How Will A Surge in Bio-Based Fuels Impact Grain Demand?

Future of Renewable Fuels 021822

The dramatic development of the U.S. renewable diesel industry is similar to how ethanol changed the U.S. corn industry from 2007 to 2010. But renewable diesel and Sustainable Aviation Fuel (SAF) could be more disruptive.

“Lifechanging is how I describe the potential,” says Chip Flory, host of “AgriTalk and Farm Journal Economist.

Chip Flory moderated a session with Dan Basse, AgResource Company, Stephen Nicholson, Rabo AgriFinance, Pete Meyer, S&P Global Platts during the Top Producer Summit in Nashville. You can still register for the Online Top Producer Summit, which gives you access to content through March 31. Use the code “VIRTUAL” to take 50% off your registration fee.

While it is a cousin of biodiesel, the two fuels are not the same. Renewable diesel, which is produced by processing fats and vegetable oils, is chemically the same as petroleum diesel and has nearly identical performance characteristics. Plus, it is 100% fuel, removing the need for blending it with diesel.

Similarly, SAF is a non-petroleum jet fuel that is made from products such as cooking oil, vegetable oil and even soybean oil.

Infrastructure is on its way and policy makers are putting their support behind these “green” fuels. So, what does it mean for American farmers?

“Based on projections, total supplies of edible fats and oils in the U.S. will need to double over the next decade to meet the feedstock needs of the renewable diesel industry,” says Stephen Nicholson, Rabo AgriFinance global analyst for grains and oilseeds. “Feedstock from waste oils, tallow or vegetable oils is limited, so it’s likely large volumes of vegetable oils will be used. This should create consistent high demand for oilseeds.”

As a result, nearly $2.6 billion will be invested in North America crushing assets within the next three years, Nicholson says.

“This creates a new local demand, and we’re seeing that crush stay here,” says Jackson Takach, chief economist with Farmer Mac.

Announcements for new crush plants are rolling out every week. If the locations on this map, which are being constructed or are in progress, all make it to production, they’ll add about 400 million bushels of domestic soybean demand by the start of 2025.

As crush facilities come online, demand could push soybean acres to 95 million and add an extra $1.50 to $2 to every bushel.

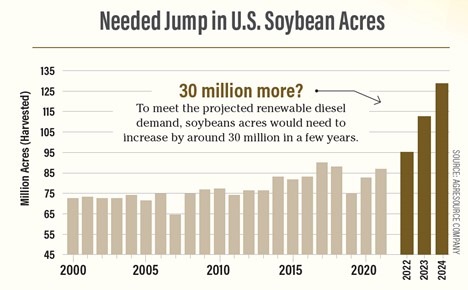

“We are calling for 90.5 million soybean acres in 2022 versus this year’s 87 million, and that just gets us started in meeting renewable diesel demand,” says Dan Basse, president of AgResource Company. “Then we’d need to increase soybean acres by 5 million to 7 million each year. We have to top 120 million acres of soybeans to meet the growing demand for renewable diesel.”

Even with increasing crush and soybean acres, sourcing enough oil and fat is likely going to be a challenge.

“You’ll probably run out of feedstocks by 2025 for Renewable diesel — that’s a problem,” says Pete Meyer, head of grain and oilseed analytics, S&P Global Platts.

By then 70% of the feedstock will have to come from vegetable oil — from soybeans, canola or even camelina.

“Camelina is a non-food oilseed that can be grown as a cover crop,” Meyer says.

ExxonMobil recently announced it is investing $125 million with Global Clean Energy Holdings to grow its proprietary camelina business in key farming regions in the U.S., as well as expand in Europe and South America.

“They’ve contracted over 100,000 acres west of Nebraska and as far north as Montana,” Meyer says. “They claim with this new money from ExxonMobil, they plan to plant on 8 million to 9 million acres.”

One bushel of soybeans creates, on average, 10.7 lb. of crude soy oil and 47.5 lb. of soybean meal.

“As this market develops, I’m guessing many will wish those were reversed,” Basse says. “Meal could become a byproduct that really drags down the price of soybeans. While at the same point, soybean oil could go to crazy levels like 90 cents or $1.”

While the impact of bio-based fuels could be similar in impact to ethanol, the comparison stops there, Flory says.

“Additional demand for vegetable oil is kind of off the charts,” he says. “It’s not like 2005-06 with ethanol — that market was developing on a mandate. Renewable diesel and SAF are developing on actual demand.”

How will these impacts be felt at the farmgate?

“Better bean prices and better basis prices for those near crush plants,” Nicholson says.

Flory agrees: “Soybeans from the 2023 crop will be in much higher demand to feed new capacity and the 2024 soybean crop will be expected to supply roughly 400 million bushels of crush capacity. All this means one thing – soybeans will be bidding more aggressive for acres in the U.S. in the next three years to feed crush expansion. Longer-term, demand for even more fuel feed stock will keep soybeans bidding for acres. This could be the rising tide that will lift all boats.”

Read More

Fuel the Crush: Renewable Diesel Pumps Up Soybean Demand

Read, watch and listen to more insights about renewable diesel.