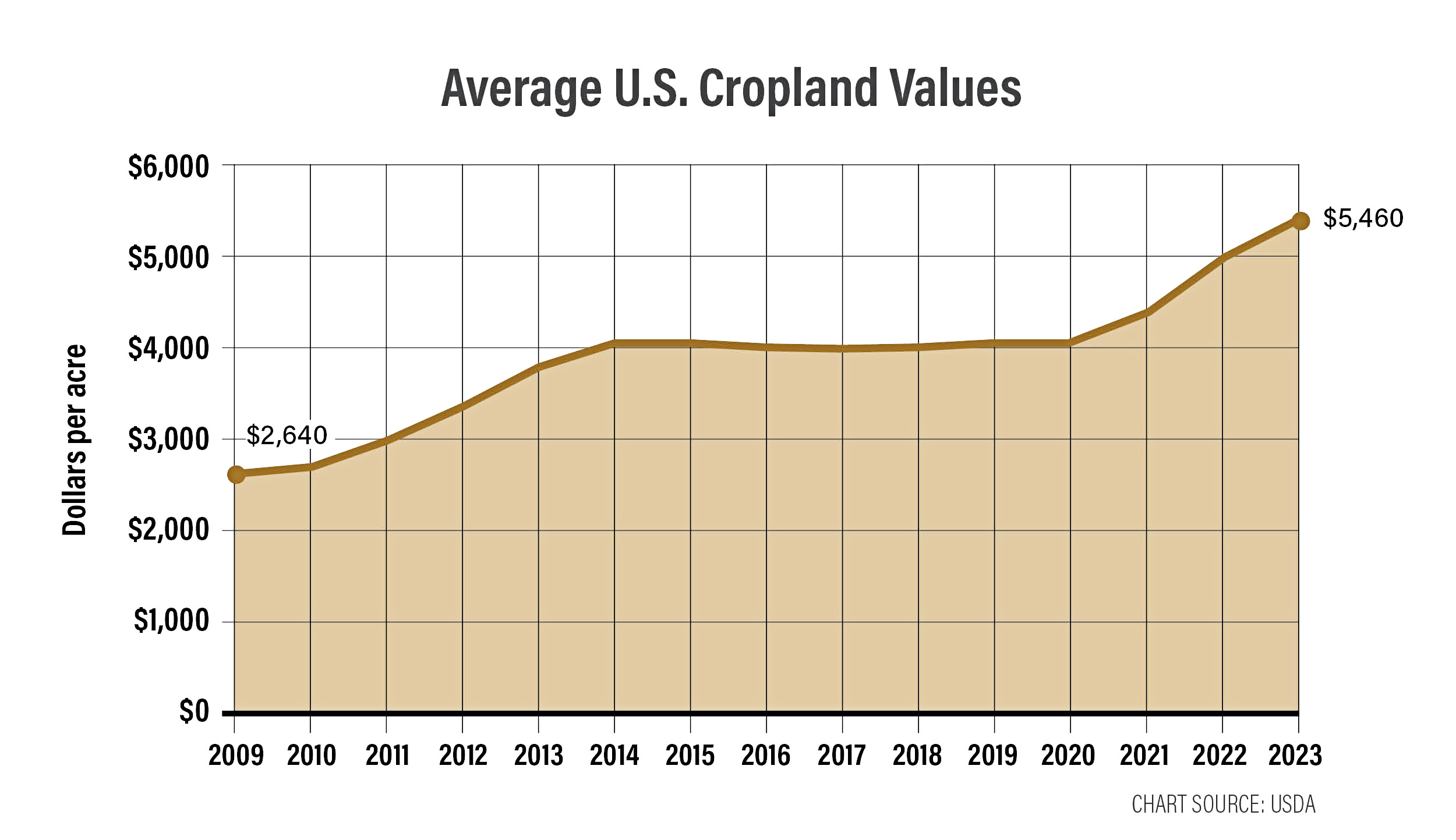

Farmland Values Are Holding Up, But There Are Hints of a Reset At a New Level

Eye-popping land sales continue to take the farmland market by storm. From the $34,800 per acre land sale in Missouri that smashed records last fall, to farmland in Sioux County, Iowa, selling for more than $22,000 per acre to start the year, it’s proof the strength in the farmland market hasn’t fizzled out yet.

“The key point, without a doubt, is resiliency,” says Paul Schadegg, senior vice president of Real Estate at Farmers National Company (FNC).

A new report from the company shows even with declining commodity prices and elevated interest rates, land values are higher than expected.

“We really haven’t seen any decreases to speak of, and there are still some really strong sales out there in the country,” Schadegg says.

“It is just remarkable how stable these market conditions have been,” says Jim Rothermich, vice president of agricultural appraisals for Iowa Appraisal. “Based on my auction data, farmland values are down 1% from 2022 to 2023, and I think it’s amazing we’re seeing it hold up that well.”

Farmers in the Driver's Seat

The farmland market in Iowa remains the strongest, but both Rothermich and Schadegg say there are other states with impressive sales.

“Illinois and Indiana have picked up a little steam — a lot of the sales are in the $20,000-plus range,” Schadegg says.

While resilient farmland prices were the theme in 2023, Rothermich recently uncovered one change in the market.

“One thing I have noticed is the number of price reductions on the listings of these companies. I haven’t seen that before,” Rothermich says. “It’s a sign the market is being affected by high interest rates.”

He's also seen an uptick in no sales in auction, yet farmers are still in the driver’s seat in most farmland sales.

“Over the past several years, when this land market really took off, the primary pool of buyers have been operating farmers, and they continue to be the most successful buyer of land,” Schadegg says.

A Potential Reset

Now the question is: Just how much of a correction could the farmland market see in 2024?

“If we look at the past 25 years, we’ve seen some run-up in land values, and then it resets at a new normal,” Schadegg says. “I think over the next 12 to 24 months, we’re probably going to see land values reset at a new level.”

“The last time we had a run-up was in 2013/14 when values went down 20% to 25%. It just doesn’t seem like it’s going to do that this time,” Rothermich says, who instead thinks the farmland market could be setting up for a correction in the single digits.

Mike Walsten of Pro Farmer’s LandOwner newsletter says the best-case scenario for 2024 is for prices to hold steady for better-quality ground.

“The more likely case, in my opinion, is a 5% decrease,” Walsten says. “I look for continued weakness going into 2025 to 2027, if things do not change radically. Values could correct 10% to 15% eventually. If energy prices go crazy again, a 20% decline is likely, but I don’t see prices correcting any more than that because I don’t see a rush of panic farm sales hitting the market and overwhelming demand.”

Walsten says farmers, in general, have manageable leverage in their recent purchases, and lenders aren’t willing to let farmers get overleveraged on land buys, which will constrain the number of farms that are moving to the market and help keep supply and demand in balance.