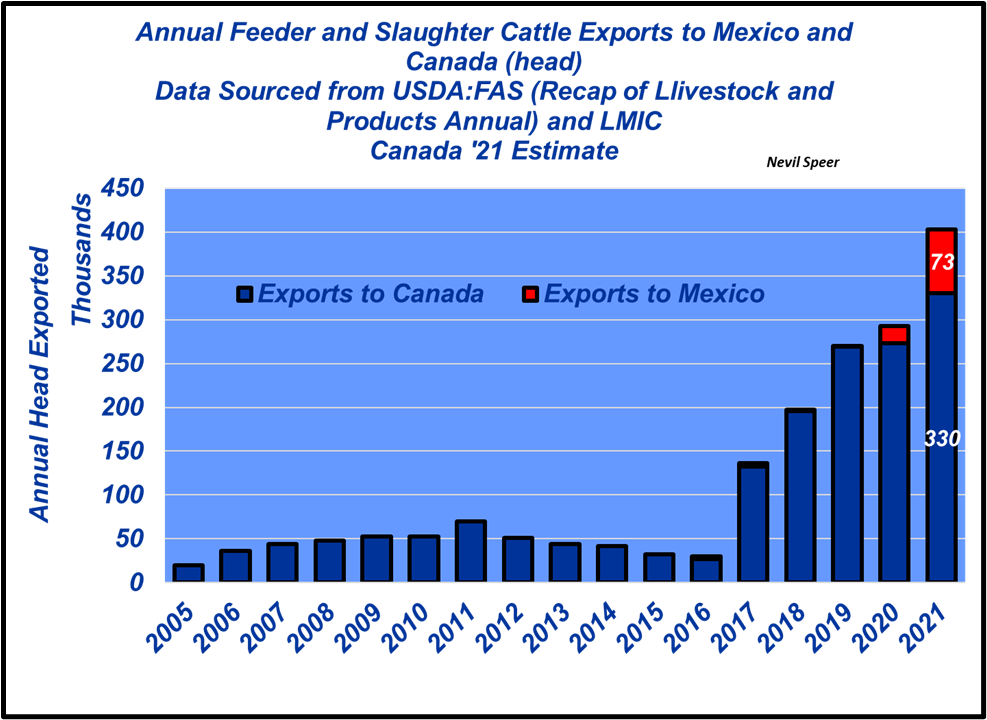

Meanwhile, there’s a new aspect to the trade equation that’s emerged in recent years. Exports to Canada and Mexico totaled over 400k head in 2021 (see second graph)! And as such, NET imports totaled only 1.357M head in 2021 (record low). For some context, that’s equivalent to about 26K head per week. Commercial weekly slaughter in 2021averaged ~650K head; net imports represent only 4% of total slaughter.

Coming full circle: the rancher’s trade concerns revolved around COOL. Proponents often harken back to ‘14/’15 prices and typically declare a cause-and-effect scenario. The prevailing perception being COOL helps slow cattle imports to the U.S. and is thus price supportive.

However, the data isn’t supportive of that supposition. During the seven years COOL was in effect (’09-’15), net imports averaged 2.067M head annually; meaning 2021 import totals represent just two-thirds of the average COOL pace. Alternatively, during that time cattle imports comprised roughly 6.5% of annual commercial slaughter (versus last year’s 4% noted above).

Regardless of the recent trend, some would argue live cattle imports are simply unnecessary. The U.S. can be self-sufficient; imports are a hindrance, and something must be done. However, that’s a perilous path - when it comes to trade, turnabout is fair play.

What might be some possibilities if the U.S. attempted to impede cattle imports from Canada and Mexico? Retribution might include restrictions on U.S. exports of dairy and pork products to Mexico, and/or fruits and vegetables to Canada – not to mention all sorts of non-ag related products. Those all have significant ramifications. But it might also hit closer to home.

What if reprisal limits the cattle rancher from selling feeder cattle to a Canadian buyer? Or alternatively, the cattle feeder loses his ability to market fed cattle to his Mexican customers? What was intended to be helpful becomes harmful; one group gets favored, while another inevitably gets punished.

Therefore, we find ourselves needing to come back to general principles. Exchange across national boundaries is a positive-sum activity; both trading partners gain else it wouldn’t occur. Any sort of intervention disrupts that premise and artificially establishes a system of winners and losers. With that in mind, and given the favorable track in recent years, handwringing about live animal trade is barking up the wrong tree.

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.