4 Charts to Analyze from the 2021 FAPRI Baseline

Taking the long view in agriculture can provide guidance for decisions you make on your farm today. While the COVID-19 pandemic turned nearly everything on its head in 2020, many agricultural commodities have dramatically improved.

The outlook is uncertain, but certainly more optimistic than it was a few months ago, according to the 2021 U.S. Baseline Outlook report compiled by Food and Agricultural Policy Research Institute (FAPRI) at the University of Missouri.

Of course, commodity markets and economic metrics will be volatile in the next decade. This report is based on models to develop a range of more than 500 market outcomes, prices, quantities and values.

Here are four key data sets and projections that give insights into the outlook:

Source: 2021 FAPRI U.S. Agricultural Market Outlook

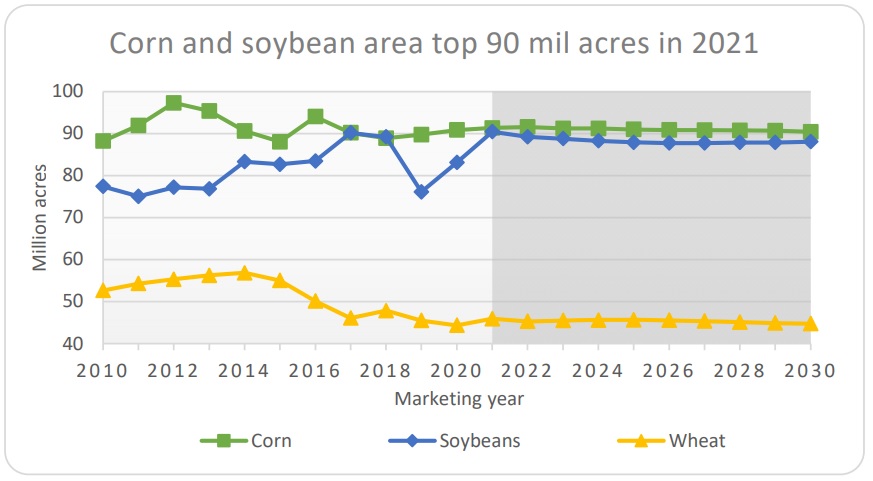

For 2021, FAPRI estimates U.S. farmers will plant 91.3 million acres of corn and 90.4 million acres of soybeans. This is based on higher prices and more normal weather, says Pat Westhoff, director of FAPRI.

Considering 12 major field crops and hay, total projected area devoted to crop production is about the same in 2021 as in 2018.

In the future, major crop prices retreat from recent peaks, but remain above the prices of 2015-2019. For the crop to be harvested in the fall of 2021, projected corn prices average $4.06 per bushel and soybeans average $10.61 per bushel.

Source: 2021 FAPRI U.S. Agricultural Market Outlook

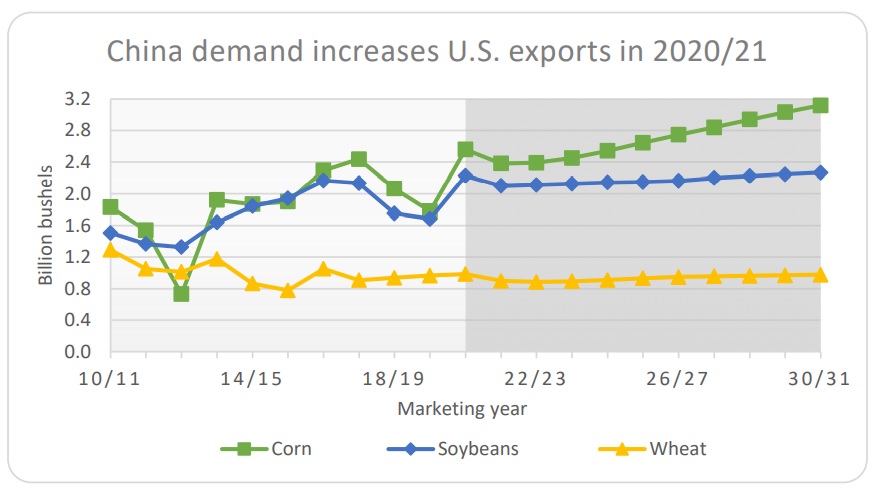

Increased imports by China are behind much of the recent strength in grain and oilseed markets. “Instead of falling with high prices, exports have actually increased,” Westhoff says.

If China’s purchases continue at the recent pace, U.S. exports and market prices could be higher than projected here, but there is downside risk. Trade disputes, the impact of African swine fever (ASF) on pork production in China and strong competition from other exporters limited U.S. corn and soybean exports in 2018/19 and 2019/20, FAPRI notes.

Source: 2021 FAPRI U.S. Agricultural Market Outlook

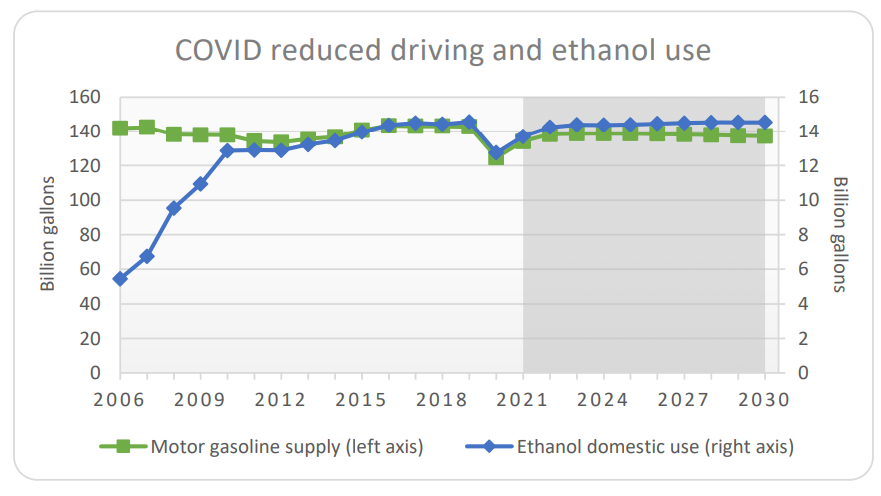

People drove less in 2020 because of the pandemic and associated responses, reducing demand for gasoline and ethanol. While domestic use of gasoline and ethanol are expected to increase in 2021, they remain below previous years.

Looking ahead, he says, more normal driving patterns could result in greater use of ethanol, as could more adoption of E-15 and E-85.

“We never get gasoline use up to levels seen in 2019,” Weshtoff says. “Part of that is because of more fuel-efficient cars and the advent of more electric vehicles. If we were to have more adoption of electric cars more quickly, the green line will trail off over time.”

Source: 2021 FAPRI U.S. Agricultural Market Outlook

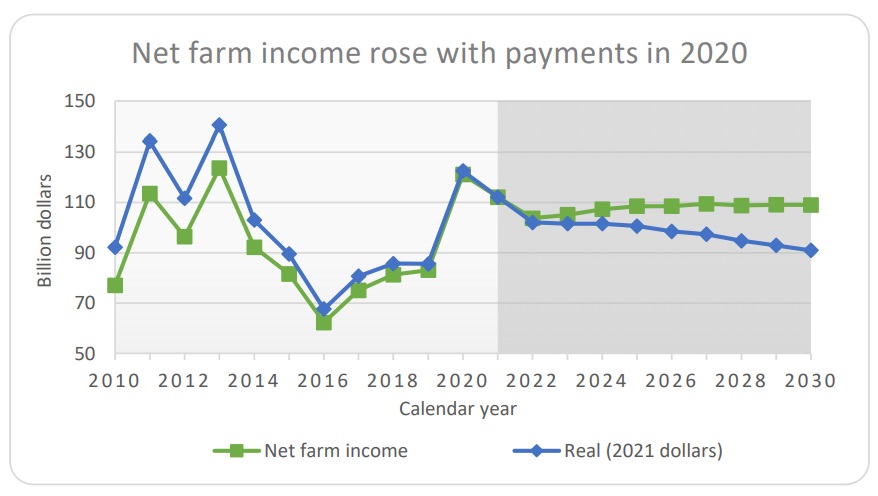

USDA reports that 2020 net farm income was $121 billion, up sharply from the previous year, primarily because of the $46 billion in government payments.

“The combination of incredibly high government payments plus much higher prices for crops at the end of the year lead to a far higher number than had been anticipated previously,” Westhoff says. “It will not be far from $123 billion record that was set back in 2013.”

FAPRI calls for net farm income to drop to $112 billion in 2021, in spite of a $25 billion increase in crop and livestock receipts. Reduced government payments and higher production costs explain the drop in net farm income.

Even with the decline, net farm income in the future looks to be above the levels from 2015 to 2019, Westhoff says.

Other highlights from the 2021 FAPRI Outlook:

- Average prices for livestock and poultry increase in 2021 as the sector returns to more normal operating conditions after the plant closures and other disruptions of 2020.

- Crop insurance and the price loss coverage (PLC) program account for most projected support to the farm sector. These programs provide far less support than the market facilitation program (MFP), the coronavirus food assistance program (CFAP) and the paycheck protection program (PPP) provided in 2020.

- Higher levels of net farm income support an increase in land and farm asset values in 2021. The result is the first slight dip in the farm debt-to-asset ratio since 2012. In later years, declining real net farm income and an eventual increase in interest rates put pressure on asset values and cause the debt-to-asset ratio to resume its increase.

Read FAPRI’s 2021 U.S. Agricultural Market Outlook

Watch a webinar with Westhoff highlighting the key numbers from the 2021 outlook: