Iowa Farmland Values Up Another 17% in 2022

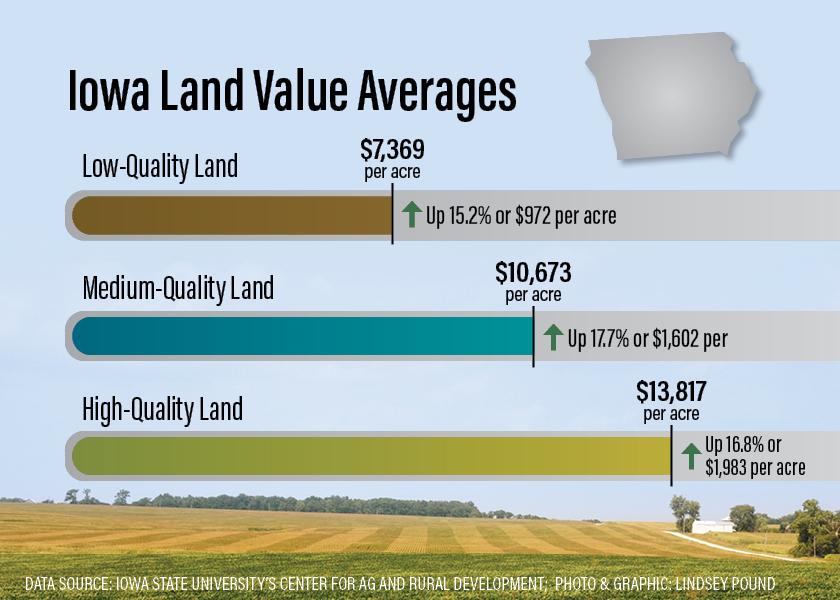

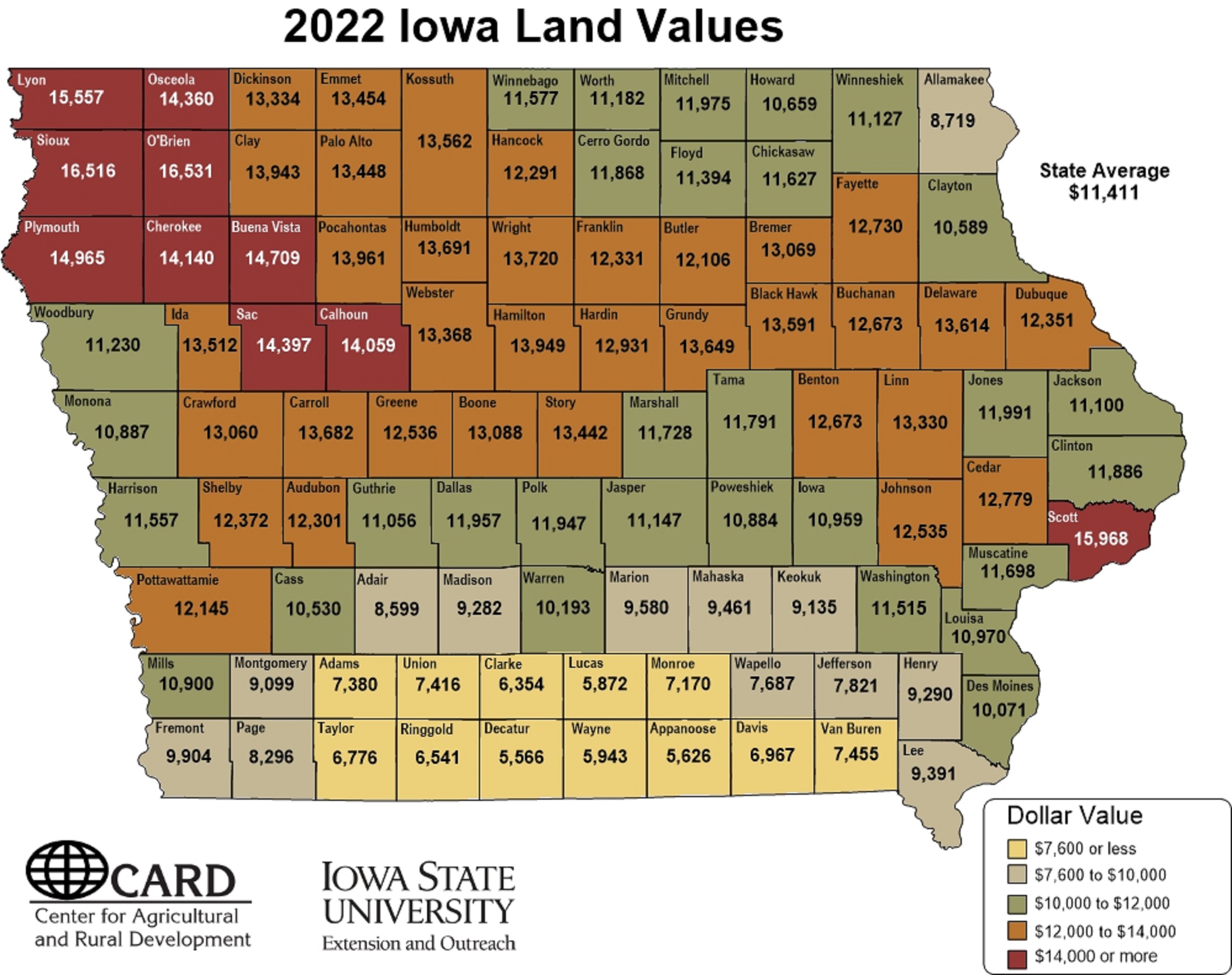

A year filled with record-breaking Iowa farmland values accumulated to a 17% increase in 2022, according to Iowa State University’s Center for Agricultural and Rural Development (CARD) latest survey.

CARD has been tracking Iowa’s farmland values since 1941, with the highest recorded hikes in 2011 (32.5%) and in 2021 (29%).

Inflation’s Role

Wendong Zhang, associate professor of economics and faculty affiliate of Iowa State’s CARD, is responsible for conducting the survey. He says inflation rates played the same role in land values in 2022 as they did in 2021, despite the Federal Reserve’s efforts.

“The Federal Reserve seems to be determined to keep raising interest rates until they get a firm control on inflation,” Zhang said. This is a tricky balance because larger and quicker interest rate hikes run the risk of slowing down the economy, potentially to a recession.”

However, according to Zhang, the higher interest rates don’t typically affect the land market values for one or two years.

George Baird, professional farm manager at Landmark Ag, says the Reserve’s control is starting to hit his clients at the knees.

“The producers I work with who are looking to expand their operations are being taken out of the market due to the cost of capital,” he says. “When you go from 3% to double or triple that, it takes you out of the game.”

Rent v. Own

But the interest rates might not have as big of an affect as some might think, as Zhang reports 81% of Iowa farmland is fully paid for.

“Farmers have a lot more cash on hand and supply chain issues led to a shortage of equipment, so the money that farmers normally spend on equipment is now devoted to land,” he said.

Hot Commodities

Zhang finds commodity prices are also at play, as yields have surpassed expectations.

“Not only are crop prices are much higher, livestock and poultry prices are also significantly higher, translating into higher farm income and profits,” he said.

While the high commodity prices have been working in producers’ favor, Baird says they won’t guarantee the win.

“There are a lot of variables right now. If commodity prices would stabilize, and the weather would hold, we wouldn’t see a lot of volatility. Until then, land values and options will continue to be up and down.”

Farmer Feedback

This years’ survey also included, for the first time, questions about farmers’ view on land values. The answers find:

• 70% of respondents feel current land prices at “too high” or “way too high”

“The higher land values do create an even higher entry barrier for beginning farmers, and the following increase in cash rents along with higher input costs could negatively affect producers, especially those with a lot of rented ground,” said Zhang.

• 48% of respondents foresee an increase in farmland values in 2023, while 24% forecasted no change and 28% expected lower values

According to Zhang, majority of respondents anticipate the 2023 farmland values to increase 5% to 10%.

• 60% of respondents expect land values in 2026 to increase 10% to 20% from current values.

What the Markets Say

Some of these projections align with Baird’s outlook. He feels the current traffic won’t produce a “tremendous” spike in land markets, rather a 3% to 5% change, up or down, over the next 12 months.

However, the sky-high price trend might alter other elements of land sales, according to Baird.

“I think we’re going to start seeing no sales at auctions,” says Baird. “Based on my discussions with friends in the industry, we predict there will be more land coming online that won’t do as well in an auction, but will sell well in a private offering. That’s something to keep an eye on.”

More on land:

$30,000 Per Acre? Yep, The Details on the Latest Record-Breaking Farmland Sale

4 Keys to Building Land Lease Relationships that Last

When to Sell Your Farmland