Food at Home Prices Shot Up 10% — and American Shoppers are Willing to Fork Over the Extra Cash

Food prices continue to climb across the board. According to the latest Consumer Price Index (CPI), increasing grocery prices account for the largest share of the hike.

According to the Labor Department’s March CPI, the food price index increased 1% in a month and 8.8% year-over-year. Food prepared at home jumped 10% during that same time.

“Food at home prices increased about 10% relative to the same time last year,” says Jayson Lusk, department head in the Department of Agricultural Economics at Purdue University. “That’s higher than we've seen in recent months, despite it being high in recent months, and it's really higher than we've seen since the early 1980s, so 40 years ago.”

Some of the largest spikes in food prices at home include:

- Flour and prepared flour mixes: 14.2%

- Butter and margarine: 14%

- Meat, poultry and fish: 13.8%

- Milk: 13.3%

- Eggs: 11.2%

- Fresh fruits: 10.1%

- Bread: 7.1%

- Fresh vegetables: 5.9%

While consumers are paying more for food items at the grocery store, it isn’t causing shoppers to adjust buying habits as of yet.

“Interestingly, consumers are paying these higher prices; we're not seeing a lot of evidence of consumers really starting to try to skip back in response to the higher prices,” Lusk adds.

Purdue University started a “Consumer Food Insights” report based on a survey of 1,000 consumers. Earlier this year, shoppers were asked how they were responding to food price inflation.

“The most common answer was ‘just paying more,’’ Lusk says. “They’re trying to find more and cut more coupons and not trying to shop at different stores. That suggests to me that a big part of what's happening here is there's just still really strong demand in the economy. At the moment, at least, people are just sucking it up and paying the higher prices.”

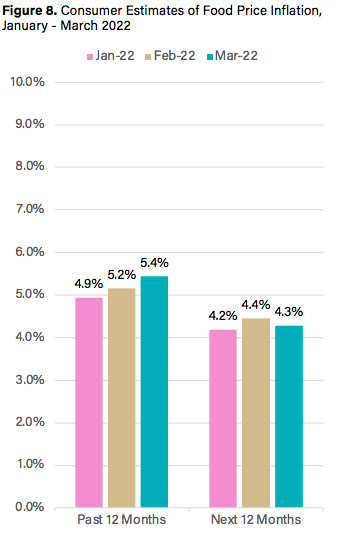

The latest Consumer Food Insights report released this week shows consumers largely underestimate the increase in food prices over the past year. Despite the inflation headlines covering much of the media, the survey found consumers see food prices increasing 5.4%, which is lower than the official government estimate by 2.5 percentage points.

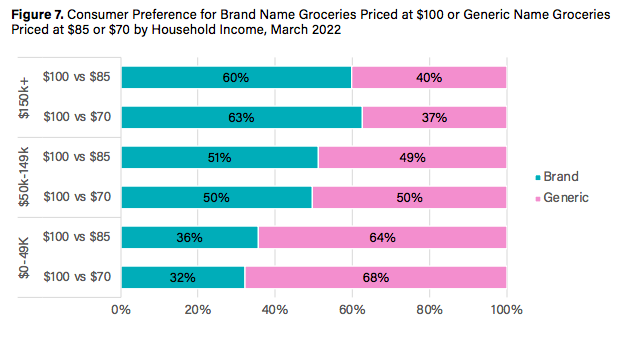

“Moreover, when asked if they would purchase brand name groceries priced at $100 or generic name groceries priced at $85 or $70, our results show that consumer demand currently has low sensitivity to price changes,” the report states. “While it is clear that lower-income households care more about price, only a very small share of respondents switched from brand to generic name when the price of generic dropped by $15. If consumers were feeling the effects of higher prices, we would expect more people to switch to generic at its lower price.”

Other findings in the latest survey show:

- The sustainable food purchasing index was unchanged from last month;

- The share of households experiencing very low food security increased by 3% from last month;

- 21% of consumers could not find specific foods at the store compared to 25% last month;

- Total food spending increased by 8% from last month;

- 16% of spending on food away from home went to delivery this month; and,

- 63% of consumers agree that climate change will impact food prices.

As gas and food prices continue to rise, Lusk says less disposable income will ultimately impact what consumers are willing and able to buy. It’s just a matter of when.

“It'll have to kick in at some point. I think part of the macroeconomic picture that's driving this is that in response to the pandemic, there was a lot of stimulus payment money pumped into the economy, and you saw savings rates really increase. So households, at least on average, have money they're sitting on,” Lusk says. “Now, maybe they're drawing some of that down at the moment, but it can't go on forever unless wages continue to increase. In some parts of the economy, wages have been increasing, but particularly for people on a fixed income or if you're in a type of employment where you can't experience rapid rates of wage increases, those are the people who are really getting hurt in a situation.”

Purdue’s most recent survey of consumers also found although several indictors — such as social, environment and economic — have inched up since January, food purchasing across the U.S. continues to favor the cheapest, tastiest options much more than those food choices that better support personal, environmental and social health.