Sold! Record $19,000 Per Acre Iowa Farmland Sale Fueled By Inflation, Strong Commodity Prices

AgDay 08/19/21 - Record Iowa Land Sale

The size of Iowa's crop will play a major part in the price buyers pay for Iowa land this year. That's as real estate appraisers call the land market the hottest they’ve seen in 40 years.

“The market has been intensely aggressive,” says Jim Rothermich, of Iowa Appraisal and Research. “After the first of the year, the market just exploded. My auction sale data indicates the markets been up 25% from January 1 to June 30.”

The average statewide price is $10,800, which is up more than $2,000 from the same period last year.

“The market is still very aggressive,” he adds. “There are still more buyers than there are sellers, there is more supply coming to the market right now. The higher prices are bringing more supply, and the crop is looking pretty good. We're dry here in Iowa, but it appears we're going to have a pretty good crop. And as long as those commodity prices are above breakeven, it's going to be a good time in the land market.”

Who's Buying?

As Rothermich tracks not just sale prices and who’s buying, he says the mix today includes 50% farmers and 50% investors. Traditionally, the mix is 25% investors and 75% farmers.

“Typically, when you see those land sales that's upwards of $16,000 to $18,000 an acre, it's at an auction setting. And two people got in a bidding war and wanted that farm so bad that they just absolutely drove it up way above any market prices we had seen in the past several years. I mean, we haven't seen a market like this since 2013 or 2014. And it's just incredible what how bad people want to own land right now. And the prices they are willing to pay.”

Rothermich says the recipe for the skyrocketing farmland value market included several factors, including inflation, the uptick in commodity prices and more buyers than sellers in the farmland market.

“With inflation that’s here, it doesn't take much inflation to make owning land make you look really smart,” he adds. “So people are really wanting to get into this land market. There's more buyers than we've ever seen before. And there's people that never owned land before that's in the market right now. And they are being very aggressive in the marketplace right now. And they are pushing, they are really pushing prices.”

Record Sales

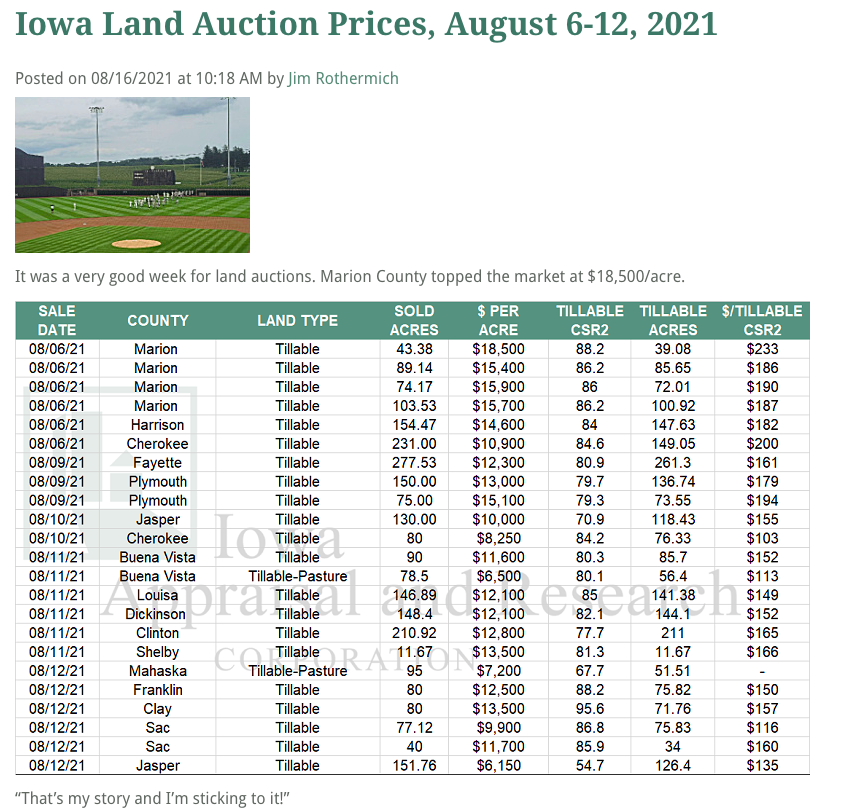

Recent sales have even produced eye-popping prices. One recent sale raked in $19,000 an acre in northwest Iowa. Rothermich says details on that exact sale aren’t publicly available yet. But there are other sales also cashing in at $18,500 in Marion County, for instance. In one week’s time, farmland sold just in that county included 17 above the state average price right now.

“The top one I've seen so far in Iowa is a little over 19,000 an acre, but we've had several at $18,000 an acre. And there's been a numerous sales between $16,000 and $17,000 an acre. And the market just exploded so fast that what's different about this market is the speed at which it went up. A year ago, we might have seen a couple sales at $15,000 an acre, but now it's every week, we see sales of $16,000 and typically we have one up there in the $18,000 range.”

He says the majority of the sales bringing in top dollar are farmer buyers.

“Typically, that's a bidding war that occurred between two farmers, but once we get down to around $15,000 or $16,000, it covers investors paying that much for land right now. And they want to get in this market really bad, and price is important, but they're willing to pay up and they're willing to compete against farmers. And farmers typically have a longer hold period, so a lot of dynamics are in the market right now.”

Have Iowa Farmland Prices Topped?

So, when will Iowa farmland values reach the top? Rothermich says that’s anyone’s guess, as the factors fueling farmland values today are still at play. And he expects the farmland value bull to make another run this fall.

“Farm income is forecasted to be pretty good, and typically, when farmers have good income, they like buying dirt and iron,” he says. “So, I expect to see a really (strong) bull run this fall. There's more land coming to the market, there's going to be a lot of land auctions right now, because nobody knows where the top is. The land market is so hot, the only way you can find the top is selling the farm at auction.”