Everything’s Bigger in Brazil: The Country Is Poised To Set A Grain Production Record

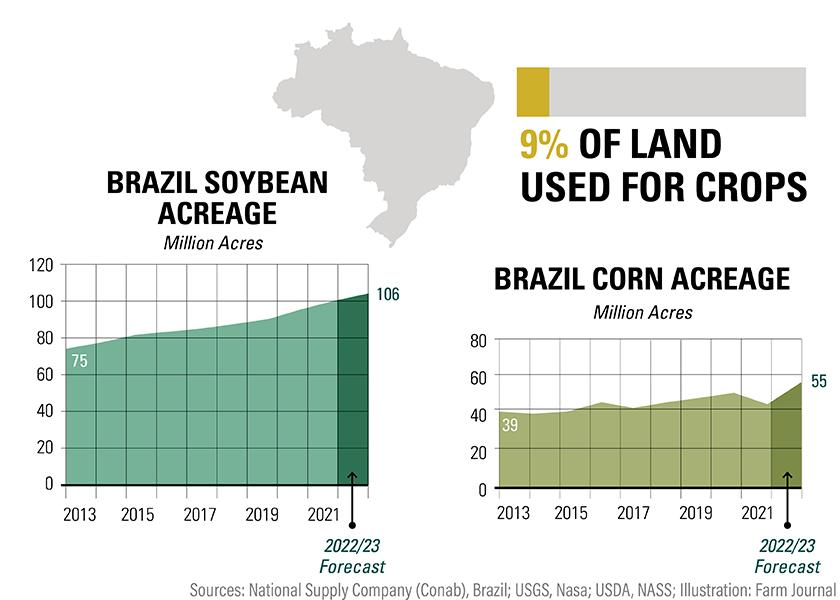

Brazil has more arable land than any other country in the world. It’s also a top-five producer of 34 agricultural commodities, per USDA. As Brazilian farmers start to plant this fall, forecasts show the 2022/23 crop harvest could be the largest ever.

For the upcoming crop season, CONAB, the country’s statistics agency, forecasts Brazilian production will top 312 million tons of soybeans, corn, cotton, rice and wheat. That is 15% higher than last season, when Brazilian farmers harvested an all-time high of 271.4 million tons of grains.

“There’s no reason not to expect the same trend of higher production in the future,” says Gary Schnitkey, Universi-ty of Illinois Extension agricultural economist.

PROFITS PUSH ACRES

Several factors are behind the increase. “High prices and profits last season, coupled with the depreciation of the Brazilian currency relative to the U.S. dollar, have motivated farmers to increase acres,” says Joana Colussi, academic researcher at the University of Illinois.

Similar to U.S. farmers, Brazilian farmers are facing higher input costs. For soybeans, some farmers are seeing a 40% to 50% increase from last year, says Daniele Siqueira, grains market analyst for AgRural, a Brazilian agricultural consultancy. For corn, costs are up around 30%.

While the threat of another La Niña and its devastating impact on crop yields is a concern, Siqueira says farmers will continue to plant and hope for the best.

Instead, their biggest concern is the Oct. 30 presidential election. “Most farmers are supporters of President Bolso-naro and are afraid his leftist opponent, former president Luiz Inácio Lula da Silva, might win,” she says. “Farmers believe Lula could take measures that would weigh on their profitability, such as export taxes and export quotas, ‘turning Brazil into Argentina’, as they say. They also fear a nervous economic environment, with foreign investors afraid of putting money in Brazil.”

Beyond politics, Brazilian farmers are worried about slow demand for soybeans from China, Siqueira says. In 2021, China was the top importer from Brazil of soybeans, cotton, sugar, beef, pork and chicken.