Spring Wheat Bull is Driving the Bus

Market Watch with Alan Brugler and Austin Schroeder

October 15, 2021

Spring Wheat Bull is Driving the Bus

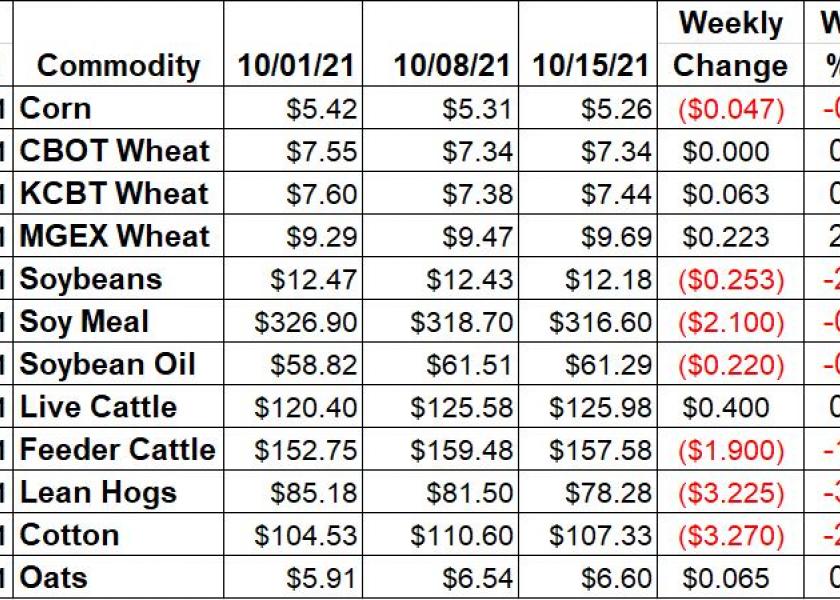

While corn and soybeans were lower this week, wheat and cattle put up some plus signs. Some things didn’t change from last week’s Market Watch. Crude oil posted new highs, with nearby futures the highest since 2014. Bitcoin futures hit the highest reading since April as US inflation remains stubbornly high at 5.4%. As we noted last week, “Clearly there are some inflationary pressures percolating, coupled with transportation snags and labor issues.” John Deere workers went on strike, joining those from Kellogg’s in complicating already screwed up logistics. USDA bumped up estimated US corn and soybean yields on Tuesday, and projects looser ending stocks/use ratios for those commodities. Projected US wheat ending stocks dropped to 580 million bushels, and world stocks are seen at only 277.18 MMT. That makes US wheat ending stocks the tightest since 2013/14, and world wheat stocks the tightest since 2015/16.

We say that spring wheat is driving the bullish bus (for grains at least) because that’s the class that will take the longest to fix. Corn and soybeans will get supplemented by South American supplies, which in the case of soybeans are larger than the US. Aussie white wheat provides alternative supply for that class before 2021 ends. Winter wheat will be harvested in the US beginning in May 2022. North American spring wheat harvest is over, and there won’t be significant quantities until September 2022. USDA’s October by class breakdown for HRS (not Other Spring) shows a stocks/use ratio for HRS of 17.05%, the tightest ever. The second closest was 2017/18.

Corn futures slipped just 4 ¾ cents per bushel this week despite December getting within 6 ¾ cents from $5 on Wednesday. A little of the pressure earlier in the week came via a USDA report with a bearish undertone. Crop Production data indicated a 0.2 bpa increase in yield from the September report to 176.5 bpa. That helped to push production over the 15 bbu mark to 15.019 bbu. Along with a larger crop and higher 20/21 carryover, WASDE reflected ending stocks jumping 92 mbu to 1.5 bbu. Per weekly Crop Progress data, corn was 41% harvested by last Sunday, 10% above the normal pace. A good portion of the US received precip this week, which may slow that a little. Weekly corn export sales dropped to 1.04 MMT for the week ending 10/07. That took the total of shipped and unshipped sales to 27.621 MMT, a 4% increase vs. last year and now 43% of the current USDA forecast. Ethanol production continues to be a dark horse for demand, as output surpassed 1 million barrels per day to of 1.032 million bpd in this week’s report. That was a 13-week high and makes a 118,000 bpd increase over the last 2 weeks. Friday’s Commitment of Traders report showed managed money spec funds slicing 22,665 contracts from their net long in corn futures and options during the week ending October 12. That took them to a net long 227,931 contracts by Tuesday.

Wheat futures had quite the ride this week, with bulls and bears each taking a spin. When all was said and done, Dec CBT wheat futures were back where they started, unch on the week. KC wheat was up just 6 ¼ cents, with MPLS the bull leader, up 2.35%. Of the major commodities in Tuesday’s report, wheat for sure had the most bullish numbers. US ending stocks were cut by 35 mbu to 580 mbu, much of which was expected with the Small Grains Summary showing lower production. A bigger surprise was a 6.04 MMT cut to the world ending stocks total to 277.18 MMT – a 5-year low. Weekly Export Sales data showed all wheat bookings up 70% from the previous week to a 4-week high of 567,600 MT. Total commitments for wheat exports are 12.114 MMT, which is now 51% of the USDA forecast vs. the 57% average pace for this date. The weekly CFTC Commitment of Traders report showed spec funds in CBT wheat swinging back to a net short position of 8,546 contracts for the week of 10/12. That was a move of 13,758 contracts as of Tuesday. In KC HRW, they sliced 1,660 contracts from their net long for the week, to 48,286 contracts.

Despite November Soybean futures hitting $11.84 ½ on Wednesday, they were only down 25 1/4 cents for the week, or 2.03% at $12.18. Much of that came on Monday and Tuesday. As for the rest of the complex, soymeal was weaker again with a 0.66% drop. Bean oil slipped 0.36%, in spite of Malaysian palm oil hitting record highs. The reasoning behind the bean selling was a bigger bear than analysts expected to come from USDA’s monthly update on Tuesday. NASS raise yield by a total of 0.9 bpa from September to 51.5 bpa, 0.5 more than was expected. That took the crop to a record 4.448 bbu, up 74 mbu from last month. That, along with a larger carryover, propelled stocks to 320 mbu, up 135 mbu mo/mo and 22 mbu above expectations. USDA’s Export Sales report indicated exporters sold 1.148 MMT of soybeans during the week of October 7. That was the second highest in the short MY. Total export commitments are now 26.390 MMT, 39% smaller than year ago. US Exporters have now booked 46% of the USDA estimate vs. the average 51% pace for this date. For this week, a total of 1.516 MMT in export sales to unknown/China was announced via daily reporting. We need more weeks like this to meet USDA’s target. Commitment of Traders data released on Friday showed spec funds in soybean futures and options cutting back their net long position by 20,385 contracts as of October 12. That dropped it to 29,068 as of Tuesday.

Live cattle futures managed to squeeze out a 0.32% gain on the week. Cash cattle trade has been steady for the last few weeks near $122 to 124 with most sales near the upper end of that range. Feeder cattle futures couldn’t keep up with October down 1.19%, though November managed a 0.17% gain. The CME feeder cattle index is $153.35, down $1.22 from the previous week. Wholesale beef prices continued their pullback this week. Choice boxes were down another $3.03 (-1.1%), with Select down $2.12/cwt (-0.8%). Weekly beef production was down 1.7% for the week and 3.6% below last year. YTD beef production is now 2.8% above year ago on 3.2% larger slaughter. Weekly Export Sales data showed 15,700 MT in beef bookings for the week ending 10/7. That was up slightly from the previous week. The weekly Commitment of Traders report saw spec funds adding back 10,312 contracts to their net long of 35,469 contracts in live cattle futures and options as of October 12.

Lean hog futures couldn’t manage to piece things back together from last week, as Dec fell another 3.96% on the week. The CME Lean Hog index fell $3.77 to $88.82 as of 10/13. The pork carcass cutout value was down $5.67, or 5.3%, this week to $101.32. Hams continue their unwind, this time joined by butts, as each were 17% and 13.5% weaker this week respectively. Weekly pork production was up 1.8% from the previous week, and 4% lower vs. the same but COVID distorted week in 2020. The YTD pork production is 2.0% smaller YTD vs. last year. Weekly pork export sales for the week ending 10/7 were up 51% from the previous week at 33,500 MT. China was again missing from the top buyers, coming in a distant 3rd with 4,300 MT in sales. Spec funds trimmed back their large net long position in lean hog futures and options by 6,514 contracts as of Tuesday. According to Commitment of Traders data their net long position was 68,632 contracts on 10/12.

Cotton futures rallied to the highest prices since 2011, but closed 3% lower for the week. USDA gave bulls a little ammunition on Tuesday, with a 24 lb cut to yield at 871 lbs/ac. That took production down 510,000 bales to 18 million, and helped push ending stocks down the same amount to 3.2 million bales Export bookings slowed from 246,700 RB of upland cotton to 146,700 RB sold in the week ending 10/7. Shipments fell to a multi-year low 95,164 RB in that week. Exporters have now sold 52% of the USDA projected total, now 4% behind the average pace. USDA’s weekly Cotton Market Review noted 12,723 bales were sold at spot through the week that ended 10/14 at an average price of 104.35 cents. The week’s AWP for cotton was raised 1.07 cents to 92.88 cents/lb. Friday’s Commitment of Traders report showed managed money spec funds trimming back their net long in cotton futures and options by 9.298 contracts for the week of 10/12. They were net long 87,445 contracts on Tuesday. The mills have a lot of On Call sales to price, and the funds know it.

Market Watch

Next week’s schedule has a little more of a normal tone to it. We start Monday with the Export Inspections report from USDA in the morning and the Crop Progress report in the afternoon. Fast forward to Wednesday and EIA will put out ethanol production and stocks data. On Thursday FAS will release their weekly Export Sales report. Friday will be a busy report day for livestock, as both Cattle on Feed and Cold storage data will be released. We also have expiring options for November soybeans and November serial options for corn, wheat, soy mean and soy oil on Friday.

Visit our Brugler web site at https://www.bruglermarketing.com or call 402-697-3623 for more information on our consulting and advisory services for farm family enterprises and agribusinesses.

There is a risk of loss in futures and options trading. Similar risks exist for cash commodity producers. Past performance is not necessarily indicative of future results.

Copyright 2021 Brugler Marketing & Management, LLC. All rights reserved.