How Will 400 Million People in China's Lockdown Affect Global Markets?

Nearly a month since China imposed travel restrictions due to COVID-19, an estimated 400 million Chinese people—roughly the size of the U.S. population—remain in lockdown.

While China grapples with choosing which production lines to reopen, the food shortage conversation looks to ramp up, according to AgriTalk Host Chip Flory.

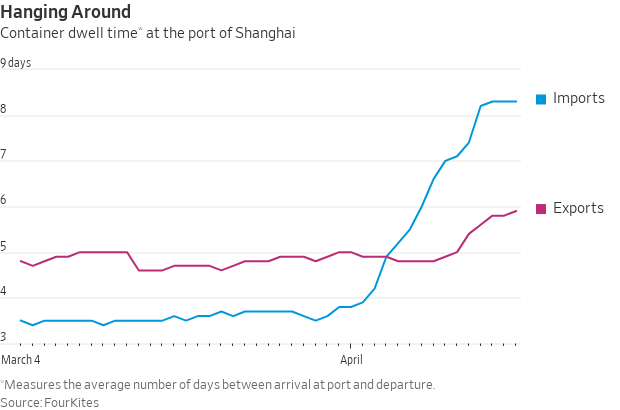

“China is not moving food from ports into the interior for that huge number of people in lockdown, setting the stage for a food shortage conversation within the next week,” says Flory, 11-minutes into the podcast. “This could have an impact on potential decision made in D.C. going forward.”

Jim Wiesemeyer, Pro Farmer policy analyst, noted China’s production forecasts haven’t seen any big changes, despite the lockdown.

“China came out with their GDP first quarter number overnight on Monday at 4.8%, which was a little higher than the trade thought, but below their so-called ‘goal’ of 5.5%,” he says. “But I suspect their downturn is going to continue.”

Shanghai, as well as the Zhejiang and Jiangsu provinces, are suffering the biggest blow from the lockdown. Wiesemeyer says, together, they account for about a fifth of national gross domestic product.

Rippling Effects

The IMF and World Bank concluded spring meetings this week. Wiesemeyer says U.S. Treasury Secretary Janet Yellen called for a separate meeting to assess food prices and supply demand due to China’s shutdown and war in Ukraine.

“USDA will continue to increase their food price forecast as logistics concerns persist in the U.S.,” he says. “The food crisis is getting the highest levels of attentions from Yellen, and it’s not going away anytime soon.”

In a new conference following the meetings, Yellen said protectionism, or taxing imports more, was not the answer, and economic benefits from the world's network of supply chains were not worth forming a reliance on other countries.

“Our supply chains are not secure, and they’re not resilient,” says Yellen. “And I think that’s something, in terms of long-term risk to the U.S. and to other countries, that’s a threat that needs to be addressed.”

Flory suggests trade dynamics might evolve as the U.S. considers whether to export or save products for domestic consumption. Wiesemeyer agrees, saying “it always happens,” but the odds of putting a restriction on U.S. exports is still “very low.”

“The pressure will be severe if you have U.S. corn and soybean crops below trend yield,” says Wiesemeyer. “A juncture of over $8 corn would mean we’d have to reassess, and it’s too early for those questions now that we’re getting into the seasons of crop variability and price volatility.”

The Missing Link

Bill Thayer, CEO of Fillogic told AgriTalk Host Chip Flory his company is piecing the supply chain back together in America with pop-up distribution centers. However, Thayer doesn’t feel the need for his business came about simply because of the pandemic.

America’s infrastructure had been on a “precipice” of shortcoming in ships, rail and labor that was bound to be exposed, according to Thayer. He says the faults were only identified when 10-years of E-Commerce developed in only 18months—at the onset of COVID-19 in early 2020.

“Everyone’s talking about the driver shortage, but that’s been a problem for 10 to 15 years, since the federal government instated hours of service to reduce trucking accidents by taking people off the road,” says Thayer. “The same case can be said for America’s road infrastructure being in terrible shape.”

Store shipments and shelf stocks are evolving due to scenarios like the long-clogged Port of L.A., according to Thayer.

“Just-in-time deliveries is a concept most companies are moving away from. They want to have some sort of inventory system close to the consumer,” he says. “The U.S. is leaning into the idea that if you’re going to have something programmed to come in through the Pacific Rim, then you’ll buy that six months in advance to have it shipped one month before you actually need it on the floor.”

Thayer says stability in supply chain outlooks are everchanging, but they’ll never again be what some consider “normal.”

“What we’re looking at right now is whether a boat is hung up in a port or at the bottom of an ocean because it was sunk in war,” he says. “The answer isn’t legislation—it’s not going to be solved by states. It’s going to be solved by small businesses in the private industry.”

More on China and the war in Ukraine:

> Port of LA Backlog Issues Compound Supply Chain Concerns, Causes Exports to Sink 23%

> Ukraine-Russia Tensions: What it Could Mean for Agriculture