Jerry Gulke: May WASDE a Real Game Changer for Corn and Soybeans

The May WASDE Report was a game changer. It confirmed the bearish reset of the corn and soybean markets as they transition from tight drought stricken old crop supplies to record production levels in 2023-24. That’s according to Jerry Gulke, president of the Gulke Group.

With record yield and production, USDA bumped up corn ending stocks to 2.22 billion bushels. That’s up 805 million bushels from last year’s drought-stricken crop and one of the biggest transitions between two crop years in history. Gulke says it was expected, but it was more aggressive than he thought the agency would go this early in the season. How did the agency get there? They didn’t change feed or residual, but they did increase exports.

Gulke thinks USDA was being generous increasing corn export demand by 200 million bushels, but if they didn’t do that the carryout would have been closer to 2.5 billion bushels.

“I use the analogy that if you're going to have cheap grain, you're going to sell more because you're more competitive,” Gulke says. “We've talked about this for months, and you’re not real competitive at $7 but you might be at $5.”

Nonetheless, it verifies the large new crop production potential and the lower prices needed for the U.S. to be competitive in the global market. While prices held up after the report, he says it implies lower prices ahead. The U.S. either needs a significant increase in corn demand, a serious weather problem or a black swan event to support prices at these levels.

Looking at a long-term December corn chart, the market took out long-term support of $5.50 before the report. Now Gulke says it looks like it will test the $4.50 to $5 level.

For soybeans, the jump between old and new crop is tighter, but USDA is still forecasting record production and higher ending stocks at 335 million bushels, which is up 130 million bushels from last year. That figure came not just from higher production but also increased competition from South America and a 40 million bushel cut in exports.

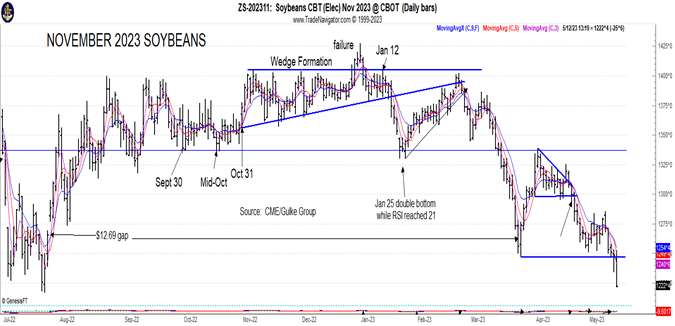

Gulke says that implies sub-$12 prices for soybeans. The November soybean chart is currently holding at $12, but he says it might have to test the $11.70 breakout area before finding a price that attracts demand.

“I think we can go down to $11.70 pretty easy,” he adds. “I'm not so sure that we don't need to go down to $10.50.”

When you look at past years with carryout at this level, Gulke says prices were lower and the U.S. didn’t have competition like this from South America.

The bullish surprise of the report was winter wheat production. USDA’s initial winter wheat crop estimate was up only 26 million bushels from last year and 100 million bushels fewer than traders expected. USDA estimates harvested area at 25.286 million acres, due to higher-than-average abandonment. Gulke says small crops generally get smaller as harvest confirms lower yields and because USDA did not adjust spring wheat production. As a result, he thinks prices will be well supported.

“The theory behind price discovery is that if I need more bushels of premium wheat, who's left to support it? I either import from Ukraine or Russia or I get my friends in North Dakota to continue to plant even beyond what would be reasonable,” he explains.