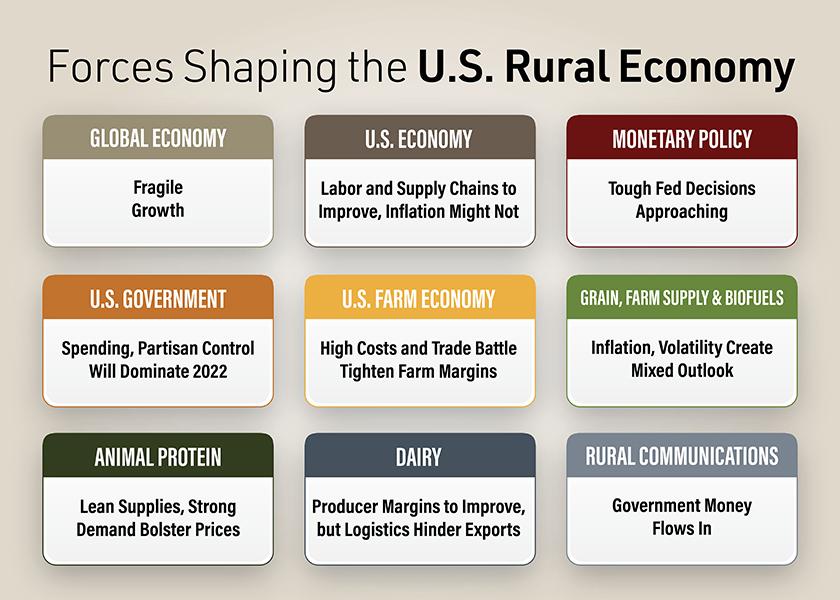

9 Forces Shaping the U.S. Rural Economy in 2022

With 2021 winding down, now is a perfect time to reflect on the past year and make expectations for the year ahead. Despite COVID-19 variants, inflationary pressures and supply chain limitations, consumers will continue to power the economic rebound, according to a comprehensive year-ahead outlook report from CoBank’s Knowledge Exchange.

“2021 was the best year for overall farm incomes since 2013,” says Rob Fox, director of CoBank’s Knowledge Exchange. “As we look into 2022, there are several things that have changed, creating a lot of headwinds. But, in the grand scheme of things, farmers should still be mildly profitable in 2022.”

Fox says the headwinds include widespread higher input costs, including fertilizer, fuel, chemicals, equipment, labor, etc.

The good news is commodity prices are still high versus historic levels, he says. The market strength is being driven by fundamental factors.

“If you look at each and every commodity market, stock levels are tight everywhere and the demand is strong,” he says. “Plus, the economy is doing pretty well all over the world, particularly the U.S. and the more developed countries.”

Listen in as Fox discusses the report with Clinton Griffiths on AgriTalk:

The CoBank report examines several key factors shaping agriculture and U.S. rural economies:

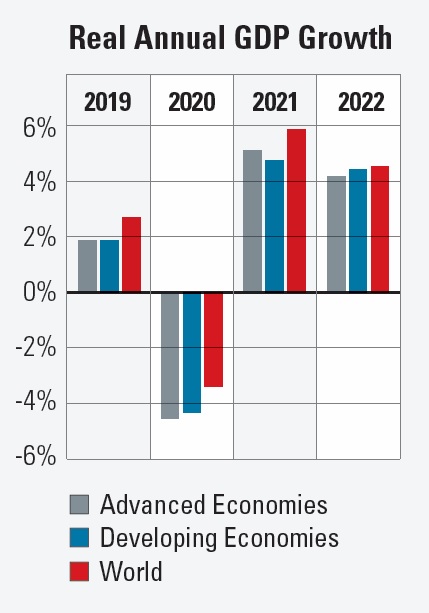

1. Global Economy: Fragile Growth

In 2021, the global economy significantly rebounded from the extreme headwinds of 2020. But for it to perform well in 2022, it will have to over three major issues, says Dan Kowalski, vice president of CoBank’s Knowledge Exchange division. Those include:

- A persistent pandemic

- Monetary tightening in the U.S.

- Slowing growth in China.

“As we enter the third year of the pandemic, the COVID-19 virus is still in control of the world economy, and it will likely remain so through much of the first half of the year,” he says. The ongoing threat of virus mutations that could evade vaccines will keep economic uncertainty unusually high.”

Nevertheless, Kowalski says strong consumer demand throughout much of the developed world will keep the economy humming. As a result, CoBank projects 4.5% global in 2022.

Source: Federal Open Market Committee, September 2021 median projections

2. U.S. Economy: Labor and Supply Chains to Improve, Inflation Might Not

The pandemic has significantly altered how our economy functions, with the greatest impact coming from what we consume, Kowalski says. Through October, in 2021 Americans spent 18% more on goods and about 1% less on services than they did in 2019.

Compounded by a labor shortage, it is easy to see why supply chains have become one of the biggest economic challenges of the pandemic — demand has significantly exceeded the capacity of our existing system. For most consumers and businesses, a key focus in 2022 will be tackling the effects of inflation. Operating and input costs will remain high for businesses in early 2022, and they will continue to look for ways to pass on those costs to consumers.

3. Monetary Policy: Tough Fed Decisions Approaching

The coming year will hold perhaps some of the most challenging monetary decisions that the Federal Reserve has faced in over a decade, Kowalski says. Chair Powell has acknowledged inflation could remain elevated well into 2022, and the Fed is now expected to accelerate the tapering of its monthly securities purchases.

The Fed will want to extend the economic recovery as long as possible before raising interest rates, Kowalski expects. But it will also be cognizant that the longer inflation remains elevated the higher the likelihood that it leads to a perpetuating cycle of higher prices and higher wages.

4. U.S. Government: Spending, Partisan Control Will Dominate 2022

COVID-19 has lingered far longer than everyone hoped and continues to cast a long shadow on Capitol Hill, says Brian Cavey, senior vice president or government affairs for CoBank. Both the House and Senate agriculture committees plan oversight hearings in 2022 to begin the farm bill planning for 2023. While that is important and timely work, he says, the widely expected change in partisan control of Congress following the 2022 elections may render much of that work perfunctory.

5. U.S. Farm Economy: High Costs and Trade Battle Tighten Farm Margins

The U.S. farm economy will continue to struggle with the ongoing supply chain dysfunction and cost inflation issues that emerged in the summer of 2021, Fox says.

Historically strong prices will be more than offset by increases in cost structure for nearly all crops. CoBank economists do not anticipate any significant pullback in farm-level costs until Q3, at the earliest.

6. Grain, Farm Supply and Biofuels – Inflation, Volatility Create Mixed Outlook

The grain, farm supply and biofuels sectors enter 2022 facing a mixture of inflationary headwinds, supply chain bottlenecks and high-energy prices that present challenges — but also a few opportunities, says Kenneth Scott Zuckerberg, CoBank’s lead economist for grain and farm supply.

CoBank economists view the short-term outlook as mixed for grain, challenging for farm supply and positive for biofuels. Biofuels enter 2022 with considerable momentum as the fuel ethanol complex is revving on all cylinders driven by strong consumer demand and higher gasoline and fuel ethanol prices. Beyond ethanol, 2022 should see the continued build-out of soybean crushing and soy oil refining capacity to support the expected growth in renewable diesel.

7. Animal Protein – Lean Supplies, Strong Demand Bolster Prices

The Bureau of Labor and Statistics’ Consumer Price Index for all meats, poultry fish, and eggs hit an all-time high in October, up 12% year-over-year. As restaurant and grocery prices adjust, consumer-level meat inflation is likely to continue well into the new year, says Brian Earnest, CoBank’s lead economist for animal protein.

While higher retail prices could limit consumption growth, tighter cattle supplies, ongoing broiler breeder issues and sow herd reductions should support favorable processor margins through at least the first half of 2022. Although beef exports have been robust during the second half of 2021, the collective U.S. protein opportunity to China may have already peaked.

8. Dairy – Producer Margins to Improve, but Logistics Hinder Exports

Milk supplies in the U.S. and around the world will tighten in 2022 as dairy farmers reduce herd sizes in response to cost inflation pressures, says Tanner Ehmke, CoBank’s lead economist for dairy and specialty crops. The cross current of resilient domestic and global demand for dairy products with the slowing growth in milk supplies will give an upward lift to milk prices in 2022. Combined with softer feed costs following big corn and soybean harvests, producer margins will finally improve.

However, he says, high costs for labor, construction, and freight will limit upside margin potential and dampen milk production growth. For dairy processors, tighter availability of milk will mean some processors get squeezed.

9. Rural Communications – Government Money Flows In

With bipartisan support to bridge the digital divide, the government funding flood gates are expected to open in 2022, says Jeff Johnston, CoBank’s lead economist for communications. The Infrastructure Investment and Jobs Act includes $65 billion in broadband funding, of which $42.5 billion will be allocated to the states to build networks in unserved and underserved areas.

Cable operators have enjoyed robust broadband subscriber growth over the last several years due to consumer trends and limited competition from the telecommunication companies. But competition should start to heat up in 2022.

Read the full report, 2022 The Year Ahead: Forces That Will Shape the U.S. Rural Economy.