Chip Flory: The Upside for The Corn Market

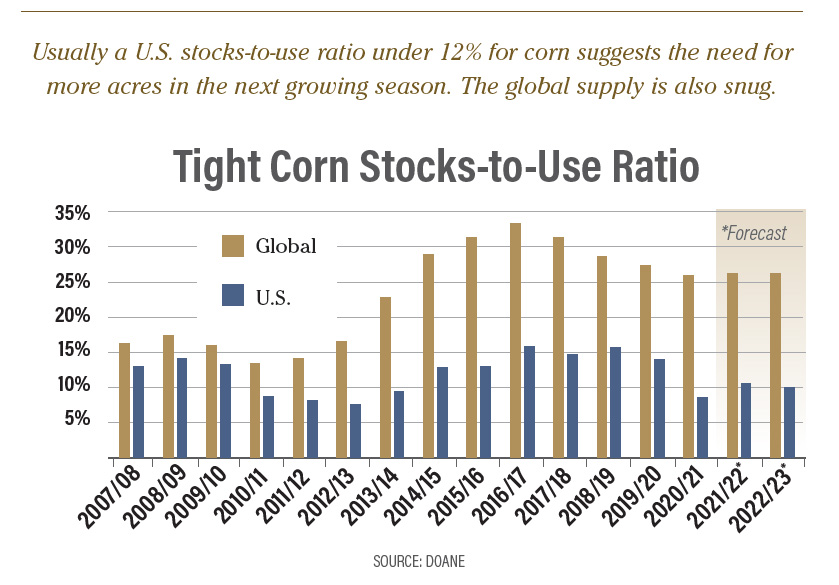

Corn supplies are likely to remain tight enough for long enough to limit downside price risk through spring 2023. The trend in corn’s stocks-to-use ratio tells the story, just look at the chart below.

For 2022/23, the U.S. corn stocks-to-use ratio sits at 9.6%. Traditionally, a ratio under 12% suggests the need for more acres in the next growing season — and maintaining a high-enough price (and a positive margin) is what it takes to keep any crop in play for more acres in the next growing season.

STRONG GLOBAL FUNDAMENTALS

Corn’s global fundamentals add support for positive margins. The 2022/23 global stocks-to-use is a snug 26%. Even with tight supplies, global use is expected to decline 15 million metric tons (MMT), and stocks are expected to be down 5.16 MMT from 2021/22. Drought in Europe and uncertainty about Ukrainian production will likely further tighten global corn supplies.

In the U.S., animal numbers are contracting, and U.S. feed and residual use is expected to be down 275 million bushels from last year. Food, seed and industrial use is expected to increase 30 million bushels, but exports are projected to drop 75 million bushels from the 2021/22 marketing year.

Domestic use in 2022/23 is expected to be up 75 million bushels from 2020/21 due to a recovery in ethanol production. But corn exports this year are estimated to be 372 million bushels below two years ago.

Brazil’s short crop in 2020/21 increased demand for U.S. corn that year, but a crop recovery has turned importers back to South America. For 2022/23, less supply from Europe and Ukraine could make USDA’s 2.375-billion-bushel corn export forecast too conservative.

WHEN PRICE MATTERS

But price does matter to end users. The national average on-farm corn price in 2020/21 was $4.53. It is estimated at $5.95 for 2021/22 and $6.65 for 2022/23. Input costs have absorbed a chunk of the $2 gain, but these elevated prices are likely to stay as incentive to increase acres and the supply-side of the balance sheet.

Soybeans will also compete for acres, as the stocks-to-use ratio is projected at a tight 5.4% in 2022/23. Total sup-plies are inching higher, but use has been amazingly resilient in the face of a $3.50 rise in the national average price from two years ago.

The lack of a supply cushion in soybeans ups the odds that this period of price strength will ex-tend to 2023/24.