All Eyes on South America: Did USDA Trim Production Enough

Dryness in South American prompted USDA to cut production estimates for key countries, such as Brazil, Argentina. The cuts were more aggressive than most analysts expected, says Joe Vaclavik, Standard Grain President.

Here are the current estimates:

Soybeans:

- Brazil production: 139 MMT, down from 144 MMT estimate in December, but up 1 MMT from last season’s record crop.

- Argentina production: 46.5 MMT, down from 49.5 MMT estimate in December, but up less than 1% from last year.

Corn:

- Brazil production: 115 MMT, down from 118 MMT estimate in December, but larger than last year’s crop by 28 MMT.

- Argentina production: 54 MMT, down from 54.5 MMT estimate in December

“Those were big cuts from USDA, but it’s not surprising that they didn't go any lower than that,” says Brian Grete, editor of Pro Farmer. “They typically slow walk those numbers, whether it's an increase or decrease.”

Listen in as Grete discusses the USDA reports on AgriTalk with host Chip Flory:

Even with the lower production numbers, Grete says, most private firms are calling for even lower corn production.

“Many of them are in the 112 MMT to 113MMT range right now,” he says. “Remember that the first corn crop, which is damaged, only accounts for about a quarter of Brazil’s production. The Safrinha crop accounts for three-quarters and it won't be planted until after the soybeans are harvested.”

As such, if the weather pattern does change the majority of the Brazilian corn crop could create much higher yields.

“So, I don't think you can get too aggressive to the downside on the Brazilian corn at this point,” Grete says. “I do think there's more downside risk in soybeans.”

South American Drought

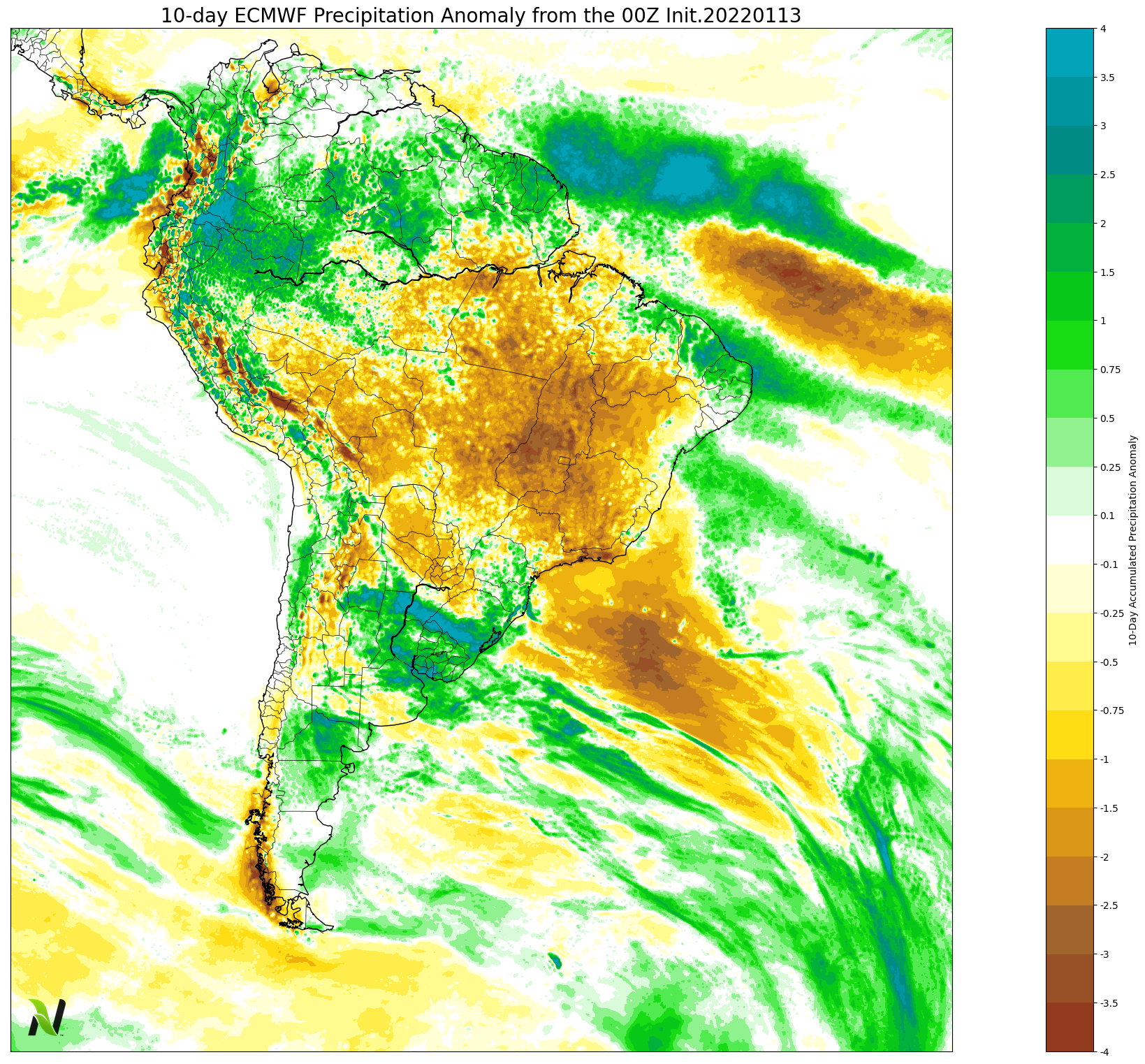

Very hot and dry conditions persist this week for southern Brazil and Argentina, reports Eric Snodgrass, principal atmospheric scientist with Nutrien Ag Solutions.

“Models continue to produce a cold front that will deliver storms (possibly severe) from Argentina through Rio Grande Do Sul and Uruguay late this weekend into early next week,” he says. “The heaviest rains are forecast for northern Argentina to Rio Grande Do Sul and Uruguay.”

Weather models, Snodgrass says, have been consistent in showing a drying trend for Brazil's northern and eastern growing regions, which includes Mato Grosso, over the next 10 days.

“This will allow for more rapid harvest progress and planting of the Safrinha crop,” he says.

Markets Shift Focus

With USDA’s big round of reports behind us, the market’s focus will shift, Flory says.

“South American weather is absolutely going to dominate this bean market and the corn market for the near term,” he says. “Then I'm going to say U.S. weather is the next focus — even ahead of demand.”

Read More USDA Report Coverage

USDA's Final 2021 Crop Production Numbers Are In, Here's What You Should Know

USDA’s January Reports Reveal Hay Stocks Hit a 10-Year Low in December