Fallout From Falling Net Farm Income and Stubborn Interest Rates: Ag Economists Reveal What’s Now at Risk in 2024

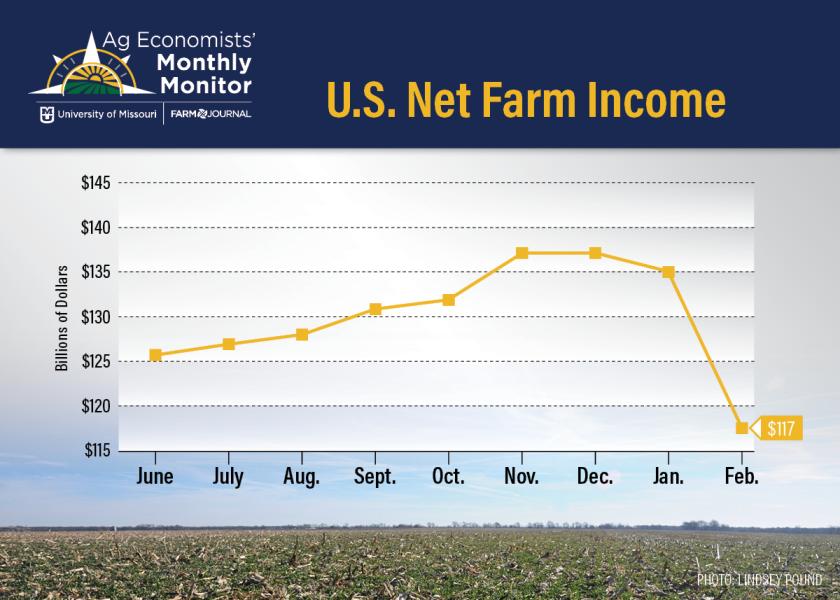

As farmers face the reality of falling commodity prices and tighter margins in 2024, the latest Ag Economists’ Monthly Monitor shows a projected major drop in net farm income this year with interest rates not expected to improve much if any in 2024.

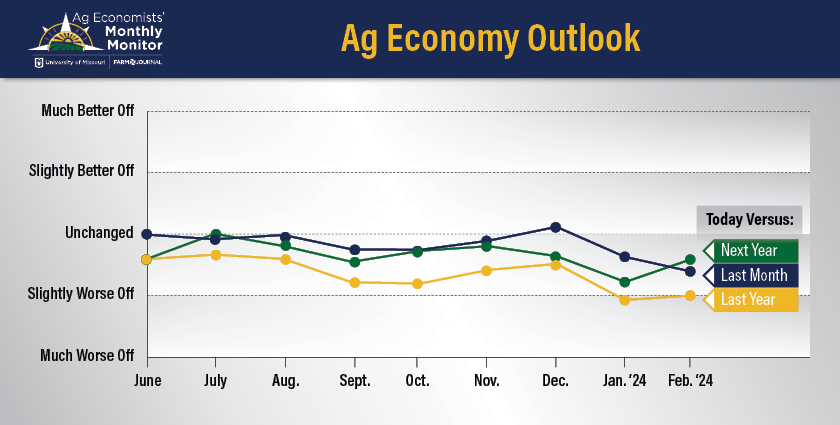

The Ag Economists’ Monthly Monitor is a survey of 70 ag economists from across the country. The latest survey shows pessimism is growing regarding the farm economy.

“I think there were really two things that were important from the February Monthly Monitor,” says TaylorAnn Washburn, program director for the University of Missouri Rural and Farm Finance Policy Analysis Center.

“Each month we ask our economists to share their sentiment on the economic situation of the U.S. ag economy and, since December, our respondents have continued to be pretty pessimistic about the state of the ag economy compared to previous months and the previous year.”

Economists surveyed expect net farm income to shift down to $117 billion in 2024, which is much lower than what USDA anticipates. The USDA is projecting $121.7 billion for net farm income this calendar year.

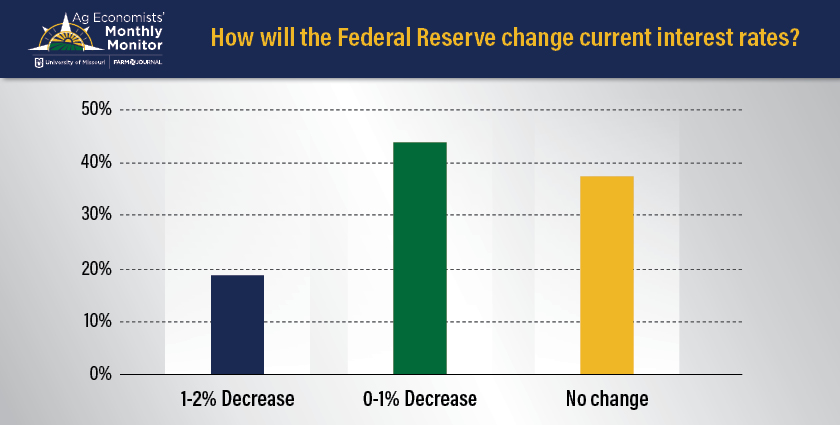

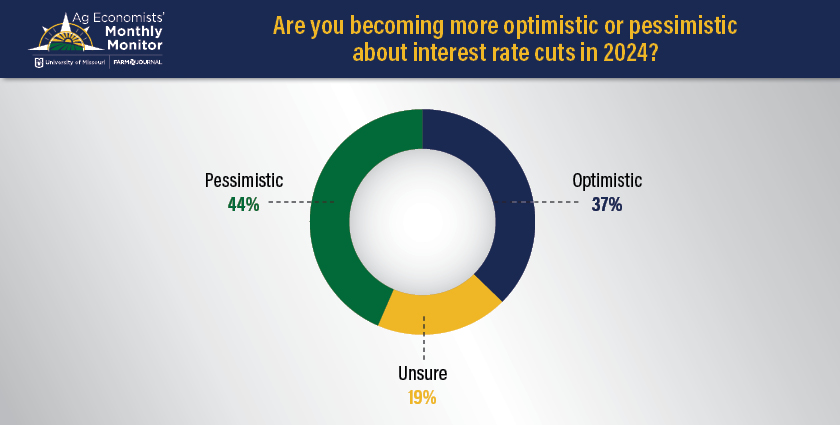

At the same time, operating costs are expected to stay high due to elevated interest rates. The February Monthly Monitor shows more than 40% of those surveyed expect interest rates to fall no more than 1% this year, and 44% of economists are becoming more pessimistic about any interest rate cuts in 2024.

With net farm income expected to take a hard fall this year, the latest Ag Economists' Monthly Monitor asked economists to outline the potential fallout that could occur in the ag economy over the next couple of years.

“Generally, the consensus was the immediate fallout was likely pretty minimal. But if farm income continues to drop in 2025 and beyond, there are some concerns that the fallout will grow,” says Washburn. “Some potential impacts that were mentioned by our economists include a slowdown of equipment sales, some moderation of land values and rental rates, consolidation across farm businesses on the service side of things, and then some negative impacts to financial ratios.”

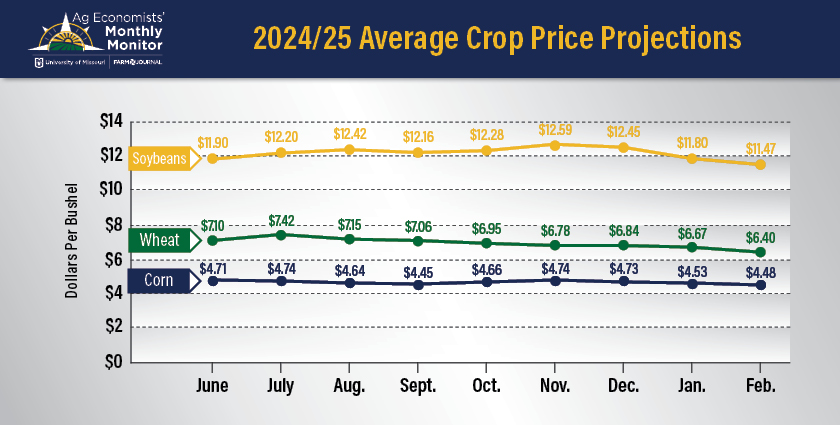

The anonymous survey revealed several possible outcomes from a sharp drop in net farm income. One economist pointed out for those producers who thought 2021-2022 was a new normal for commodity prices, they and may be overextended heading into the latest downturn. Another economist said corn farmers could face the steepest losses this year.

“It looks like corn prices will be below production costs for many producers. We have not had that for a long time, especially since the ethanol boom started almost 20 years ago. The struggles this time will be for corn farmers. Producers of other crops like cotton, wheat and rice have had difficult years,” said one economist.

The ripple effect of the sudden downturn, according to other economists, could be a slowdown in new equipment sales and a correction in land values.

“A slowdown in new equipment sales, slow upward creep in loan defaults, some leveling off of growth in land values,” responded one economist, citing his concerns.

“Moderation of land value gains on the one hand, and deteriorating financial conditions for farmers involved in U.S. wheat enterprises,” said another economist in the latest survey.

“Producers without significant cash reserves will start to get squeezed. I would expect rental rates to slow down or even fall,” said one economist.

According to the latest survey, some economists think a slump in net farm income could be cushioned by Congress. One economist stated that a Congressional push, during an election year, could cause more money to flow to farmers. Other economists think the strength of the U.S. balance sheet will also help cushion the fall.

“The 2024 net farm income is similar to the average since 2007. Given the strength of the U.S. balance sheet, I expect the fallout to be minimal unless net farm income is even lower in 2025,” said one economist in the anonymous survey.

“This forecast is following the outlook that there will be a cost-price squeeze in agriculture and that it could be more severe in 2024 than earlier thought. This may be the financial pressure needed to complete the next farm bill,” said another economist.

Economists were also asked to outline the most negative and positive aspects regarding the outlook for U.S. agriculture. On the positive side, economists said they expect:

• Relatively strong farm balance sheets to weather periods of stress and handle downturns.

• Demand for biofuels and opportunities for new markets.

• Declining costs for some inputs.

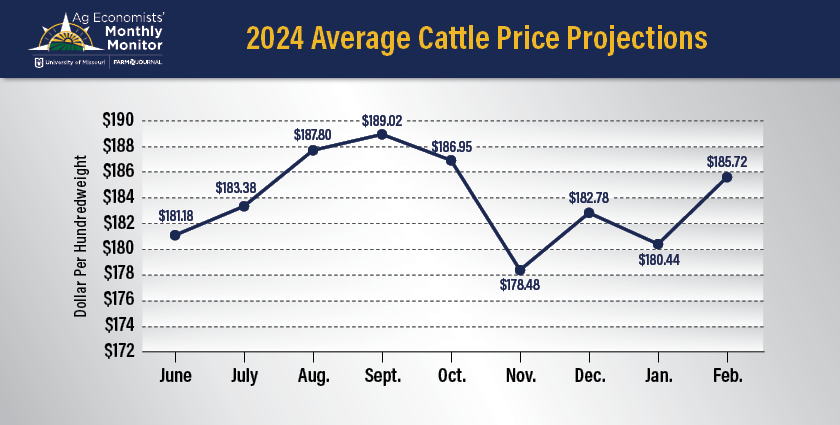

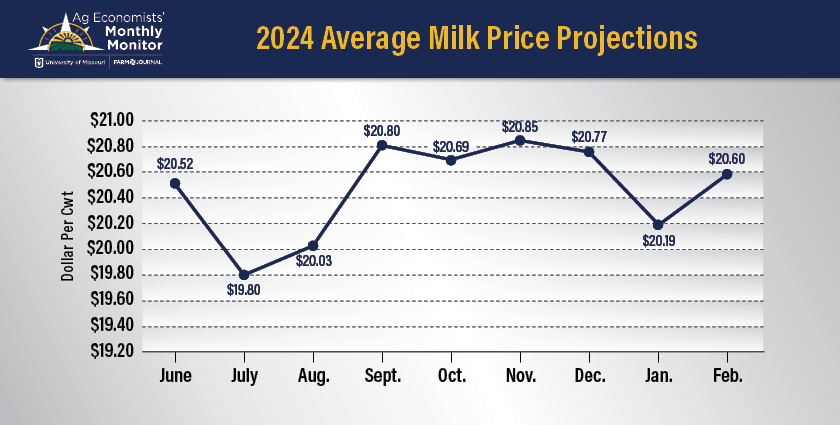

• Strong consumer demand, specifically for beef, and broader strength for other commodities.

Among the negative aspects of the ag outlook, economists in the Monthly Monitor said they anticipate:

• Higher interest rates for longer than anticipated.

• Over-production and creation of a situation when the U.S. is oversupplied relative to demand.

• Volatile, declining commodity prices and broader declines in profitability, which creates uncertainty.

“There was one sentiment made that I really like about the spirit and resilience of the American farmer, which is a really positive piece of what's going on here with the U.S. farm economy. That general theme of resilience really came through in this month's responses,” Washburn says. “Some of our economists rallied around the sentiment of being able to withstand some periods of stress and potential downturn due to some relatively strong farm balance sheets over the last few years, and being able to weather the storms that are possibly ahead.”

Washburn says another positive that stems from the latest Monthly Monitor is ramped-up demand from renewable fuels, specifically renewable diesel and Sustainable Aviation Fuel (SAF) and the opportunity to grow that new demand source in the months ahead.