Speer: Where’s Your Focus?

The responses to my previous column covered the full gamut. For example, one message said this: “Keep up the good work! Amazing how emotion and not facts seem to drive the conversation.” But there was also this: “…your columns seem to ignore the reality that there is a problem somewhere in the market.”

Let’s zero in on that thought. The reader’s email surmised the next rebuilding phase will unfold: “The packers will keep prices relatively high, knowing the consumer will continue to pay, and keep the difference in their margin.” (For more on packers, price spreads and their contribution to retail price see Farmers’ Share: An Iffy Indicator.) The note ultimately ends by stating, “Hell, even the packers in their SEC filings acknowledge the profits in the cattle industry are beyond their own expectations.”

Those assertions all point to an overarching theme: packer versus producer. That’s a commodity mindset, and the approach positions the business as a zero-sum game. The more “they” (packer) get, the less “we” (producer) get. And it’s been repeated over and over as packer margins surged through the Tyson fire and COVID.

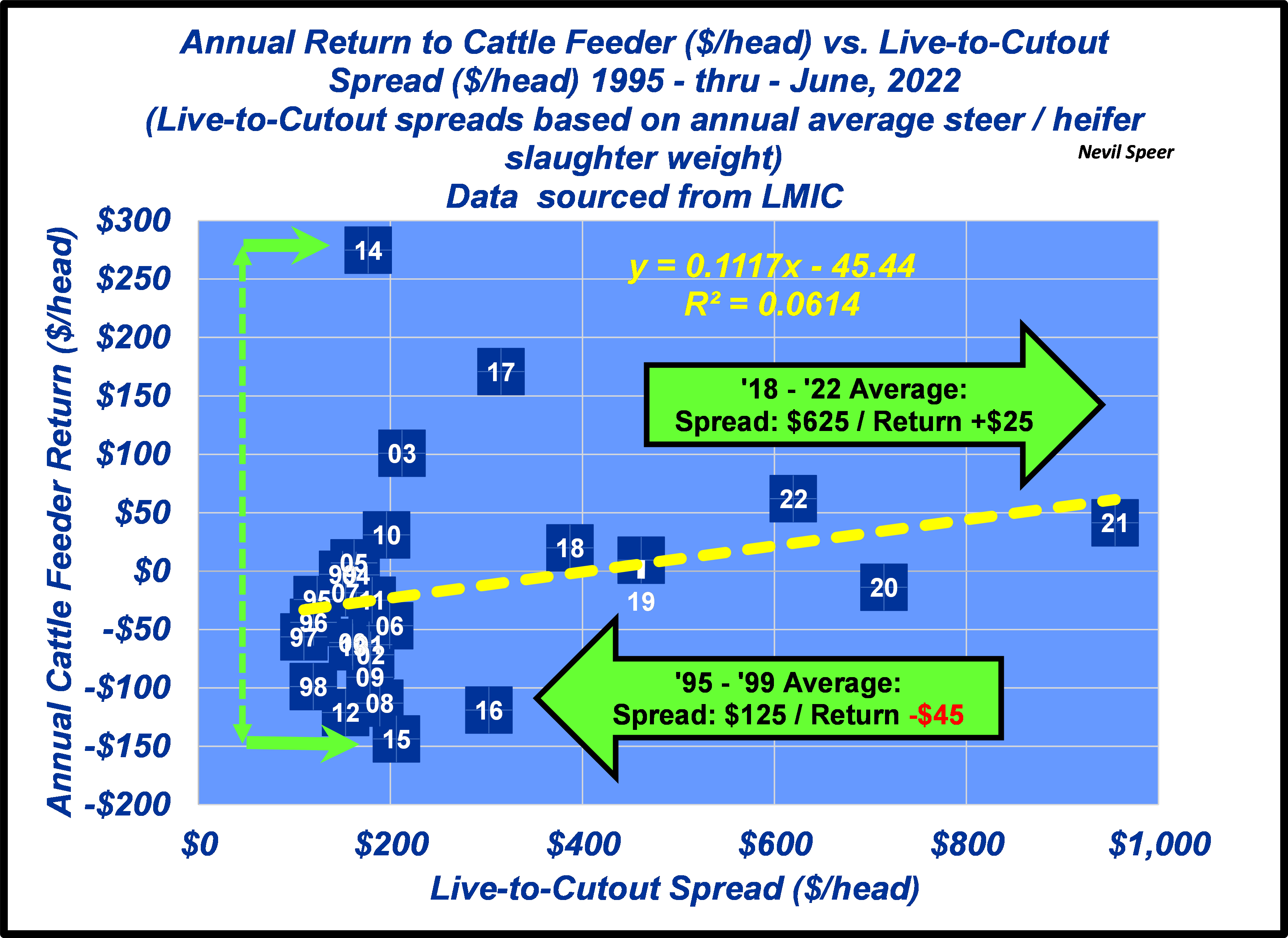

But the data doesn’t support that line-of-thinking. The first graph details annual returns to cattle feeders versus the live-to-cutout spread (packer gross margins). Data for 2022 is summarized through June. Several items are significant.

One, the relationship is positive (NOT negative); correlation does NOT imply causation, but the variables don’t trend as normally portrayed by critics. Two, the relationship is weak – only 6% of the variation in feedyard returns is explained by differences in packer margins. For instance, many pundits point to ’14-’15 as a period of quintessential market efficiency; packer margins were nearly identical, but the returns couldn’t be more different (nearly $450 apart!). Last, note the difference between the ’95-to-’99 averages versus ’18-to-’22. Packers margins were only $125 in the late-90s; that’s since surged to $625 during the last five years (therein lies the rub). BUT annual returns to cattle feeders were NEGATIVE during ’95-to-’99 and have been POSITIVE in the most recent period.

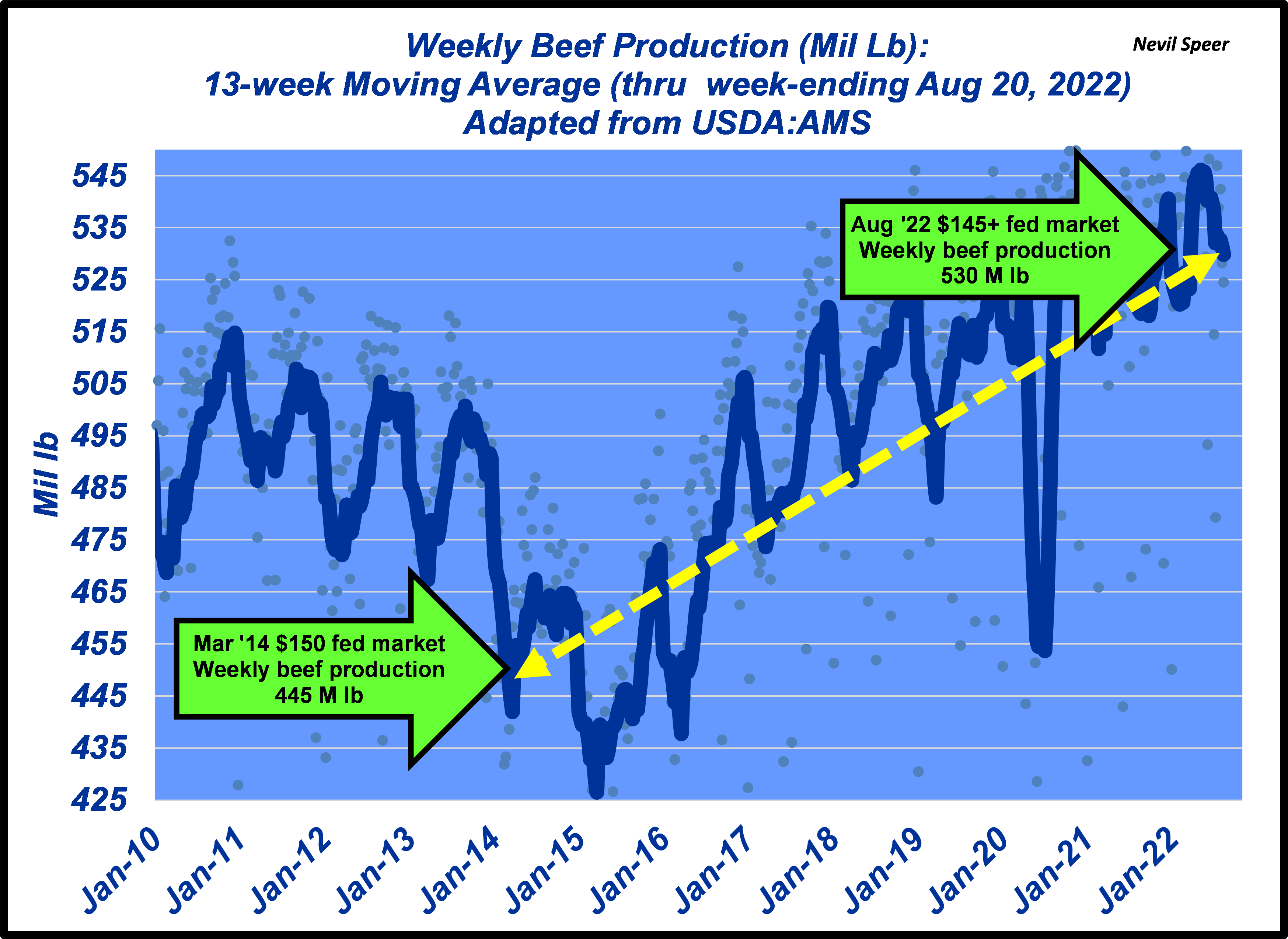

Never mind all that; what about the market itself? The reader notes, “…recent market activity means it’s not always awful, but that’s the exception that proves the rule.” That’s also not accurate. Consider the first time the fed market hit $150 was March, 2014. At that time, weekly beef production was averaging ~445 M lb; the market is now close to that same benchmark but with an additional throughput of 85 M lb!! (see second graph) That is, last time, higher prices were spurred by declining production; this time, it’s different – bigger volume AND higher prices. Broken market? Not so much.

In the end, it’s all about focus. My favorite Carl Richard’s (Behavior Gap) sketch is a simple Venn diagram. The left circle is labeled, “Things that matter”; the right one titled, “Things you can control.” The intersection is deliberately small; in that space we find instruction from Richards: “What you should focus on.” That’s a great reminder for all of us – individually and collectively – both personally and professionally.

Some want to focus their energy worrying about government regulation in hopes of scraping some margin from the packer. But that’s a hollow pursuit. The better investment is directed towards consumers and growing beef demand (per the market description above). That’s the focus that makes a difference and where opportunity happens!

Nevil Speer is an independent consultant based in Bowling Green, KY. The views and opinions expressed herein do not reflect, nor are associated with in any manner, any client or business relationship. He can be reached at nevil.speer@turkeytrack.biz.

Related articles: