Strong Crop Prices: Supply-Driven Spike or a New Super Cycle?

Given stubborn demand, the answer hangs on 2021 crops

The current strength in grains and oilseeds may have started with weather-related crop issues last year, which affected corn, soybeans, wheat, barley, palm oil, sunseed and rapeseed in important growing areas in the United States, South America, Europe and Asia. But it is unrelenting demand that has sustained the drive, Stefan Vogel, global strategist for grain and oilseeds at Rabobank, told partners of the agri benchmark network on June 7.

Three areas of demand, he says, are showing stubborn growth despite strong prices:

- U.S. domestic use of corn for ethanol (after a dip in 2020/21, 2021/22 is expected to exceed that of 2019/20).

- Growing interest in biodiesel in Malaysia, Indonesia, Europe and the United States.

- China’s unprecedented feed grain imports.

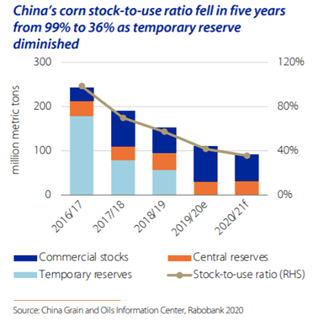

China’s corn stock-to-use ratio fell from an estimated 99% to 36% in five years, as the government shrank its temporary reserves. Rapid recovery of commercial hog production following the African Swine fever outbreak promises continued strong feed demand. As the hog recovery is a multi-year process and China’s grain production is difficult to scale quickly, high feed grain imports, as well as continued rising soybean imports, over the next years are to be expected.

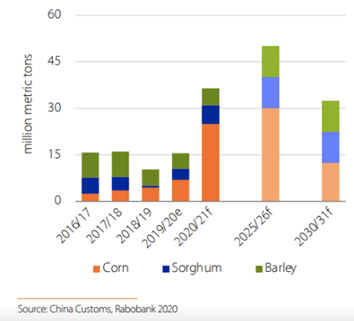

Chinese Feed Grain Imports from All Sources

Walking a Tightrope

Globally, corn is in its fourth year of deficit and won’t replenish much in 2021, he pointed out, observing that as of mid-June, 35-40% of U.S. corn acreage was in regions affected by some level of drought.

“We now have multi-year low inventories of multiple commodities in key export countries, including the United States,” Vogel says, noting that U.S. inventories of corn, wheat and soybeans are at seven-year lows. “Add production risk, difficult-to-ration demand and fund interest in these commodities and we can expect elevated, and volatile, prices well into 2022.”

Recent high-price periods lasted one to two years (2004 and 2008) or three to four years (2011-14), he points out. Should crops disappoint in 2021, prices likely would soar to all-time highs and remain elevated for three to four years, according to Vogel. Normal global crops in 2021 would provide cooling off of prices, but concern would carry over into 2022. Perfect global production this year would pressure prices, but even then, not to the levels seen in 2015-19. Time will tell.