Volatility and Opportunity

|

|

|

Crop Insurance2023 U.S. crop insurance price discovery results

South American Crop Estimates Dr. Cordonnier lowered production estimates in Argentina and Brazil.

Black Sea Grain Deal

Outside Markets

|

|

|

|

Corn Managed Money Position Updated each Friday with the weekly CoT Report

Seasonal Trend in Play

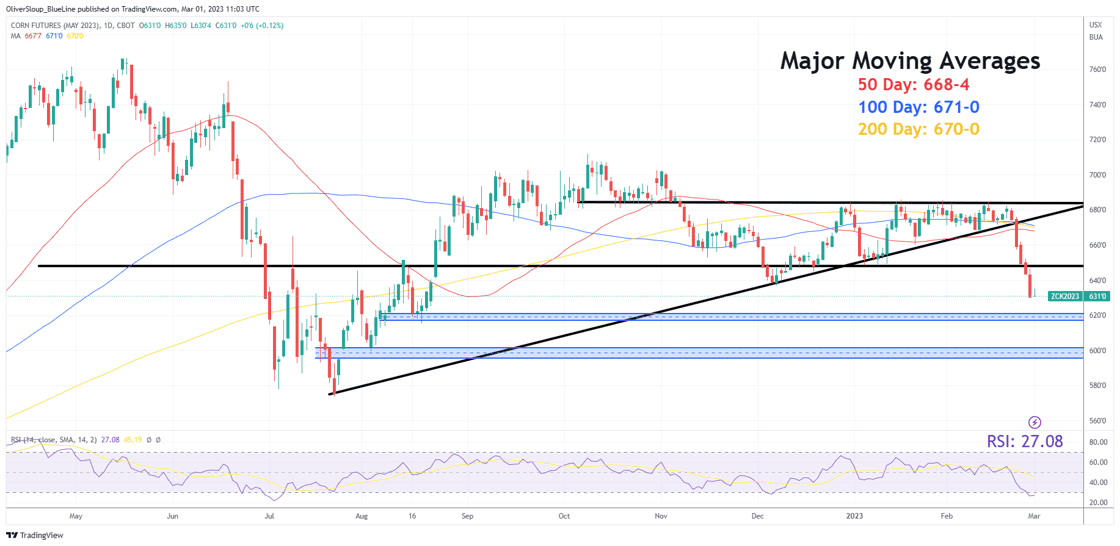

Technicals (May)

Bias: Bearish/Neutral Previous Session Bias: Bearish/Neutral Resistance: 647 1/4-652 3/4****, 668 1/2-671 3/4** Pivot: 636 3/4 Support: 615 1/4-619 1/4**, 595 1/4-599 1/2**** |

|

|

|

|

Soybeans Managed Money Position Updated each Friday with the weekly CoT Report

Seasonal Trend in Play

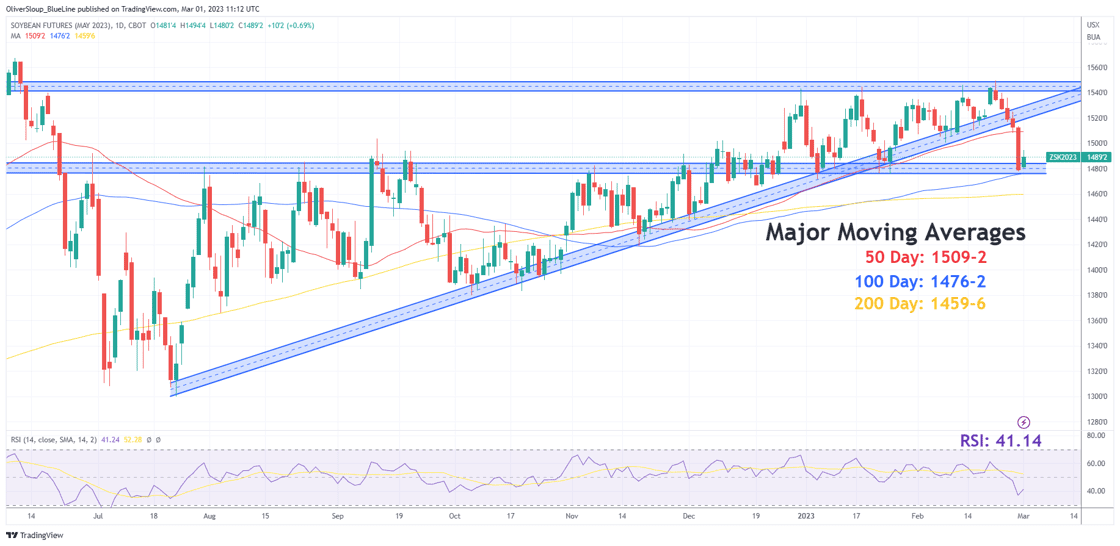

Technicals (May)

Bias: Neutral Previous Session Bias: Bearish/Neutral Resistance: 1507-1512****, 1522-1530*** Support: 1472-1476****, 1459 3/4** |

|

|

|

|

Wheat Managed Money Position Updated each Friday with the weekly CoT Report

Seasonal Trend

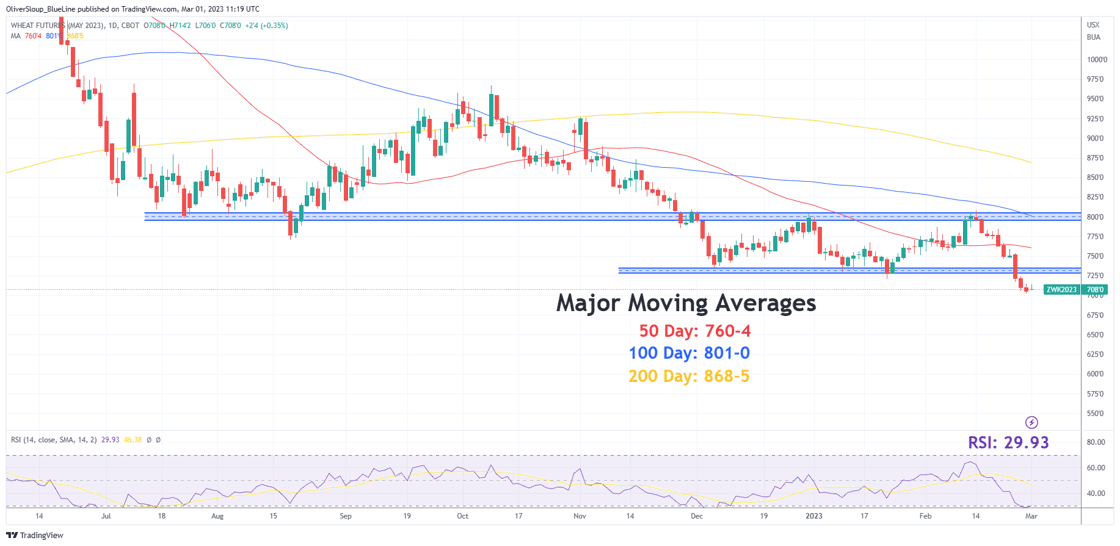

Technicals (May)

Bias: Neutral Previous Session Bias: Neutral Resistance: 797-807***, 822 1/4-829*** Pivot: 730-735 Support: 690-700*** |

|

|

|

|

Our daily commodity commentary covers the fundamentals and technicals for: Grains, Livestock, Energies, Metals, and More! Pick and choose the reports you want!https://www.bluelinefutures.com/free-trialIf you have any questions about markets, trading, or opening an account You can email us at info@BlueLineFutures.com or call 312-278-0500 Futures trading involves a substantial risk of loss and may not be suitable for all investors. Trading advice is based on information taken from trade and statistical services and other sources Blue Line Futures, LLC believes are reliable. We do not guarantee that such information is accurate or complete, and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder. Past performance is not necessarily indicative of future results.

|